Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 9CE

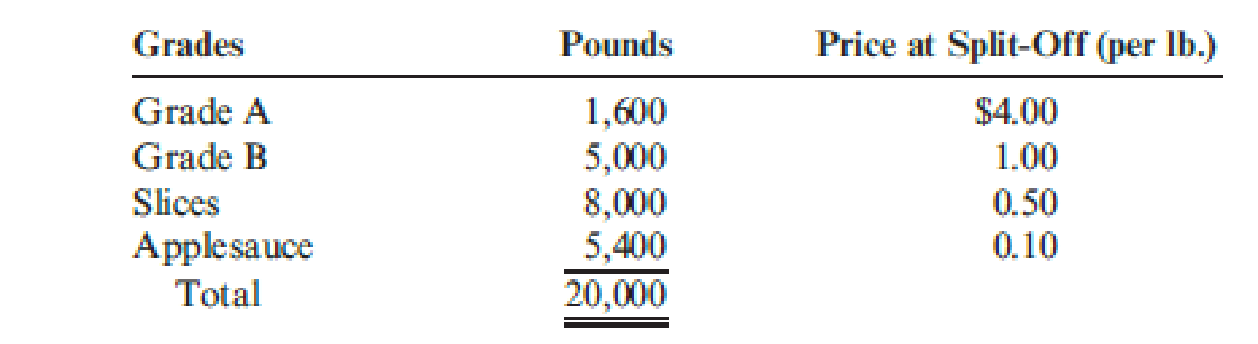

Refer to Cornerstone Exercise 7.7. Assume that Orchard Fresh. Inc., uses the sales-value-at-split-off method of joint cost allocation and has provided the following information about the four grades of apples:

Total joint cost is $18,000.

Required:

- 1. Allocate the joint cost to the four grades of apples using the sales-value-at-split-off method. (Carry out the percent calculations to four significant digits. Round all cost allocations to the nearest dollar.)

- 2. What if the price at split-off of Grade B apples increased to $1.20 per pound? How would that affect the allocation of cost to Grade B apples? How would it affect the allocation of cost to the remaining grades?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Determine the price of a $1.3 million bond issue under each of the following independent assumptions:

Maturity 10 years, interest paid annually, stated rate 8%, effective (market) rate 10%.

Maturity 10 years, interest paid semiannually, stated rate 8%, effective (market) rate 10%.

Maturity 10 years, interest paid semiannually, stated rate 10%, effective (market) rate 8%.

Maturity 20 years, interest paid semiannually, stated rate 10%, effective (market) rate 8%.

Maturity 20 years, interest paid semiannually, stated rate 10%, effective (market) rate 10%.

If total assets increase while liabilities remain unchanged, equity must:

A) IncreaseB) DecreaseC) Remain the sameD) Be negative

No chatgpt!!

Which of the following is an intangible asset?

A) InventoryB) CopyrightC) EquipmentD) Accounts Receivable

Chapter 7 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 7 - Describe the two-stage allocation process for...Ch. 7 - Why must support service costs be assigned to...Ch. 7 - Explain how allocation of support service costs is...Ch. 7 - Prob. 4DQCh. 7 - Explain how allocating support service costs will...Ch. 7 - Prob. 6DQCh. 7 - Explain why it is better to allocate budgeted...Ch. 7 - Why is it desirable to allocate variable costs and...Ch. 7 - Explain why either normal or peak capacity of the...Ch. 7 - Explain why variable bases should not be used to...

Ch. 7 - Prob. 11DQCh. 7 - Explain the difference between the direct method...Ch. 7 - The reciprocal method of allocation is more...Ch. 7 - What is a joint cost? How does it relate to...Ch. 7 - How do joint costs differ from other common costs?Ch. 7 - The expected costs for the Maintenance Department...Ch. 7 - Prob. 2CECh. 7 - Valron Company has two support departments, Human...Ch. 7 - Refer to Cornerstone Exercise 7.3. Now assume that...Ch. 7 - Refer to Cornerstone Exercise 7.3. Now assume that...Ch. 7 - Refer to Cornerstone Exercise 7.3 and solve for...Ch. 7 - Orchard Fresh, Inc., purchases apples from local...Ch. 7 - Refer to Cornerstone Exercise 7.7. Assume that...Ch. 7 - Refer to Cornerstone Exercise 7.7. Assume that...Ch. 7 - A company manufactures three products, L-Ten,...Ch. 7 - Refer to Cornerstone Exercise 7.10. (Round...Ch. 7 - Classify each of the following departments in a...Ch. 7 - Prob. 13ECh. 7 - Identify some possible causal factors for the...Ch. 7 - Prob. 15ECh. 7 - Prob. 16ECh. 7 - Prob. 17ECh. 7 - Kumar, Inc., evaluates managers of producing...Ch. 7 - Refer to the data in Exercise 7.18. When the...Ch. 7 - Jasmine Company manufactures both pesticide and...Ch. 7 - Refer to the data in Exercise 7.20. The company...Ch. 7 - Eilers Company has two producing departments and...Ch. 7 - Refer to the data in Exercise 7.22. The company...Ch. 7 - Refer to the data in Exercise 7.22. The support...Ch. 7 - Alomar Company manufactures four products from a...Ch. 7 - Refer to Exercise 7.25 and allocate the joint...Ch. 7 - Pacheco, Inc., produces two products, overs and...Ch. 7 - Minor Co. has a job order cost system and applies...Ch. 7 - A CPA would recommend changing from plantwide...Ch. 7 - A company uses charging rates to allocate service...Ch. 7 - Chester Company provided information on overhead...Ch. 7 - Which of the following statements is true? a. The...Ch. 7 - Biotechtron, Inc., has two research laboratories...Ch. 7 - AirBorne is a small airline operating out of...Ch. 7 - Duweynie Pottery, Inc., is divided into two...Ch. 7 - Macalister Corporation is developing departmental...Ch. 7 - Prob. 37PCh. 7 - Welcome Inns is a chain of motels serving business...Ch. 7 - Sonimad Sawmill, Inc. (SSI), purchases logs from...Ch. 7 - Prob. 40P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following is an intangible asset? A) InventoryB) CopyrightC) EquipmentD) Accounts Receivableno aiarrow_forwardWhich of the following is an intangible asset? A) InventoryB) CopyrightC) EquipmentD) Accounts Receivablearrow_forwardWhat does a ledger account represent? A) A detailed record of all business transactionsB) A summary of trial balancesC) An individual record for each accountD) The final balance of a financial statement Need help!arrow_forward

- What is the primary purpose of accounting? A) To generate tax revenueB) To record, summarize, and report financial transactionsC) To determine the market value of assetsD) To manage payrollarrow_forwardWhat are the three main financial statements in accounting?arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Incremental Analysis - Sell or Process Further; Author: Melissa Shirah;https://www.youtube.com/watch?v=7D6QnBt5KPk;License: Standard Youtube License