Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 8CE

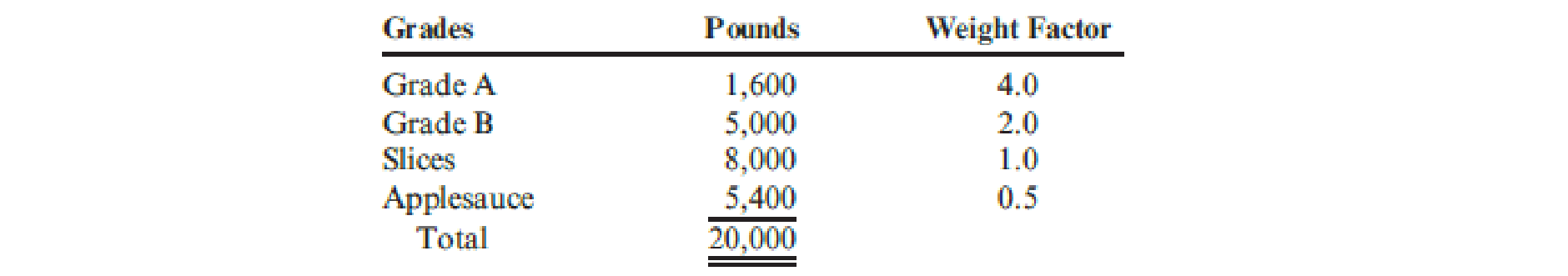

Refer to Cornerstone Exercise 7.7. Assume that Orchard Fresh, Inc., uses the weighted average method of joint cost allocation and has assigned the following weights to the four grades of apples:

Total joint cost is $18,000.

Required:

- 1. Allocate the joint cost to the four grades of apples using the weighted average method. (Carry out the percent calculations to four significant digits. Round all cost allocations to the nearest dollar.)

- 2. What if the factory found that Grade A apples were being valued less by customers and decided to decrease the weight factor for Grade A apples to 3.0? How would that affect the allocation of cost to Grade A apples? How would it affect the allocation of cost to the remaining grades?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

The following lots of Commodity Z were available for sale during the year.

Beginning inventory

First purchase

Second purchase

Third purchase

10 units at $30

25 units at $32

30 units at $34

10 units at $35

The firm uses the periodic inventory system, and there are 20 units of the commodity on hand at

the end of the year.

What is the ending inventory balance of Commodity Z using the weighted average cost method?

a. $620

b. $659

c. $690

d. $655

Assume that three identical units of merchandise were purchased during October, as follows:

Units

Cost

Oct. 5

Purchase

1

$ 5

12

Purchase

1

13

28

Purchase

1

15

Total

3

$33

One unit is sold on October 31 for $28. Using the table provided, determine the cost of goods sold

using the weighted average cost method.

a. $11

b. $17

c. $13

d. $22

Boxwood Company sells blankets for $39 each. The following information was taken from the inventory records during May. The company had no beginning inventory on May 1. Boxwood uses a perpetual inventory system.DateBlanketsUnitsCostMay 3Purchase21$1710Sale8

17Purchase36$1920Sale15

23Sale

30Purchase37$20Determine the gross profit for the sale of May 23 using the FIFO inventory costing method.a. $100b. $221c. $95d.$259

Chapter 7 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 7 - Describe the two-stage allocation process for...Ch. 7 - Why must support service costs be assigned to...Ch. 7 - Explain how allocation of support service costs is...Ch. 7 - Prob. 4DQCh. 7 - Explain how allocating support service costs will...Ch. 7 - Prob. 6DQCh. 7 - Explain why it is better to allocate budgeted...Ch. 7 - Why is it desirable to allocate variable costs and...Ch. 7 - Explain why either normal or peak capacity of the...Ch. 7 - Explain why variable bases should not be used to...

Ch. 7 - Prob. 11DQCh. 7 - Explain the difference between the direct method...Ch. 7 - The reciprocal method of allocation is more...Ch. 7 - What is a joint cost? How does it relate to...Ch. 7 - How do joint costs differ from other common costs?Ch. 7 - The expected costs for the Maintenance Department...Ch. 7 - Prob. 2CECh. 7 - Valron Company has two support departments, Human...Ch. 7 - Refer to Cornerstone Exercise 7.3. Now assume that...Ch. 7 - Refer to Cornerstone Exercise 7.3. Now assume that...Ch. 7 - Refer to Cornerstone Exercise 7.3 and solve for...Ch. 7 - Orchard Fresh, Inc., purchases apples from local...Ch. 7 - Refer to Cornerstone Exercise 7.7. Assume that...Ch. 7 - Refer to Cornerstone Exercise 7.7. Assume that...Ch. 7 - A company manufactures three products, L-Ten,...Ch. 7 - Refer to Cornerstone Exercise 7.10. (Round...Ch. 7 - Classify each of the following departments in a...Ch. 7 - Prob. 13ECh. 7 - Identify some possible causal factors for the...Ch. 7 - Prob. 15ECh. 7 - Prob. 16ECh. 7 - Prob. 17ECh. 7 - Kumar, Inc., evaluates managers of producing...Ch. 7 - Refer to the data in Exercise 7.18. When the...Ch. 7 - Jasmine Company manufactures both pesticide and...Ch. 7 - Refer to the data in Exercise 7.20. The company...Ch. 7 - Eilers Company has two producing departments and...Ch. 7 - Refer to the data in Exercise 7.22. The company...Ch. 7 - Refer to the data in Exercise 7.22. The support...Ch. 7 - Alomar Company manufactures four products from a...Ch. 7 - Refer to Exercise 7.25 and allocate the joint...Ch. 7 - Pacheco, Inc., produces two products, overs and...Ch. 7 - Minor Co. has a job order cost system and applies...Ch. 7 - A CPA would recommend changing from plantwide...Ch. 7 - A company uses charging rates to allocate service...Ch. 7 - Chester Company provided information on overhead...Ch. 7 - Which of the following statements is true? a. The...Ch. 7 - Biotechtron, Inc., has two research laboratories...Ch. 7 - AirBorne is a small airline operating out of...Ch. 7 - Duweynie Pottery, Inc., is divided into two...Ch. 7 - Macalister Corporation is developing departmental...Ch. 7 - Prob. 37PCh. 7 - Welcome Inns is a chain of motels serving business...Ch. 7 - Sonimad Sawmill, Inc. (SSI), purchases logs from...Ch. 7 - Prob. 40P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- General accounting questionarrow_forwardNonearrow_forwardChapter 18 Homework i Saved 15 Exercise 18-14 (Algo) Contribution margin income statement LO C2 1 points eBook Hint Sunn Company manufactures a single product that sells for $190 per unit and whose variable costs are $133 per unit. The company's annual fixed costs are $628,000. The sales manager predicts that next year's annual sales of the company's product will be 39,800 units at a price of $198 per unit. Variable costs are predicted to increase to $138 per unit, but fixed costs will remain at $628,000. What amount of income can the company expect to earn under these predicted changes? Prepare a contribution margin income statement for the next year. SUNN COMPANY Contribution Margin Income Statement Units $ per unit 39,800 $ 198 Ask Sales Variable costs 39,800 Print Contribution margin 39,800 Fixed costs Income References Mc Graw Hill $ 7,880,400 138 5,492,400 2,388,000 628,000 $ 1,760,000 Help Save & Exit Submit Check my workarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY