Sonimad Sawmill, Inc. (SSI), purchases logs from independent timber contractors and processes them into the following three types of lumber products:

- 1. Studs for residential construction (e.g., walls and ceilings)

- 2. Decorative pieces (e.g., fireplace mantels and beams for cathedral ceilings)

- 3. Posts used as support braces (e.g., mine support braces and braces for exterior fences around ranch properties)

These products are the result of a joint sawmill process that involves removing bark from the logs, cutting the logs into a workable size (ranging from 8 to 16 feet in length), and then cutting the individual products from the logs, depending upon the type of wood (pine, oak, walnut, or maple) and the size (diameter) of the log.

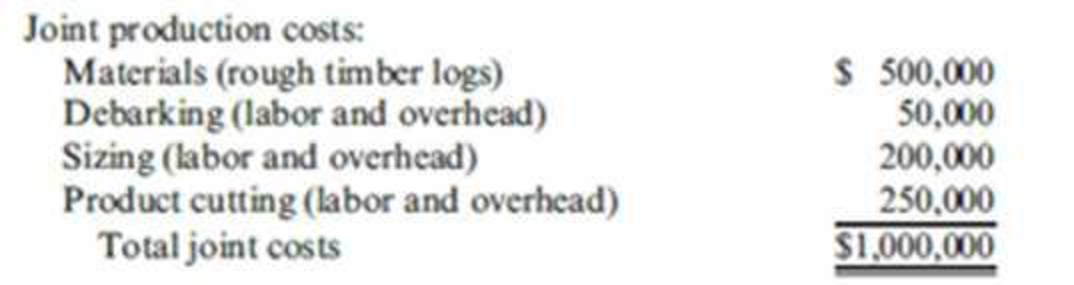

The joint process results in the following costs and output of products during a typical month:

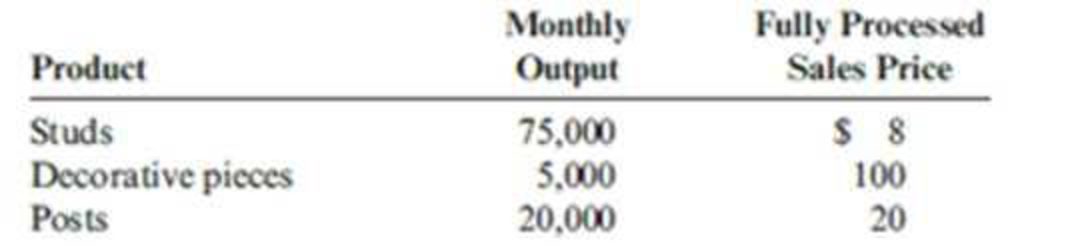

Product yield and average sales value on a per-unit basis from the joint process are as follows:

The studs are sold as rough-cut lumber after emerging from the sawmill operation without further processing by SSI. Also, the posts require no further processing. The decorative pieces must be planed and further sized after emerging from the SSI sawmill. This additional

Required:

- 1. Based on the information given for Sonimad Sawmill, Inc., allocate the joint processing costs of $1,000,000 to each of the three product lines using the:

- a. Relative sales-value-at-split-off method

- b. Physical units method at split-off

- c. Estimated net realizable value method

- 2. Prepare an analysis for Sonimad Sawmill, Inc., to compare processing the decorative pieces further as it presently does, with selling the rough-cut product immediately at split-off. Be sure to provide all calculations.

- 3. Assume Sonimad Sawmill, Inc., announced that in six months it will sell the rough-cut product at split-off due to increasing competitive pressure. Identify at least three types of likely behavior that will be demonstrated by the skilled labor in the planing and sizing process as a result of this announcement. Explain how this behavior could be improved by management. (CMA adapted)

Trending nowThis is a popular solution!

Chapter 7 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,