Exercise 7-15 Straight-line amortization of a bond discount

Diaz Company issued $180,000 face

Required

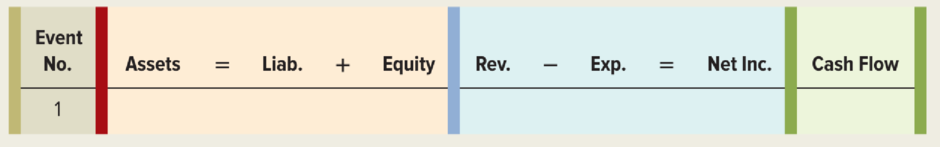

a. Use a financial statements model like the one shown below to demonstrate how (1) the January 1, 2018, bond issue and (2) the December 31, 2018, recognition of interest expense, including the amortization of the discount and the cash payment, affect the company’s financial statements. Use + for increase, − for decrease, and NA for not affected.

b. Determine the carrying value (face value less discount or plus premium) of the bond liability as of December 31, 2018.

c. Determine the amount of interest expense reported on the 2018 income statement.

d. Determine the carrying value (face value less discount or plus premium) of the bond liability as of December 31, 2019.

e. Determine the amount of interest expense reported on the 2019 income statement.

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Survey Of Accounting

- In pension accounting, actuarial gains and losses are____. (a) Added to pension obligation directly (b) Recognized in other comprehensive income (c) Deferred indefinitely (d) Always recognized immediately in profit or lossarrow_forwardwhat were its actual salea?arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning