Performing ratio analysis using real-world data

Companies in the coal mining business use a lot of property, plant, and equipment. Not only is there the significant investment they must make in the equipment used to extract and process the coal, but they must also purchase the rights to the coal reserves themselves.

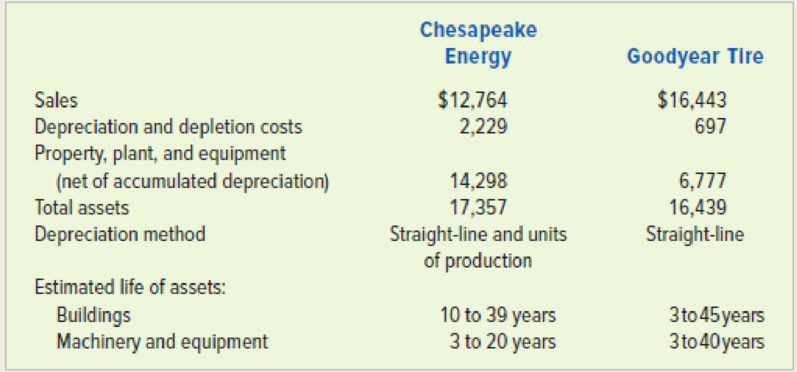

Goodyear Tire & Rubber Company, Inc. is the largest tire manufacturer in North America.

Chesapeake Energy Corporation claims to be the largest private-sector coal company in the world. The following information was taken from these companies’ December 31, 2015, annual reports. All dollar amounts are in millions.

Required

a. Calculate

b. Calculate buildings, property, plant, and equipment as a percentage of total assets for each company. (Round to three decimal places.)

c. Based only on the percentages calculated in Requirements a and b, which company appears to be using its assets most efficiently? Explain your answer.

d. Identify some of the problems a financial analyst encounters when trying to compare the used of long-term assets of Chesapeake versus Goodyear.

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Survey Of Accounting

- Meagan Industries completes Job #843, which has a standard of 450 labor hours at a standard rate of $24.50 per hour. The job was completed in 420 hours, and the average actual labor rate was $25.20 per hour. What is the labor efficiency (quantity) variance?arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forwardHow can I solve this financial accounting problem using the appropriate financial process?arrow_forward

- I am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardCan you help me solve this general accounting problem with the correct methodology?arrow_forwardPlease provide the answer to this financial accounting question with proper steps.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College