Exercise 7-23 Effective interest amortization of a bond discount

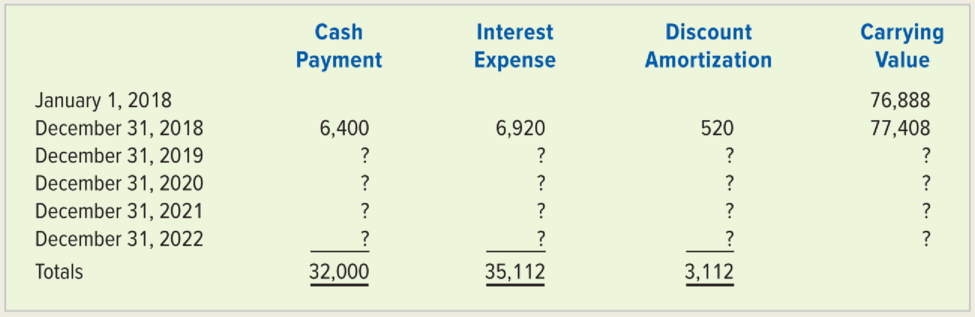

On January 1, 2018, Parker Company issued bonds with a face value of $80,000, a stated rate of interest of 8 percent, and a five-year term to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was 9 percent at the time the bonds were issued. The bonds sold for $76,888. Parker used the effective interest rate method to amortize the bond discount.

Required

a. Prepare an amortization table like the one that follows. Round answers to nearest whole dollar.

b. What item(s) in the table would appear on the 2021

c. What item(s) in the table would appear on the 2021 income statement?

d. What item(s) in the table would appear on the 2021 statement of

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Survey Of Accounting

- Blackwell Retail Corporation has experienced significant growth in the past fiscal year, with gross sales totaling $2,750,000. However, the company's records show that customers returned merchandise worth $175,000, and they provided a 4% early payment discount on $1,400,000 of their sales after accounting for returns. As the newly appointed financial analyst, your manager has asked you to calculate the net sales figure that should appear on the income statement for accurate financial reporting and investor communication. What is Blackwell Retail Corporation's net sales for the fiscal year?need helparrow_forwardPlease explain the accurate process for solving this financial accounting question with proper principles.arrow_forwardCan you solve this general accounting problem using accurate calculation methods?arrow_forward

- I need help with this general accounting problem using proper accounting guidelines.arrow_forwardCan you solve this general accounting problem using accurate calculation methods?arrow_forwardBlackwell Retail Corporation has experienced significant growth in the past fiscal year, with gross sales totaling $2,750,000. However, the company's records show that customers returned merchandise worth $175,000, and they provided a 4% early payment discount on $1,400,000 of their sales after accounting for returns. As the newly appointed financial analyst, your manager has asked you to calculate the net sales figure that should appear on the income statement for accurate financial reporting and investor communication. What is Blackwell Retail Corporation's net sales for the fiscal year?arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning