a)

To calculate: The IRR (

Introduction:

The IRR (Internal Rate of Return) is a rate of discount which makes the predictable investment’s NPV equal to zero.

The NPV (

a)

Answer to Problem 10QP

As IRR is higher in Project A when compared to that of Project B, Project A can be accepted. However, it is not the appropriate decision because the criterion of IRR has a problem in ranking mutually exclusive projects.

Explanation of Solution

Given information:

Company R has identified two mutually exclusive projects where the cash flows of Project A are$34,000, $27,000, $21,000, and $17,000 for years 1, 2, 3, and 4 respectively. The cash flows of Project B are $19,000, $25,000, $29,000, and $34,000 for years1, 2, 3, and 4 respectively. The initial costs of both the projects are -$65,000 respectively.

Note:

- NPV is the difference between the present values of the cash inflows and the

present value of cash outflows. - The IRR is the rate of interest which makes the project’s NPV equal to zero. Hence, using the available information, assume that NPV is equal to zero and form an equation to compute the IRR.

Equation of NPV to compute IRR assuming that NPV is equal to zero:

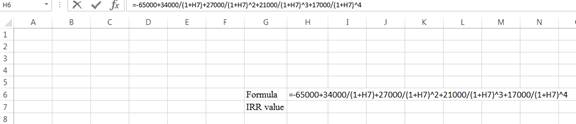

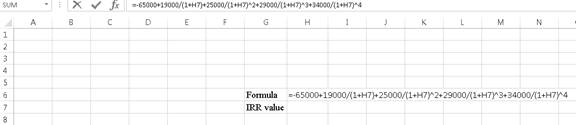

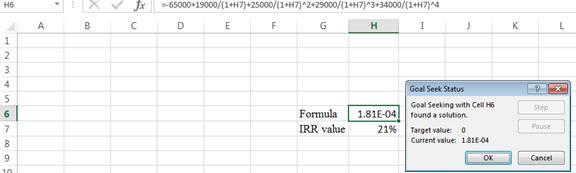

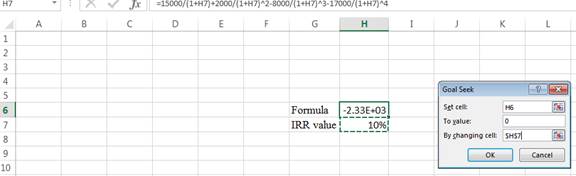

Compute IRR for Project A using a spreadsheet:

Step 1:

- Type the equation of NPV in H6 in the spreadsheet and consider the IRR value as H7

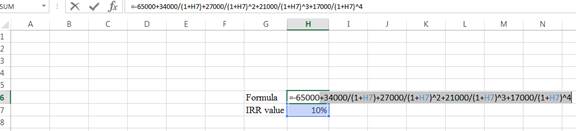

Step 2:

- Assume the IRR value as 10%

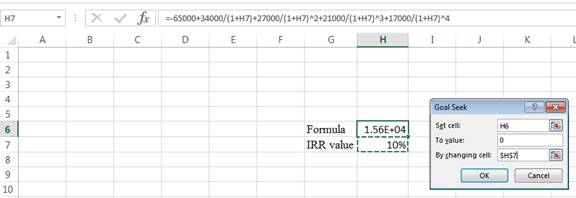

Step 3:

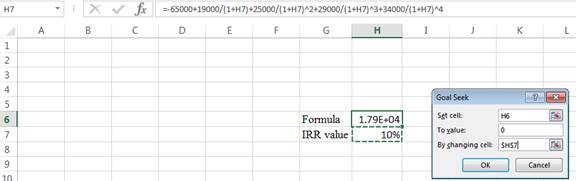

- In the spreadsheet, go to data and select What-If-Analysis.

- In What-If-Analysis, select goal seek.

- In set cell, select H6 (the formula).

- The “To value” is considered as 0 (the assumption value for NPV).

- The H7 cell is selected for "by changing cell".

