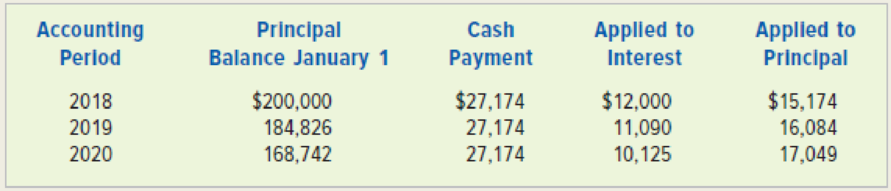

Amortization of a long-term loan

A partial amortization schedule for a 10-year note payable that Mabry Company issued on January 1, 2018, is shown as follows.

Required

a. What rate of interest is Mabry Company paying on the note?

b. Using a financial statements model like the one shown, record the appropriate amounts for the following two events:

(1) January 1, 2018, issue of the note payable.

(2) December 31, 2018, payment on the note payable.

c. If the company earned $62,000 cash revenue and paid $45,000 in cash expenses in addition to the interest in 2018, what is the amount of each of the following?

(1) Net income for 2018.

(2)

(3) Cash flow from financing activities for 2018.

d. What is the amount of interest expense on this loan for 2021?

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Survey Of Accounting

- Financial Accounting: Suppose the 2009 financial statements of 7D Company reported net sales of $27.6 billion. Accounts receivable (net) are $4.7 billion at the beginning of the year and $7.65 billion at the end of the year. A. Compute 7D Company's receivable turnover. B. Compute 7D Company's average collection period for accounts receivable in days.arrow_forward???arrow_forwardGeneral Accountingarrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning