Concept explainers

The stocks in Example 7.9 are all positively correlated. What happens when they are negatively correlated? Answer for each of the following scenarios. In each case, two of the three correlations are the negatives of their original values. Discuss the differences between the optimal portfolios in these three scenarios.

- a. Change the signs of the correlations between stocks 1 and 2 and between stocks 1 and 3. (Here, stock 1 tends to go in a different direction from stocks 2 and 3.)

- b. Change the signs of the correlations between stocks 1 and 2 and between stocks 2 and 3. (Here, stock 2 tends to go in a different direction from stocks 1 and 3.)

- c. Change the signs of the correlations between stocks 1 and 3 and between stocks 2 and 3. (Here, stock 3 tends to go in a different direction from stocks 1 and 2.)

EXAMPLE 7.9 PORTFOLIO SELECTION AT PERLMAN & BROTHERS

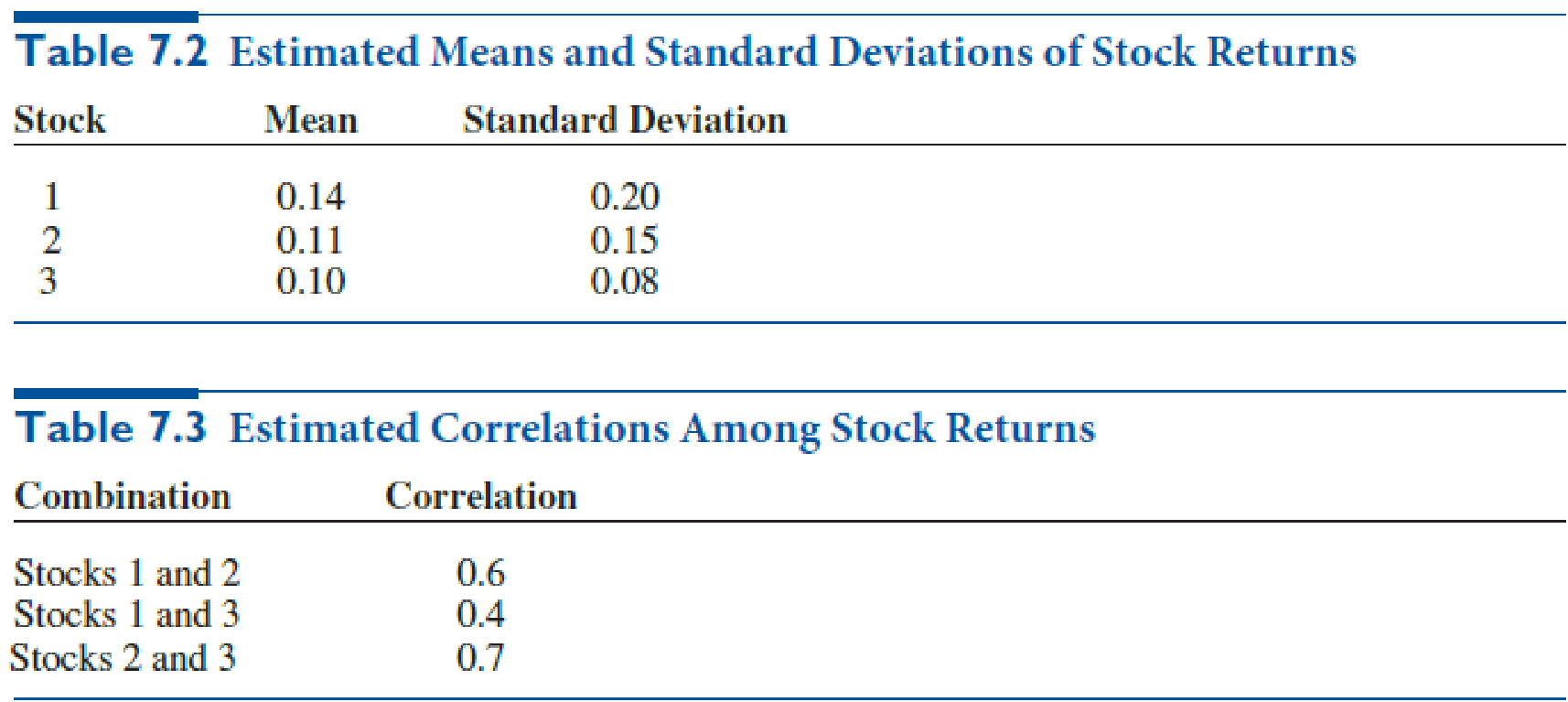

Perlman & Brothers, an investment company, intends to invest a given amount of money in three stocks. From past data, the means and standard deviations of annual returns have been estimated as shown in Table 7.2. The correlations among the annual returns on the stocks are listed in Table 7.3. The company wants to find a minimum-variance portfolio that yields a mean annual return of at least 0.12.

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Practical Management Science

- I need the answer to requirement C.arrow_forwardImagine you are Susan Kim and are faced with a difficult choice to either follow the orders she was given, or refusing to do so. Using each lens determine what the ethical response would be. Suppot your answer with materials from readings and lectures. For example, using Universalism what would the ethical response be? Do the same for all four lenses.arrow_forwardAnswer all these questions, selecting any company of your choice. Choose a specific type of food company. Select a specific product. Develop all the inputs that are part of the process. Develop the transformation process in a graphic (diagram, etc.). Develop all the outputs or finished products that are part of the process. Describe all the processes involved in one line of production in any manufacturing facility. Also describing how good management is the center of any part of a production company.arrow_forward

- Using exponential smoothing with α =0.2, forecast the demand for The initial forecast for January is 2000 tons. Calculate the capacity utilization for June, July and Discuss the implications of underutilized or over utilized capacity for Green Harvestarrow_forwardIn organizational development when results are improving but relationships are declining, what leadership style is appropriate? directing delegating supporting coachingarrow_forwardWhat is the first thing a leader should do when moving through a cultural change? conduct an assessment comparing the practices to other high-performing organizations learn about the current organizational culture continue to monitor key metrics define expectationsarrow_forward

- The third change leadership strategy, Collaborate on Implementation, is designed to address what type of concerns? impact concerns personal concerns refinement concerns collaboration concernsarrow_forwardIf team members are concerned with specifics such as their tasks, contingency plans, resources, and timeline, what concerns do they have? implementation concerns impact concerns refinement concerns personal concernsarrow_forwardAt the developing stage of organizational development, which leadership style is most appropriate? supporting coaching delegating directingarrow_forward

- During the start-up phase of organizations, which leadership style is appropriate? supporting coaching directing delegatingarrow_forwardRegarding relationships and results, what is typically seen in start-up orgnanizations? low results/high relationships low results/low relationships high results/high relationships high results/ low relationshipsarrow_forwardWhat issues lie within Employee and Labor relations with hours worked and how to solve the issues effectively.arrow_forward

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,