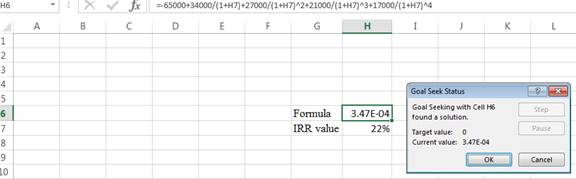

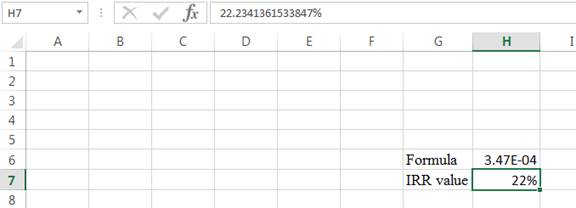

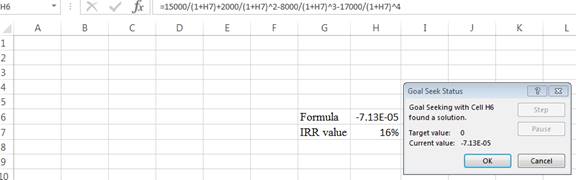

Step 4:

- Following the previous step, click OK in the goal seek. The goal seek status appears with the IRR value.

Step 5:

- The value appears to be 22.2341361533847%.

Hence, the IRR value is 22.23%.

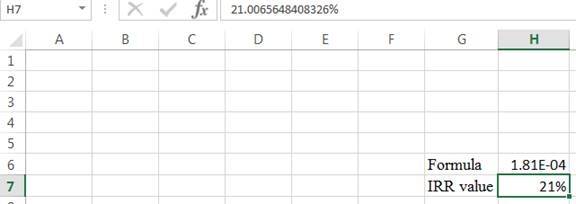

Compute IRR for Project B using a spreadsheet:

Step 1:

- Type the equation of NPV in H6 in the spreadsheet and consider the IRR value as H7.

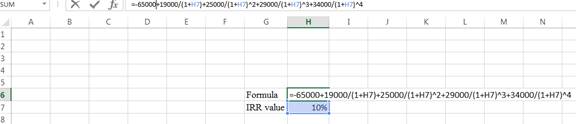

Step 2:

- Assume the IRR value as 10%.

Step 3:

- In the spreadsheet, go to data and select What-If-Analysis.

- In What-If-Analysis, select goal seek.

- In set cell, select H6 (the formula).

- The “To value” is considered as 0 (the assumption value for NPV).

- The H7 cell is selected for "by changing cell".

Step 4:

- Following the previous step click OK in the goal seek. The goal seek status appears with the IRR value,

Step 5:

- The value appears to be 21.0065648408326%.

Hence, the IRR value is 21%.

b)

To calculate: The NPV to choose the best project for the company.

Introduction:

The IRR (Internal

The NPV (Net Present Value) is a capital budgeting technique which is used to assess the investment that, in turn, is utilized to identify the profitability in a proposed investment.

b)

Answer to Problem 10QP

As NPV is greater in Project B, the company must accept Project B.

Explanation of Solution

Given information:

Company R has identified two mutually exclusive projects where the cash flows of Project A are$34,000, $27,000, $21,000, and $17,000 for years 1, 2, 3, and 4 respectively. The cash flows of Project B are $19,000, $25,000, $29,000, and $34,000 for years1, 2, 3, and 4 respectively. The initial costs of both the projects are -$65,000 respectively.

Note:

- NPV is the difference between the present values of the cash inflows andthe present value of cash outflows.

- The IRR is the rate of interest which makes the project’s NPV equal to zero. Hence, using the available information, assume that NPV is equal to zero and form an equation to compute the IRR.

Formula to calculate the NPV:

Compute NPV for Project A:

Hence, the NPV for Project A is $14,097.88.

Compute NPV for Project B:

Note: The rate is given at 11%.

Hence, the NPV for project B is $16,009.08.

c)

To calculate: The rates of discount at which the company will select Project A and Project B and the discount rate in which the company will be indifferent in selecting between the two projects.

Introduction:

The IRR (Internal Rate of Return) is a rate of discount which makes the predictable investment’s NPV equal to zero.

The NPV (Net Present Value) is a capital budgeting technique which is used to assess the investment that, in turn, is utilized to identify the profitability in a proposed investment.

c)

Answer to Problem 10QP

At the rate of discount above 16.30%, the company must choose Project A, and for the rate below 16.30%, the company should choose Project B. Hence, it is indifferent at the discount rate of 16.30%.

