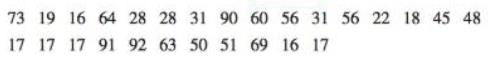

An insurance company has the business objective of reducing the amount of time it takes to approve applications for life insurance. The approval process consists of underwriting, which includes a review of the application, a medical information bureau check, possible requests for additional medical information and medical exams. and a policy compilation stage in which the policy pages ate generated and sent for delivery. The ability to deliver approved policies to customers in a timely manner is critical to the profitability of this service. During a period of one month. a random sample of 27 approved policies is selected. and the total processing time. in days, is collected. These data, stored in Insurance, are:

a. 1n the past, the

b. What assumption about the population distribution is needed in order to conduct the t test in (a)?

c. Construct a boxplot or a normal probability plot to evaluate the assumption made in (b).

d. Do you think that the assumption needed in order to conduct the t test in (a) is valid? Explain.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Basic Business Statistics, Student Value Edition (13th Edition)

- For context, the images attached below are a question from a June, 2024 past paper in statistical modelingarrow_forwardFor context, the images attached below (question and related graph) are from a February 2024 past paper in statistical modelingarrow_forwardFor context, the images attached below are from a February 2024 past paper in statistical modelingarrow_forward

- For context, the image provided below is a question from a September, 2024 past paper in statistical modelingarrow_forwardFor context, the image below is from a January 2024 past paper in statistical modelingarrow_forwardFor context, the image provided below is a question from a September, 2024 past paper in statistical modelingarrow_forward

- Section 2.2 Subsets 71 Exercise Set 2.2 Practice Exercises In Exercises 1-18, write or in each blank so that the resulting statement is true. 1. {1, 2, 5} {1, 2, 3, 4, 5, 6, 7} 2. {2, 3, 7} {1, 2, 3, 4, 5, 6, 7} 3. {-3, 0, 3} {-4,-3,-1, 1, 3, 4} 4. {-4, 0, 4} 5. {Monday, Friday} {-3, -1, 1, 3} {Saturday, Sunday, Monday, Tuesday, Wednesday} 6. {Mercury, Venus, Earth} {Venus, Earth, Mars, Jupiter} 7. {x/x is a cat} {xx is a black cat} {x|x is a pure-bred dog} ibrary mbers, ause the entire sual 8. {xx is a dog} 9. (c, o, n, v, e, r, s, a, t, i, o, n} {v, o, i, c, e, s, r, a, n, t, o, n} 10. [r, e, v, o, l, u, t, i, o, n} {t, o, l, o, v, e, r, u, i, n} 33. A = {x|x E N and 5 < x < 12} B = {x|x E N and 2 ≤ x ≤ 11} A_ B 34. A = {x|x = N and 3 < x < 10} B = A. {x|x = N and 2 ≤ x ≤ 8} B 35. Ø {7, 8, 9,..., 100} 36. Ø _{101, 102, 103, . . ., 200} 37. [7, 8, 9,...} 38. [101, 102, 103, ...} 39. Ø 40. { } { } e In Exercises 41-54, determine whether each statement is true or false. If…arrow_forwardA = 5.8271 ± 0.1497 = B 1.77872 ± 0.01133 C=0.57729 ± 0.00908 1. Find the relative uncertainty of A, B, and C 2. Find A-3 3. Find 7B 4. Find A + B 5. Find A B-B - 6. Find A * B 7. Find C/B 8. Find 3/A 9. Find A 0.3B - 10. Find C/T 11. Find 1/√A 12. Find AB²arrow_forwardWhy charts,graphs,table??? difference between regression and correlation analysis.arrow_forward

- You’re scrolling through Instagram and you notice that a lot of people are posting selfies. This piques yourcuriosity and you want to estimate the percentage of photos on Instagram that are selfies.(a) (5 points) Is there a “ground truth” for the percentage of selfies on Instagram? Why or why not?(b) (5 points) Is it possible to estimate the ground truth percentage of selfies on Instagram?Irrespective of your answer to the previous question, you decide to pull up n = 250 randomly chosenphotos from your friends’ Instagram accounts and find that 32% of these photos are selfies.(c) (15 points) Determine which of the following is an observation, a variable, a sample statistic (valuecalculated based on the observed sample), or a population parameter.• A photo on Instagram.• Whether or not a photo is a selfie.• Percentage of all photos on Instagram that are selfies.• 32%.(d) (5 points) Based on the sample you collected, do you think 32% is a reliable ballpark estimate for theground truth…arrow_forwardCan you explain this statement below in layman's terms? Secondary Analysis with Generalized Linear Mixed Model with clustering for Hospital Center and ICUvs Ward EnrolmentIn a secondary adjusted analysis we used generalized linear mixed models with random effects forcenter (a stratification variable in the primary analyses). In this analysis, the relative risk for the primaryoutcome of 90-day mortality for 7 versus 14 days of antibiotics was 0.90 (95% Confidence Interval [CI]0.78, 1.05).arrow_forwardIn a crossover trial comparing a new drug to a standard, π denotes the probabilitythat the new one is judged better. It is desired to estimate π and test H0 : π = 0.5against H1 : π = 0.5. In 20 independent observations, the new drug is better eachtime.(a) Find and plot the likelihood function. Give the ML estimate of π (Hint: youmay use the plot function in R)arrow_forward

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman