Corporate Finance

3rd Edition

ISBN: 9780132992473

Author: Jonathan Berk, Peter DeMarzo

Publisher: Prentice Hall

expand_more

expand_more

format_list_bulleted

Question

Chapter 8, Problem 11P

a.

Summary Introduction

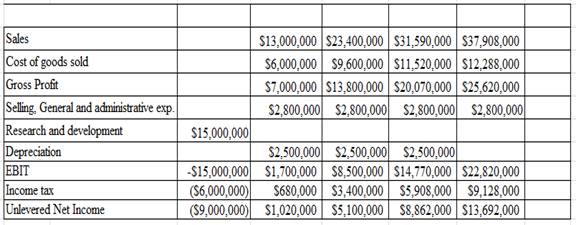

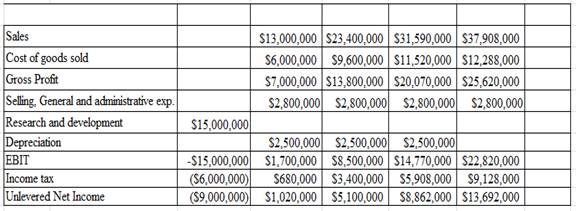

After changing the following assumptions for income projections:

- The sales will not be constant over the four-year life of the project, since other companies are likely to offer competing products. The prices are expected to decline 10% annually.

- With increase in sales every year by 50,000 units, the scale economies will reduce the cost of production per unit by 20% annually.

- The new tax laws permit that the equipment will be

depreciated over three years rather than five years.

The recomputed income projections are as follows:

b.

Summary Introduction

Derive the

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

You invest $1,000 a year for 10 years at 6 percent and then invest $2,000 a year for an additional 10 years at 6 percent. How much will you have accumulated at the end of the 20 years?

Answer: $49,967

*Please include all work & formulas

No ai please!

What is the role of an underwriter in an IPO?A) To lend money to the companyB) To set the dividend policyC) To buy the securities and sell them to the publicD) To manage the company’s operations

need he

No ai tool

What is the role of an underwriter in an IPO?A) To lend money to the companyB) To set the dividend policyC) To buy the securities and sell them to the publicD) To manage the company’s operations

Chapter 8 Solutions

Corporate Finance

Ch. 8.1 - How do we forecast unlevered net income?Ch. 8.1 - Prob. 2CCCh. 8.1 - Prob. 3CCCh. 8.2 - Prob. 1CCCh. 8.2 - What is the depreciation tax shield?Ch. 8.3 - Prob. 1CCCh. 8.3 - Prob. 2CCCh. 8.4 - Prob. 1CCCh. 8.4 - What is the continuation or terminal value of a...Ch. 8.5 - Prob. 1CC

Ch. 8.5 - How does scenario analysis differ from sensitivity...Ch. 8 - Pisa Pizza, a seller of frozen pizza is...Ch. 8 - Kokomochi is considering the launch of an...Ch. 8 - Home Builder Supply, a retailer in the home...Ch. 8 - Hyperion, Inc. currently sells its latest...Ch. 8 - Prob. 5PCh. 8 - Prob. 6PCh. 8 - Castle View Games would like to invest in a...Ch. 8 - Prob. 9PCh. 8 - Prob. 10PCh. 8 - Prob. 11PCh. 8 - A bicycle manufacturer currently produces 300,000...Ch. 8 - Prob. 13PCh. 8 - Prob. 14PCh. 8 - Prob. 15PCh. 8 - Prob. 16PCh. 8 - Prob. 17PCh. 8 - Prob. 18PCh. 8 - Prob. 20PCh. 8 - Prob. 21P

Knowledge Booster

Similar questions

- Which of the following is a money market instrument?A) Treasury bondsB) Corporate bondsC) Commercial paperD) Common stock need help!!arrow_forwardFinance Subject.Which of the following is a money market instrument?A) Treasury bondsB) Corporate bondsC) Commercial paperD) Common stockarrow_forwardHelp please without use of AI. no What is the main purpose of financial ratios?A) To guarantee a company's profitabilityB) To evaluate a company's financial performance and healthC) To increase a company's stock priceD) To ensure a company's debts are eliminatedarrow_forward

- Please don't use ai tool If a stock’s beta is 1.5, what does this indicate?A) The stock is less volatile than the marketB) The stock is more volatile than the marketC) The stock is not correlated with the market D) The stock is risk-freearrow_forwardNo ai What is the primary function of a financial market?A) To set interest ratesB) To facilitate the transfer of funds between savers and borrowersC) To regulate the banking industryD) To manage the government’s budgetarrow_forwardno What is the main purpose of financial ratios?A) To guarantee a company's profitabilityB) To evaluate a company's financial performance and healthC) To increase a company's stock priceD) To ensure a company's debts are eliminatedarrow_forward

- please don't use chatgpt What happens to the value of money when inflation increases?A) The value of money increasesB) The value of money decreasesC) The value of money remains unchangedD) The value of money fluctuates randomly helparrow_forwardDo not use Ai tool What happens to the value of money when inflation increases?A) The value of money increasesB) The value of money decreasesC) The value of money remains unchangedD) The value of money fluctuates randomlyarrow_forwardNo AI tool. Which of the following best defines a bond's coupon rate?A) The market rate of interest on the bondB) The annual interest payment as a percentage of the bond's face valueC) The difference between the bond's face value and its market priceD) The total return from holding the bond to maturityarrow_forward

- No ai!! answer it A portfolio's risk can be reduced by: A) Investing in a single stock B) Diversifying investments across different asset classes C) Borrowing money to invest more D) Only investing in high-risk assets need help.arrow_forwardNo chatgpt! A portfolio's risk can be reduced by: A) Investing in a single stock B) Diversifying investments across different asset classes C) Borrowing money to invest more D) Only investing in high-risk assets need help!arrow_forwardNo chatgpt!! A portfolio's risk can be reduced by:A) Investing in a single stockB) Diversifying investments across different asset classesC) Borrowing money to invest moreD) Only investing in high-risk assetsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education