Explanation of Solution

Given information:

Company R has identified two mutually exclusive projects where the cash flows of Project A are$34,000, $27,000, $21,000, and $17,000 for years 1, 2, 3, and 4 respectively. The cash flows of Project B are $19,000, $25,000, $29,000, and $34,000 for years1, 2, 3, and 4 respectively. The initial costs of both the projects are -$65,000 respectively.

Note:

- NPV is the difference between the present values of the cash inflows and the present value of cash outflows.

- The IRR is the rate of interest which makes the project’s NPV equal to zero. Hence, using the available information, assume that NPV is equal to zero and form an equation to compute the IRR.

Equation to calculate the crossover rates:

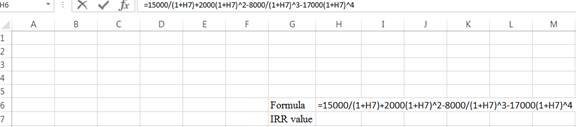

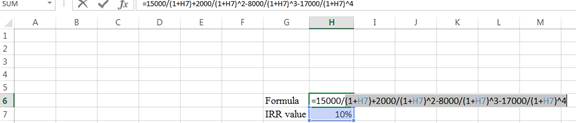

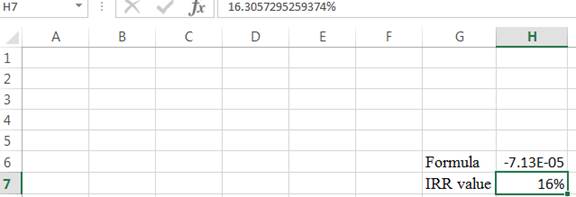

Compute the discount rate using a spreadsheet:

Step 1:

- Type the equation of NPV in H6 in the spreadsheet and consider the R value as H7.

Step 2:

- Assume the R value as 10%.

Step 3:

- In the spreadsheet, go to data and select What-If-Analysis.

- In What-If-Analysis, select goal seek.

- In set cell, select H6 (the formula).

- The “To value” is considered as 0 (the assumption value for NPV).

- The H7 cell is selected for "by changing cell".

Step 4:

- Following the previous step click OK in the goal seek. The goal seek status appears with the R value.

Step 5:

- The value appears to be 16.3057295259374%.

Hence, the R value is 16.31%.

Want to see more full solutions like this?

Chapter 8 Solutions

Essentials of Corporate Finance

- calculate ratios for the financial statment given and show all working manually: 1. Total Assets Turnover 2. Inventory Turnover 3. Inventory Periodarrow_forwardcalculate ratios for the financial statment given and show all working manually: 1. Debt Ratios 2. Debt to Equityarrow_forwardcalculate the following ratios for the statements and show all working: 1. Current Ratios 2. Quick Ratio 3. Cash Ratioarrow_forward

- Dont solve this question with incorrect values. i will give unhelpful . do not solvearrow_forwardJeff Krause purchased 1,000 shares of a speculative stock in January for $1.89 per share. Six months later, he sold them for $9.95 per share. He uses an online broker that charges him $10.00 per trade. What was Jeff's annualized HPR on this investment? Jeff's annualized HPR on this investment is %. (Round to the nearest whole percent.)arrow_forwardno ai do not answer this question if data is not clear or image is blurr. but do not amswer with unclear values. i will give unhelpful.arrow_forward

- Estefan Industies has a new project available that requires an initial investment of sex million. The project will provide unlevered cash flows of $925,000 per year for the next 20 years. The company will finance the project with a debt-value ratio of 35. The company's bonds have a YTM of 5.9 percent. The companies with operations comparable to this project have unlevered betas of 1.09, 1.17, 1.28, and 1.20. The risk-free rate is 3.6 percent, and the market risk premium is 7 percent. The tax rate is 21 percent. What is the NPV of this project?arrow_forwardno ai do not answer this question if data is not clear or image is blurr. please comment i will write values . but do not amswer with unclear values. i will give unhelpful.arrow_forwardno ai Image is blurr do not answer this question if data is not clear or image is blurr. please comment i will write values but do not amswer with unclear values. i will give unhelpful sure.arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education