Effect of

The following events apply to Gulf Seafood for the 2018 fiscal year:

1. The company started when it acquired $60,000 cash by issuing common stock.

2. Purchased a new cooktop that cost $40,000 cash.

3. Earned $72,000 in cash revenue.

4. Paid $25,000 cash for salaries expense.

5. Adjusted the records to reflect the use of the cooktop. Purchased on January 1, 2018, the cooktop has an expected useful life of four years and an estimated salvage value of $4,000. Use straightline depreciation. The

Required

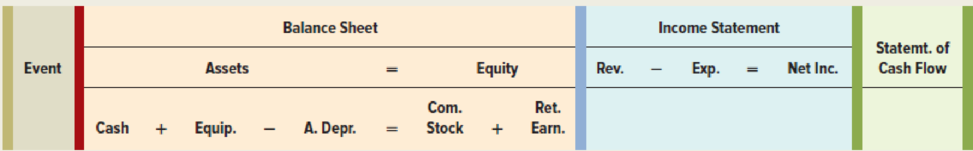

a. Record the previous transactions in a horizontal statements model like the following one.

b. What amount of depreciation expense would Gulf Seafood report on the 2018 income statement?

c. What amount of

d. Would the

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Survey Of Accounting