a)

To compute: The payback period and the investment that must be selected.

Introduction:

Capital budgeting is a process where a business identifies and assesses the potential investments or expenses that are larger (in general).

a)

Answer to Problem 15QP

Here, Project B must be accepted as it pays back sooner than Project A.

Explanation of Solution

Given information:

The cash flows for two mutually exclusive projects are $38,000, $47,000, $62,000, $455,000 for Project A for year 1, year 2, year 3, and year 4respectively. Project A has an initial investment of -$365,000. The cash flows of Project B are $20,300, $15,200, $14,100, and $11,200 for year 1, year 2, year 3, and year 4respectively. The initial investment for Project B is -$40,000. The

Formula to compute the payback period of a project:

Compute the payback period of Project A:

Hence, the payback period is 3.47 years for Project A.

Compute the payback period of Project B:

Hence, the payback period is 2.29 years for Project B.

b)

To compute: The NPV (

Introduction:

Capital budgeting is a process where a business identifies and assesses the potential investments or expenses that are larger (in general).

b)

Answer to Problem 15QP

Here, Project A must be accepted as the NPV is higher in Project A.

Explanation of Solution

Given information:

The cash flows for two mutually exclusive projects are $38,000, $47,000, $62,000, $455,000 for Project A for year 1, year 2, year 3, and year 4respectively. Project A has an initial investment of -$365,000. The cash flows of Project B are $20,300, $15,200, $14,100, and $11,200 for year 1, year 2, year 3, and year 4respectively. The initial investment for Project B is -$40,000. The rate of return is 13%.

Formula to calculate the NPV:

Calculate the NPV for Project A:

Hence, the NPV for Project A is $27,465.34385.

Calculate the NPV for Project B:

Hence, the NPV for Project B is $6,509.074.

c)

To compute: The

Introduction:

Capital budgeting is a process where a business identifies and assesses the potential investments or expenses that are larger (in general).

c)

Answer to Problem 15QP

Here, Project B must be accepted as the IRR is higher in Project B.

Explanation of Solution

Given information:

The cash flows for two mutually exclusive projects are $38,000, $47,000, $62,000, $455,000 for Project A for year 1, year 2, year 3, and year 4respectively. Project A has an initial investment of -$365,000. The cash flows of Project B are $20,300, $15,200, $14,100, and $11,200 for year 1, year 2, year 3, and year 4respectively. The initial investment for Project B is -$40,000. The rate of return is 13%.

Equation of the IRR of Project A:

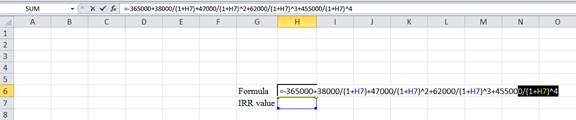

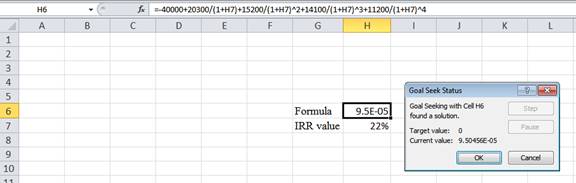

Compute IRR for Project A using a spreadsheet:

Step 1:

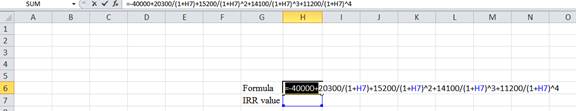

- Type the equation of NPV in H6 in the spreadsheet and consider the IRR value as H7.

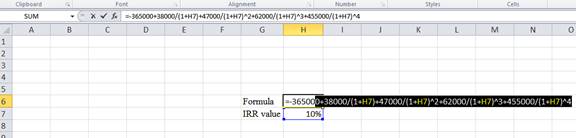

Step 2:

- Assume the IRR value as 10%.

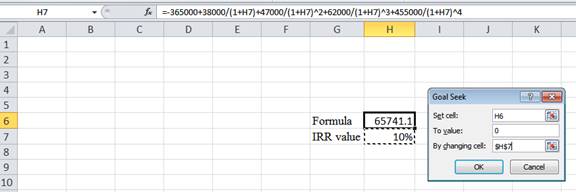

Step 3:

- In the spreadsheet, go to data and select What-if analysis.

- In What-if analysis, select Goal Seek.

- In “Set cell”, select H6 (the formula).

- The “To value” is considered as 0 (the assumption value for NPV).

- The H7 cell is selected for “By changing cell”.

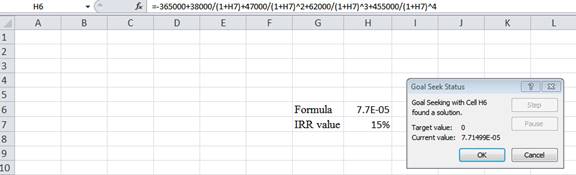

Step 4:

- Following the previous step, click OK in the Goal Seek Status. Goal Seek Status appears with the IRR value.

Step 5:

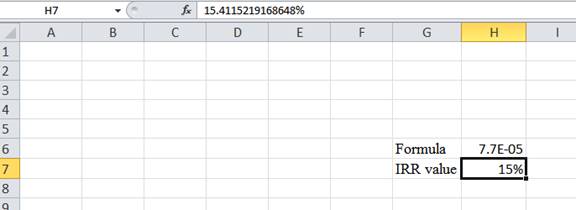

- The value appears to be 15.4115219168648%.

