Survey Of Accounting

5th Edition

ISBN: 9781259631122

Author: Edmonds, Thomas P.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 32P

Problem 7-32 Accounting for a line of credit

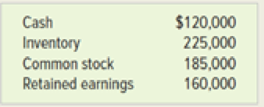

Elite Boat Sales uses a line of credit to help finance its inventory purchases. Elite Boat Sales sells boats

and equipment and uses the line of credit to build inventory for its peak sales months, which tend to be

clustered in the summer months. Account balances at the beginning of 2018 were as follows.

Elite Boat Sales experienced the following transactions for April, May, and June 2018:

- 1. April 1, 2018, obtained approval for a line of credit of up to $700,000. Funds are to be obtained or repaid on the first day of each month. The interest rate is the bank prime rate plus 1 percent.

- 2. April 1, 2018, borrowed $190,000 on the line of credit. The bank’s prime interest rate is 5 percent for April.

- 3. April 15, purchased inventory on account, $210,000.

- 4. April 31, paid other operating expenses of $105,000.

- 5. In April, sold inventory for $420,000 on account. The inventory had cost $250,000.

- 6. April 30, paid the interest due on the line of credit.

- 7. May 1, borrowed $230,000 on the line of credit. The bank’s prime rate is 6 percent for May.

- 8. May 1, paid the accounts payable from transaction 3.

- 9. May 10, collected $380,000 of the sales on account.

- 10. May 20, purchased inventory on account, $230,000.

- 11. May sales on account were $510,000. The inventory had cost $305,000.

- 12. May 31, paid the interest due on the line of credit.

- 13. June 1, repaid $150,000 on the line of credit. The bank’s prime rate is 6 percent for June.

- 14. June 5, paid $280,000 of the accounts payable.

- 15. June 10, collected $630,000 from

accounts receivable . - 16. June 20, purchased inventory on account, $375,000.

- 17. June sales on account were $605,000. The inventory had cost $370,000.

- 18. June 31, paid the interest due on the line of credit.

Required

- a. What is the amount of interest expense for April? May? June?

- b. What amount of cash was paid for interest in April? May? June?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Can you explain this general accounting question using accurate calculation methods?

What is the gross profit percentage?

I need assistance with this general accounting question using appropriate principles.

Chapter 7 Solutions

Survey Of Accounting

Ch. 7 - 1. What type of transaction is a cash payment to...Ch. 7 - Prob. 2QCh. 7 - How does recording accrued interest affect the...Ch. 7 - 4. Who is the maker of a note payable?Ch. 7 - How does the going concern assumption discussed in...Ch. 7 - 6. Why is it necessary to make an adjusting entry...Ch. 7 - Assume that on October 1, 2018, Big Company...Ch. 7 - Prob. 8QCh. 7 - Prob. 9QCh. 7 - Prob. 10Q

Ch. 7 - 11. Are contingent liabilities recorded on a...Ch. 7 - Prob. 12QCh. 7 - Prob. 13QCh. 7 - Prob. 14QCh. 7 - Prob. 15QCh. 7 - Prob. 16QCh. 7 - 1. What is the difference between classification...Ch. 7 - 2. At the beginning of Year 1, B Co. has a note...Ch. 7 - 3. What is the purpose of a line of credit for a...Ch. 7 - 4. What are the primary sources of debt financing...Ch. 7 - 5. What are some advantages of issuing bonds...Ch. 7 - 6. What are some disadvantages of issuing bonds?Ch. 7 - 7. Why can a company usually issue bonds at a...Ch. 7 - 15. If Roc Co. issued 100,000 of 5 percent,...Ch. 7 - 16. What is the mechanism is used to adjust the...Ch. 7 - 17. When the effective interest rate is higher...Ch. 7 - 18. What type of transaction is the issuance of...Ch. 7 - 19. What factors may cause the effective interest...Ch. 7 - 20. If a bond is selling at 97, how much cash will...Ch. 7 - Prob. 30QCh. 7 - 22. Gay Co. has a balance m the Bonds Payable...Ch. 7 - Prob. 32QCh. 7 - Prob. 33QCh. 7 - Recognizing accrued interest expense Abardeen...Ch. 7 - Prob. 2ECh. 7 - Prob. 3ECh. 7 - Prob. 4ECh. 7 - Prob. 5ECh. 7 - Effect of warranties on income and cash flow To...Ch. 7 - Effect of warranty obligations and payments on...Ch. 7 - Principle due at maturity versus installments...Ch. 7 - Prob. 9ECh. 7 - Amortization of a long-term loan A partial...Ch. 7 - Prob. 11ECh. 7 - Prob. 12ECh. 7 - Prob. 13ECh. 7 - Prob. 14ECh. 7 - Exercise 7-15 Straight-line amortization of a bond...Ch. 7 - Prob. 16ECh. 7 - Prob. 17ECh. 7 - Prob. 18ECh. 7 - Prob. 19ECh. 7 - Prob. 20ECh. 7 - Prob. 21ECh. 7 - Exercise 7-22 Preparing a classified balance sheet...Ch. 7 - Exercise 7-23 Effective interest amortization of a...Ch. 7 - Prob. 24ECh. 7 - Prob. 25ECh. 7 - Prob. 26PCh. 7 - Prob. 27PCh. 7 - Prob. 28PCh. 7 - Problem 7-29 Current liabilities The following...Ch. 7 - Prob. 30PCh. 7 - Prob. 31PCh. 7 - Problem 7-32 Accounting for a line of credit Elite...Ch. 7 - Prob. 33PCh. 7 - Prob. 34PCh. 7 - Problem 7-35 Straight-line amortization of a bond...Ch. 7 - Prob. 36PCh. 7 - Prob. 37PCh. 7 - Prob. 38PCh. 7 - Writing Assignment Definition of elements of...Ch. 7 - Prob. 5ATC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY