Companies in different industries often use different proportions of current versus long-term assets to accomplish their business objective. The technology revolution resulting from the silicon microchip has often been led by two well-known companies: Microsoft and Intel. Although often thought of together, these companies are really very different. Using either the most current Forms 10-K or annual reports for Microsoft Corporation and Intel Corporation, complete the following requirements. To obtain the Forms 10-K, use either the EDGAR system following the instructions in Appendix A or the company’s website. Microsoft’s annual report is available on its website; Intel’s annual report is its Form 10-K.

Required

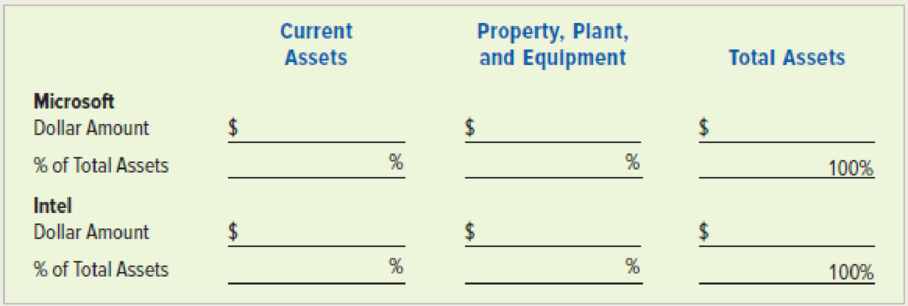

a. Fill in the missing data in the following table. The percentages must be computed; they are not

included in the companies’ 10-Ks. (Note: The percentages for current assets and property, plant,

and equipment will not sum to 100.)

b. Briefly explain why these two companies have different percentages of their assets in current

assets versus property, plant, and equipment.

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Survey Of Accounting

- I am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forwardPlease provide the solution to this general accounting question with accurate financial calculations.arrow_forward

- Can you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forward

- I need assistance with this general accounting question using appropriate principles.arrow_forwardPlease provide the solution to this general accounting question with accurate financial calculations.arrow_forwardI am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forward

- Can you help me solve this general accounting problem with the correct methodology?arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forward

Accounting Information SystemsFinanceISBN:9781337552127Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan HillPublisher:Cengage Learning

Accounting Information SystemsFinanceISBN:9781337552127Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan HillPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L

Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning