Concept explainers

Purchase and use of tangible asset: Three accounting cycles, doubledeclining- balance

The following transactions pertain to Accounting Solutions Inc. Assume the transactions for the purchase of the computer and any capital improvements occur on January 1 each year.

2018

1. Acquired $80,000 cash from the issue of common stock.

2. Purchased a computer system for $35,000. It has an estimated useful life of five years and a $5,000 salvage value.

3. Paid $2,450 sales tax on the computer system.

4. Collected $65,000 in fees from clients.

5. Paid $1,500 in fees for routine maintenance to service the computers.

6. Recorded double-declining-balance depreciation on the computer system for 2018.

2019

1. Paid $1,000 for repairs to the computer system.

2. Bought off-site backup services to maintain the computer system, $1,500.

3. Collected $68,000 in fees from clients.

4. Paid $1,500 in fees to service the computers.

5. Recorded double-declining-balance depreciation for 2019.

2020

1. Paid $6,000 to upgrade the computer system, which extended the total life of the system to six years. The salvage value did not change.

2. Paid $1,200 in fees to service the computers.

3. Collected $70,000 in fees from clients.

4. Recorded double-declining-balance depreciation for 2020.

Required

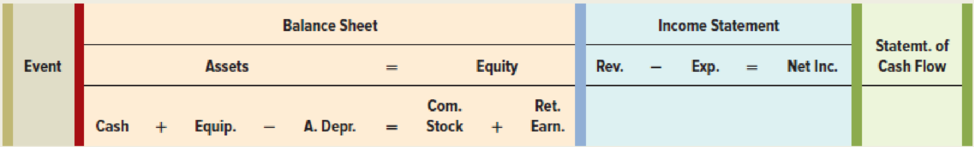

a. Record the previous transactions in a horizontal statements model like the following one.

b. Use a vertical model to present financial statements for 2018, 2019, and 2020.

a.

Record the given transactions in a horizontal statements model.

Explanation of Solution

Horizontal statements model: The model that represents all the financial statements, balance sheet, income statement, and statement of cash flows in one table in a horizontal form, is referred to as, horizontal statements model.

Record the given transactions in a horizontal statements model as follows:

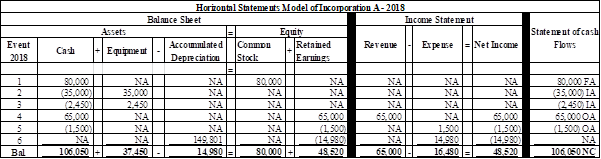

For 2018:

Figure (1)

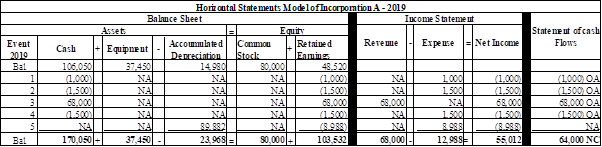

For 2019:

Figure (2)

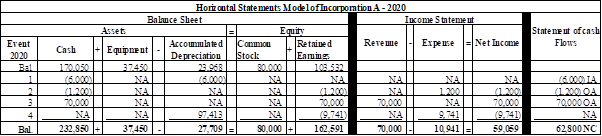

For 2020:

Figure (3)

Note: Refer working notes for the amount of depreciation expense.

Working note 1:

Determine the depreciation rate applied each year.

Useful life = 5 years

Working note 2:

Calculate the depreciation expense for 2018.

Working note 3:

Calculate the depreciation expense for 2019.

Working note 4:

Calculate the depreciation expense for 2020.

b.

Use a vertical model to present financial statements for 2018, 2019, and 2020.

Explanation of Solution

Income statement:

Income statement is a financial statement that shows the net income or net loss by deducting the expenses from the revenues and vice versa.

Statement of changes in stockholders' equity:

Statement of changes in stockholders' equity records the changes in the owners’ equity during the end of an accounting period by explaining about the increase or decrease in the capital reserves of shares.

