To calculate: The MIRR (Modified

Introduction:

MIRR is the Modified Internal Rate of Return, which is a financial measure of attracting the investments. It is utilized in capital budgeting to rank the alternative investments of the same size.

Answer to Problem 23QP

The MIRR for the project using the discounted approach is 20.01%, reinvestment approach is 13.67%, and combination approach is 13.39%.

Explanation of Solution

Given information:

Company M is assessing a project where the cash flows are$7,930, $9,490, $8,970, $7,210, and -$3,980 for year1, 2, 3, 4, and 5 respectively. The initial cost is -$19,500. The rate of discount and the rate of reinvestment are 11% and 8% respectively.

Discounted approach:

In this approach, compute the negative cash outflows value at year 0. On the other hand, the positive cash flows remain at its time of occurrence. Hence, discount the cash outflows to year 0.

Hence, the discounted cash flow at time 0 is -$21,861.93.

Equation of MIRR in discounted approach:

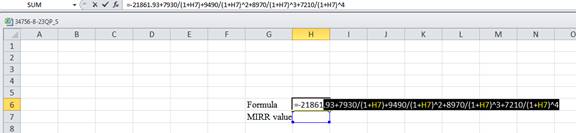

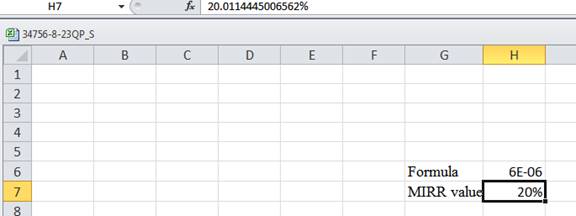

Compute MIRR using a spreadsheet:

Step 1:

- Type the equation of

NPV in H6 in the spreadsheet and consider the MIRR value as H7.

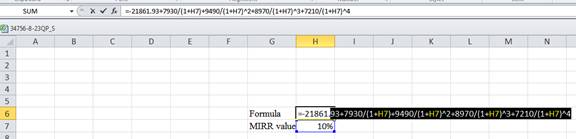

Step 2:

- Assume the MIRR value as 10%.

Step 3:

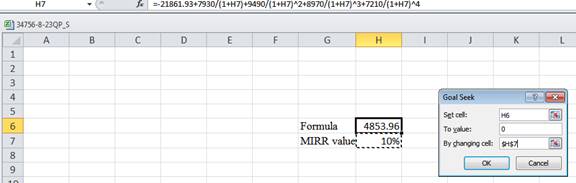

- In the spreadsheet, go to data and select the what-if analysis.

- In the what-if analysis, select goal seek.

- In set cell, select H6 (the formula).

- The “To value” is considered as 0 (the assumption value for NPV).

- The H7 cell is selected for the by changing cell.

Step 4:

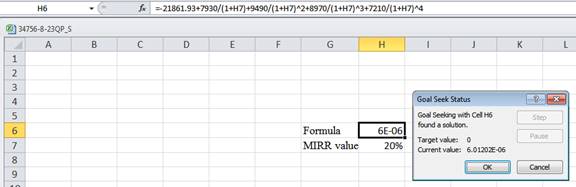

- Following the previous step click OK in the goal seek. The goal seek status appears with the MIRR value.

Step 5:

- The value appears to be 20.0114445006562%.

Hence, the MIRR value is 20.01%.

Reinvestment approach:

In this approach, compute the

Hence, the reinvesting cash flow at time 5 is $37,012.75.

Equation of MIRR in reinvestment approach:

Compute the MIRR:

Hence, the MIRR is 13.67%.

Combination approach:

In this approach, compute all the cash outflows at year 0 and all the

Hence, the total

Hence, the value of total cash inflows is $40,992.75.

Equation of MIRR in combination approach:

Compute the MIRR:

Hence, the MIRR is 13.39%.

Want to see more full solutions like this?

Chapter 8 Solutions

Essentials of Corporate Finance

- Chee Chew's portfolio has a beta of 1.27 and earned a return of 13.6% during the year just ended. The risk-free rate is currently 4.6%. The return on the market portfolio during the year just ended was 10.5%. a. Calculate Jensen's measure (Jensen's alpha) for Chee's portfolio for the year just ended. b. Compare the performance of Chee's portfolio found in part a to that of Carri Uhl's portfolio, which has a Jensen's measure of -0.25. Which portfolio performed better? Explain. c. Use your findings in part a to discuss the performance of Chee's portfolio during the period just ended.arrow_forwardDuring the year just ended, Anna Schultz's portfolio, which has a beta of 0.91, earned a return of 8.1%. The risk-free rate is currently 4.1%, and the return on the market portfolio during the year just ended was 9.4%. a. Calculate Treynor's measure for Anna's portfolio for the year just ended. b. Compare the performance of Anna's portfolio found in part a to that of Stacey Quant's portfolio, which has a Treynor's measure of 1.39%. Which portfolio performed better? Explain. c. Calculate Treynor's measure for the market portfolio for the year just ended. d. Use your findings in parts a and c to discuss the performance of Anna's portfolio relative to the market during the year just ended.arrow_forwardNeed answer.arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education