Hence, the IRR value is 15.411%.

Equation of IRR of Project B:

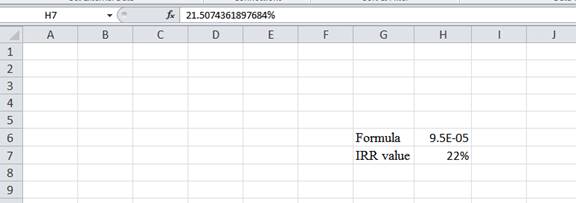

Compute IRR for Project B using a spreadsheet:

Step 1:

- Type the equation of NPV in H6 in the spreadsheet and consider the IRR value as H7.

Step 2:

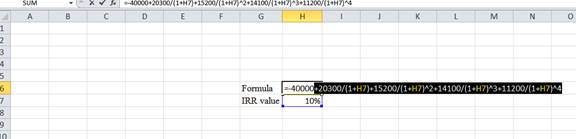

- Assume the IRR value as 10%.

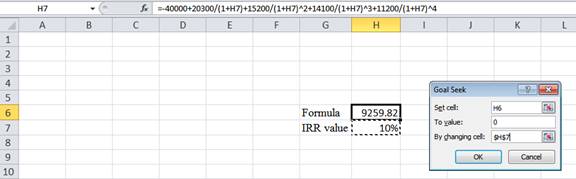

Step 3:

- In the spreadsheet, go to data and select What-if analysis.

- In the What-if analysis, select Goal Seek.

- In “Set cell”, select H6 (the formula).

- The “To value” is considered as 0 (the assumption value for NPV).

- The H7 cell is selected for “By changing cell”.

Step 4:

- Following the previous step, click OK in the Goal seek. Goal Seek Status appears with the IRR value.

Step 5:

- The value appears to be 21.5074361897684%.

Hence, the IRR value is 21.50%.

d)

To compute: The profitability index.

Introduction:

Capital budgeting is a process where a business identifies and assesses the potential investments or expenses that are larger (in general).

d)

Answer to Problem 15QP

Explanation of Solution

Given information:

The cash flows for two mutually exclusive projects are $38,000, $47,000, $62,000, $455,000 for Project A for year 1, year 2, year 3, and year 4respectively. Project A has an initial investment of -$365,000. The cash flows of Project B are $20,300, $15,200, $14,100, and $11,200 for year 1, year 2, year 3, and year 4respectively. The initial investment for Project B is -$40,000. The rate of return is 13%.

Formula to compute the profitability index:

Compute the profitability index for Project A:

Hence, the profitability index for Project A is $1.075.

Compute the profitability index for Project B:

Hence, the profitability index for Project B is $1.162.

e)

To discuss: The project that Person X will select with a reason.

Introduction:

Capital budgeting is a process where a business identifies and assesses the potential investments or expenses that are larger (in general).

e)

Explanation of Solution

Given information:

The cash flows for two mutually exclusive projects are $38,000, $47,000, $62,000, $455,000 for Project A for year 1, year 2, year 3, and year 4respectively. Project A has an initial investment of -$365,000. The cash flows of Project B are $20,300, $15,200, $14,100, and $11,200 for year 1, year 2, year 3, and year 4respectively. The initial investment for Project B is -$40,000. The rate of return is 13%.

Explanation:

In this case, the criteria of NPV denote that Project A must be accepted while the payback period, profitability index, and IRR denote that Project B must be accepted. The overall decision must be based on the NPV, as it does not have ranking problem compared to the other techniques of capital budgeting. Hence, Project A must be accepted.

Want to see more full solutions like this?

Chapter 8 Solutions

Essentials of Corporate Finance

- calculate ratios for the financial statment given and show all working manually: 1. Total Assets Turnover 2. Inventory Turnover 3. Inventory Periodarrow_forwardcalculate ratios for the financial statment given and show all working manually: 1. Debt Ratios 2. Debt to Equityarrow_forwardcalculate the following ratios for the statements and show all working: 1. Current Ratios 2. Quick Ratio 3. Cash Ratioarrow_forward

- Dont solve this question with incorrect values. i will give unhelpful . do not solvearrow_forwardJeff Krause purchased 1,000 shares of a speculative stock in January for $1.89 per share. Six months later, he sold them for $9.95 per share. He uses an online broker that charges him $10.00 per trade. What was Jeff's annualized HPR on this investment? Jeff's annualized HPR on this investment is %. (Round to the nearest whole percent.)arrow_forwardno ai do not answer this question if data is not clear or image is blurr. but do not amswer with unclear values. i will give unhelpful.arrow_forward

- Estefan Industies has a new project available that requires an initial investment of sex million. The project will provide unlevered cash flows of $925,000 per year for the next 20 years. The company will finance the project with a debt-value ratio of 35. The company's bonds have a YTM of 5.9 percent. The companies with operations comparable to this project have unlevered betas of 1.09, 1.17, 1.28, and 1.20. The risk-free rate is 3.6 percent, and the market risk premium is 7 percent. The tax rate is 21 percent. What is the NPV of this project?arrow_forwardno ai do not answer this question if data is not clear or image is blurr. please comment i will write values . but do not amswer with unclear values. i will give unhelpful.arrow_forwardno ai Image is blurr do not answer this question if data is not clear or image is blurr. please comment i will write values but do not amswer with unclear values. i will give unhelpful sure.arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education