Balance Sheet:

Balance sheet summarizes the assets, the liabilities, and the stockholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Statement of cash flows

Statement of cash flow is a financial statement that shows the cash and cash equivalents of a company for a particular period of time. It shows the net changes in cash, by reporting the sources and uses of cash as a result of operating, investing, and financing activities of a company.

Use a vertical model to present financial statements for 2018, 2019, and 2020as follows:

| Incorporation A | |||

| Financial Statements | |||

| For the year ended December 31 | |||

| Income Statements | |||

| Particulars | 2018 | 2019 | 2020 |

| Service Revenue | $65,000 | $68,000 | $70,000 |

| Less: Expenses | |||

| Maintenance Expense | 0 | (2,500) | 0 |

| Computer Service Expense | (1,500) | (1,500) | (1,200) |

| Depreciation Expense (refer working notes) | (14,980) | (8,988) | (9,741) |

| Net Income | $48,520 | $55,012 | $59,059 |

| Statement of Changes in Stockholder's Equity | |||

| Beginning Common Stock | 0 | $80,000 | $80,000 |

| Add: Stock Issued | 80,000 | 0 | 0 |

| Ending Common Stock (A) | 80,000 | 80,000 | 80,000 |

| Beginning Retained Earnings | 0 | 48,520 | 103,532 |

| Add: Net Income | 48,520 | 55,012 | 59,059 |

| Ending Retained Earnings (B) | 48,520 | 103,532 | 162,591 |

| Total Stockholders’ Equity | $128,520 | $183,532 | $242,591 |

Table (1)

| Incorporation A | |||

| Balance Sheet as of December 31 | |||

| Particulars | 2018 | 2019 | 2020 |

| Assets | |||

| Cash | $106,050 | $170,050 | $232,850 |

| Computer | 37,450 | 37,450 | 37,450 |

| Less: Accumulated Depreciation | (14,980) | (23,968) | (27,709) |

| Total Assets | $128,520 | $183,532 | $242,591 |

| Liabilities | $0 | $0 | $0 |

| Stockholders’ Equity | |||

| Common Stock | 80,000 | 80,000 | 80,000 |

| Retained Earnings | 48,520 | 103,532 | 162,591 |

| Total Stockholders’ Equity | $128,520 | $183,532 | $242,591 |

| Total Liabilities and Stockholders' Equity | $128,520 | $183,532 | $242,591 |

Table (2)

| Incorporation A | |||

| Statement of Cash Flows | |||

| For the Year Ended December 31 | |||

| Particulars |

2018 (in $) |

2019 (in $) |

2020 (in $) |

| Cash Flows From Operating Activities: | |||

| Inflow from revenue | 65,000 | 68,000 | 70,000 |

| Less: Outflow for expenses | (1,500) | (4,000) | (1,200) |

| Net Cash Flow from operating activities (C) | 63,500 | 64,000 | 68,800 |

| Cash Flows From Investing Activities: | |||

| Outflow to purchase Computer | (37,450) | 0 | (6,000) |

| Net Cash Flow from investing activities (D) | (37,450) | 0 | (6,000) |

| Cash Flows From Financing Activities: | |||

| Inflow from stock issue | 80,000 | 0 | 0 |

| Net Cash Flow from financing activities (E) | 80,000 | 0 | 0 |

| Net Increase in Cash | 106,050 | 64,000 | 62,800 |

| Add: Beginning Cash Balance | 0 | 106,050 | 170,050 |

| Ending Cash Balance | $106,050 | $170,050 | $232,850 |

(Table 3)

Want to see more full solutions like this?

Chapter 6 Solutions

Survey Of Accounting

- Can you help me solve this general accounting question using valid accounting techniques?arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forwardI am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forward

- I am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardPlease explain the solution to this general accounting problem using the correct accounting principles.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage