Concept explainers

Welcome Inns is a chain of motels serving business travelers in New Mexico and southwest Texas. The chain has grown from one motel several years ago to five motels. In 20x1, the owner of the company decided to set up an internal Accounting Department to centralize control of financial information. (Previously, local CPAs handled each motel’s bookkeeping and financial reporting.) The accounting office was opened in January 20x1 by renting space adjacent to corporate headquarters in Ruidoso, New Mexico. All motels have been supplied with personal computers and internet access to transfer information to central accounting on a daily basis.

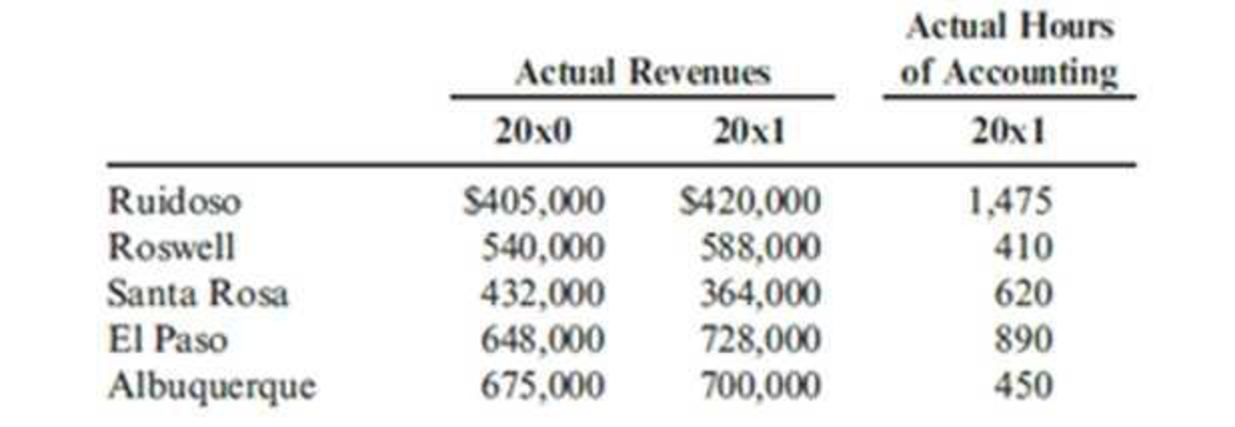

The Accounting Department has budgeted fixed costs of $135,000 per year. Variable costs are budgeted at $20 per hour. In 20x1, actual cost for the Accounting Department was $223,000. Further information is as follows:

Required:

- 1. Suppose the total actual costs of the Accounting Department are allocated on the basis of 20x1 sales revenue. How much will be allocated to each motel?

- 2. Suppose that Welcome Inns views 20x0 sales figures as a proxy for budgeted capacity of the motels. Thus, fixed Accounting Department costs are allocated on the basis of 20x0 sales, and variable costs are allocated according to 20x1 usage multiplied by the variable rate. How much Accounting Department cost will be allocated to each motel?

- 3. Comment on the two allocation schemes. Which motels would prefer the method in Requirement 1? The method in Requirement 2? Explain.

Trending nowThis is a popular solution!

Chapter 7 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,