Corporate Finance

3rd Edition

ISBN: 9780132992473

Author: Jonathan Berk, Peter DeMarzo

Publisher: Prentice Hall

expand_more

expand_more

format_list_bulleted

Question

Chapter 8, Problem 5P

a.

Summary Introduction

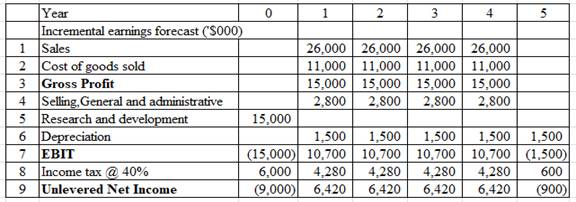

After reviewing the HomeNet project’s income projections as shown below

It was considered to change the assumptions for projections given as follows:

- The sales will not be constant over the four-year life of the project, since other companies are likely to offer competing products. The prices are expected to decline 10% annually.

- With increase in sales every year by 50,000 units, the scale economies will reduce the cost of production per unit by 20% annually.

- The new tax laws permit that the equipment will be

depreciated over three years rather than five years.

To recalculate: The unlevered net income with the above assumptions.

b.

Summary Introduction

Derive the projections under the assumption that each year 20% of sales comes from customers who would have purchased an existing Linksys router for $100 per unit and that the router costs $60 to manufacture.

To recalculate: The unlevered net income with the above assumptions.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

You just bought a new car for $X. To pay for it, you took out a loan that requires regular monthly payments of $1,640 for 27 months and

a special payment of $25,200 in 6 months. The interest rate on the loan is 1.27 percent per month and the first regular payment will be

made in 1 month. What is X?

Input instructions: Round your answer to the nearest dollar.

59

$

How much do you need in your account today if you expect to make quarterly withdrawals of $8,900 for 7 years and also make a

special withdrawal of $34,500 in 7 years. The expected return for the account is 3.28 percent per quarter and the first regular

withdrawal will be made in 3 months.

Input instructions: Round your answer to the nearest dollar.

$

Please don't use Ai solution

Chapter 8 Solutions

Corporate Finance

Ch. 8.1 - How do we forecast unlevered net income?Ch. 8.1 - Prob. 2CCCh. 8.1 - Prob. 3CCCh. 8.2 - Prob. 1CCCh. 8.2 - What is the depreciation tax shield?Ch. 8.3 - Prob. 1CCCh. 8.3 - Prob. 2CCCh. 8.4 - Prob. 1CCCh. 8.4 - What is the continuation or terminal value of a...Ch. 8.5 - Prob. 1CC

Ch. 8.5 - How does scenario analysis differ from sensitivity...Ch. 8 - Pisa Pizza, a seller of frozen pizza is...Ch. 8 - Kokomochi is considering the launch of an...Ch. 8 - Home Builder Supply, a retailer in the home...Ch. 8 - Hyperion, Inc. currently sells its latest...Ch. 8 - Prob. 5PCh. 8 - Prob. 6PCh. 8 - Castle View Games would like to invest in a...Ch. 8 - Prob. 9PCh. 8 - Prob. 10PCh. 8 - Prob. 11PCh. 8 - A bicycle manufacturer currently produces 300,000...Ch. 8 - Prob. 13PCh. 8 - Prob. 14PCh. 8 - Prob. 15PCh. 8 - Prob. 16PCh. 8 - Prob. 17PCh. 8 - Prob. 18PCh. 8 - Prob. 20PCh. 8 - Prob. 21P

Knowledge Booster

Similar questions

- 3 years ago, you invested $9,200. In 3 years, you expect to have $14,167. If you expect to earn the same annual return after 3 years from today as the annual return implied from the past and expected values given in the problem, then in how many years from today do you expect to have $28,798? Input instructions: Round your answer to at least 2 decimal places. 1.62 yearsarrow_forwardArticle: The Dallas-Fort Worth area of Texas (DFW) experienced significant growth inpopulation over the past four years and its population is expected to continue to grow rapidlyover the coming years. Hospital administrative leaders at a large hospital in the DFW havenoticed a decrease in net profits, although there has been significant growth in the area. Leadersat the hospital surmised that they have not been able to meet the new demand because of aninsufficient number of employees and inadequate facilities. Additionally, the employee retentionrate decreased because of overworked employees due to the increased demand for services.Patient expectations are not being met causing unfavorable reviews. Hospital administrativeleaders are unsure of how to address the problem successfully. What is the current problem on the above article and how the problem start? Could you please help to explain what is the background of the problem to define and the root problem and explain the…arrow_forwardPlease help with these questions.arrow_forward

- Start at 4-13 please help me with this problemarrow_forwardPlease help with problem 4-6arrow_forwardYour father is 50 years old and will retire in 10 years. He expects to live for 25 years after he retires, until he is 85. He wants a fixed retirement income that has the same purchasing power at the time he retires as $45,000 has today. (The real value of his retirement income will decline annually after he retires.) His retirement income will begin the day he retires, 10 years from today, at which time he will receive 24 additional annual payments. Annual inflation is expected to be 5%. He currently has $180,000 saved, and he expects to earn 8% annually on his savings. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Required annuity payments Retirement income today $45,000 Years to retirement 10 Years of retirement 25 Inflation rate 5.00% Savings $180,000 Rate of return 8.00%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education