To calculate: The MIRR (Modified

Introduction:

MIRR is the Modified Internal Rate of Return; it is a financial measure of attracting investments. It is utilized in capital budgeting to rank the alternative investments of the same size.

Answer to Problem 22QP

The MIRR for the project using the discounted approach is 19.74%, reinvestment approach is 14.89%, and combination approach is 14.38%.

Explanation of Solution

Given information:

Company C is assessing a project where the cash flows are$7,930, $9,490, $8,970, $7,210, and -$3,980 for year1, 2, 3, 4, and 5 respectively. The initial cost is -$19,500.

Discounted approach:

In this approach, compute the negative cash outflows value at year 0. On the other hand, the positive cash flows remain at its time of occurrence. Hence, discount the cash outflows to year 0.

Hence, the discounted cash flow at time 0 is -$21,971.26.

Equation of MIRR in a discounted approach:

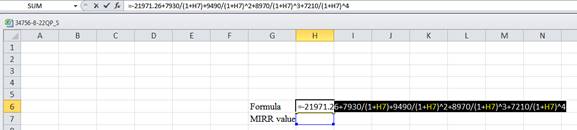

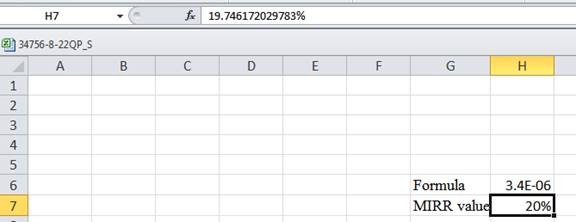

Compute MIRR using a spreadsheet:

Step 1:

- Type the equation of

NPV in H6 in the spreadsheet and consider the MIRR value as H7.

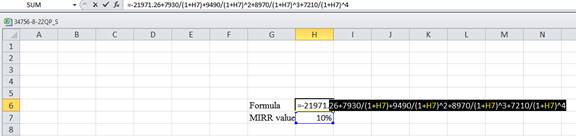

Step 2:

- Assume the MIRRvalue as 0.10%.

Step 3:

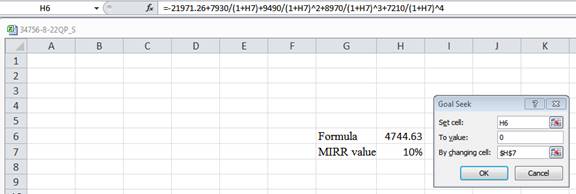

- In the spreadsheet, go to data and select the what-if analysis.

- In the what-if analysis, select goal seek.

- In set cell, select H6 (the formula).

- The “To value” is considered as 0 (the assumption value for NPV).

- The H7 cell is selected for the by changing cell.

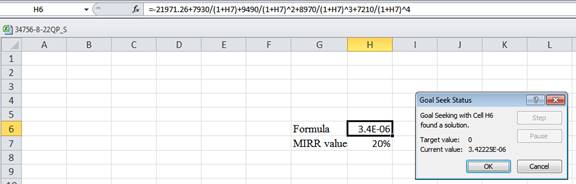

Step 4:

- Following the previous step click OK in the goal seek. The goal seek status appears with the MIRRvalue.

Step 5:

- The value appears to be 19.746172029783%.

Hence, the MIRR value is 19.74%.

Reinvestment approach:

In this approach, compute the

Hence, the reinvesting cash flow at time 5 is $39,046.203.

Equation of MIRR in reinvestment approach:

Compute the MIRR:

Hence, the MIRR is 14.89%.

Combination approach:

In this approach, compute all the cash outflows at year 0 and all the

Hence, the total

Hence, the value of total cash inflows is $43,026.203.

Equation of MIRR in combination approach:

Compute the MIRR:

Hence, the MIRR is $14.38%.

Want to see more full solutions like this?

Chapter 8 Solutions

Essentials of Corporate Finance

- What is working capital?* Equity Capital + Retained Earnings Equity Capital - Total Liabilities Total Assets - Total Liabilities Current Assets - Current Liabilitiesarrow_forwardWhich of the following is not a financing activity?* Repayment of long-term debt Issuance of equity Investments in businesses Payment of dividendsarrow_forwardThe correct order of capital stack from the most to least secured is* Equity > Subordinated debt > Senior debt Suborindated debt > Senior debt > Equity Senior debt > Subordinated debt > Equity Senior debt > Equity > Subordinated debtarrow_forward

- 16. ____ underwriting commitment is when the underwriter agrees to buy the entire issue and assume full financial responsibility for any unsold shares.* Best efforts Firm commitment All-or-none Full-purchasearrow_forwardWhich of the following is not true about private equity funds?* Private equity funds are pools of capital invested in companies which represent an opportunity for high rate of return Exit strategies for private equity funds include Initial Public Offerings (IPOs) and leveraged buyout (LBO) Venture capital is an example of private equity funds Private equity funds are usually invested for unlimited time periodsarrow_forwardWhat is finance ? explain about its parts.arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education