Concept explainers

Refer to the data in Exercise 7.20. The company has decided to use the sequential method of allocation instead of the direct method. The support departments are ranked in order of highest cost to lowest cost.

Required:

- 1. Allocate the

overhead costs to the producing departments using the sequential method. (Take allocation ratios out to four significant digits. Round allocated costs to the nearest dollar.) - 2. Using machine hours, compute departmental overhead rates. (Round the overhead rates to the nearest cent.)

1.

Allocate the overhead costs to the producing departments suing the sequential method.

Explanation of Solution

Sequential method of allocation: The sequential method of allocation foresees that the interactions between the supports departments occur; conversely the sequential method considers only partial account of this interaction.

Calculation allocation ratio:

| Power |

General Factory | Purchasing | Pesticide |

Liquid Fertilizer | |

| Square feet | (1)0.125 | (2)0.125 | (3)0.35 | (4)0.4 | |

| Machine hours | (5)0.75 | (6)0.25 | |||

| Purchase orders | (7)0.1 | (8)0.6 | (9)0.3 |

Table (1)

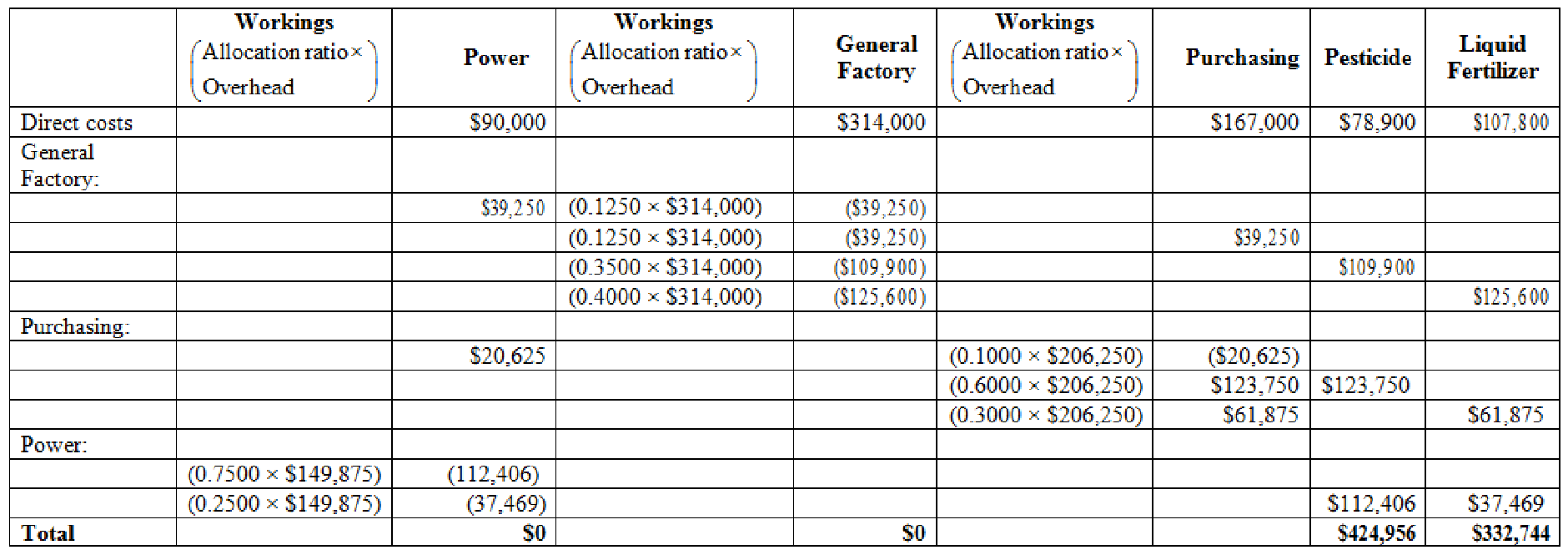

Calculate assignment of costs:

Figure (1)

Working notes:

(1)Calculate the allocation of square feet to Power department:

(2)Calculate the allocation of square feet to Purchasing department:

(3)Calculate the allocation of square feet to Pesticide department:

(4)Calculate the allocation of square feet to Liquid fertilizer department:

(5)Calculate the allocation of machine hours to Pesticide department:

(6)Calculate the allocation of machine hours to Liquid Fertilizer department:

(7)Calculate the allocation of purchase orders to power department:

(8)Calculate the allocation of purchase orders to pesticide department:

(9)Calculate the allocation of purchase orders to liquid fertilizer department:

2.

Calculate departmental overhead rates using machine hours.

Explanation of Solution

Departmental overhead rates: Departmental overhead rate is calculated by adding the allocated service costs to the overhead costs that are directly noticeable to the producing departments and dividing this total by some measure of activity, such as direct labor hours or machine hours.

Calculate the departmental overhead rate for pesticide department:

Therefore, the departmental overhead rate for pesticide department is $17.71 per machine hour.

Calculate the departmental overhead rate for Liquid fertilizer department:

Therefore, the departmental overhead rate for liquid fertilizer department is $41.59 per machine hour.

Want to see more full solutions like this?

Chapter 7 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Provide answer general accountingarrow_forwardGeneral Accounting Question please solvearrow_forwardDelivery Dudes Services has the collected the following information about operating expenditures for its delivery trucks for the past five years: Year Miles Operating costs 2019 45,000 $185,000 2020 60,000 $200,000 2021 40,000 $170,000 2022 55,000 $195,000 2023 75,000 $215,150 Using the high-low method, what is the estimated fixed cost for 2024 at an activity level of 50,000 miles? a. $123,200. b. $152,200. c. $134,600. d. $118,400.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College