Survey Of Accounting

5th Edition

ISBN: 9781259631122

Author: Edmonds, Thomas P.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 6E

LO 8-1 Exercise 8-6 A Allocating costs for a basket purchase

Pitney Co. purchased an office building, land, and furniture for $500,000 cash. The appraised value of the assets was as follows:

| Land | $180,000 |

| Building | 300,000 |

| Furniture | 120,000 |

| Total | $600,000 |

Required

- a. Compute the amount to be recorded on the books for each asset.

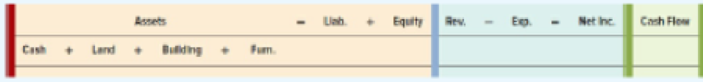

- b. Show the purchase in a horizontal statements model like the following one:

- c. Prepare the general

journal entry to record the purchase.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I need assistance with this financial accounting problem using appropriate calculation techniques.

I am trying to find the accurate solution to this financial accounting problem with appropriate explanations.

If Summit Corp. reports Salaries and Wages Expense of $520,400 for the year, and the beginning and ending balances of Salaries and Wages Payable are $22,100 and $25,300respectively, what is the amount of cash paid to employees during the year?

Chapter 6 Solutions

Survey Of Accounting

Ch. 6 - 1. What is the difference between the functions of...Ch. 6 - Prob. 2QCh. 6 - Prob. 3QCh. 6 - 4. Define depreciation. What kind of asset...Ch. 6 - Prob. 5QCh. 6 - Prob. 6QCh. 6 - Prob. 7QCh. 6 - 8. Explain the historical cost concept as it...Ch. 6 - Prob. 9QCh. 6 - Prob. 10Q

Ch. 6 - Prob. 11QCh. 6 - 12. Explain straight-line, units-of-production,...Ch. 6 - Prob. 13QCh. 6 - Prob. 14QCh. 6 - Prob. 15QCh. 6 - Prob. 16QCh. 6 - 17. What is salvage value?Ch. 6 - Prob. 18QCh. 6 - Prob. 19QCh. 6 - Prob. 20QCh. 6 - Prob. 21QCh. 6 - 22. Why would a company choose to depreciate one...Ch. 6 - Prob. 23QCh. 6 - 27. How are capital expenditures made to improve...Ch. 6 - Prob. 25QCh. 6 - Prob. 26QCh. 6 - Prob. 27QCh. 6 - Prob. 28QCh. 6 - Prob. 1ECh. 6 - Prob. 2ECh. 6 - Prob. 3ECh. 6 - Prob. 4ECh. 6 - Prob. 5ECh. 6 - LO 8-1 Exercise 8-6 A Allocating costs for a...Ch. 6 - Effect of depreciation on the accounting equation...Ch. 6 - Prob. 8ECh. 6 - Prob. 9ECh. 6 - Prob. 10ECh. 6 - Events related to the acquisition, use, and...Ch. 6 - Prob. 12ECh. 6 - Prob. 13ECh. 6 - Prob. 14ECh. 6 - Prob. 15ECh. 6 - Prob. 16ECh. 6 - Prob. 17ECh. 6 - Prob. 18ECh. 6 - Prob. 19ECh. 6 - Prob. 20ECh. 6 - Prob. 21ECh. 6 - Accounting for acquisition of assets, including a...Ch. 6 - Calculating depreciation expense using three...Ch. 6 - Determining the effect of depreciation expense on...Ch. 6 - Prob. 25PCh. 6 - Prob. 26PCh. 6 - Prob. 27PCh. 6 - Prob. 28PCh. 6 - Revision of estimated salvage value Delta Machine...Ch. 6 - Purchase and use of tangible asset: Three...Ch. 6 - Recording continuing expenditures for plant assets...Ch. 6 - Prob. 32PCh. 6 - Prob. 33PCh. 6 - Prob. 34PCh. 6 - Prob. 35PCh. 6 - Performing ratio analysis using real-world data...Ch. 6 - Prob. 1ATCCh. 6 - ATC 6-3 Research Assignment Comparing Microsofts...Ch. 6 - Prob. 4ATCCh. 6 - ATC 6-5 Ethical Dilemma Whats an expense? Several...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I am searching for the right answer to this financial accounting question using proper techniques.arrow_forwardKindly help me with this General accounting questions not use chart gpt please fast given solutionarrow_forwardHii teacher please provide for General accounting question answer do fastarrow_forward

- I am looking for help with this general accounting question using proper accounting standards.arrow_forwardPlease provide the correct answer to this general accounting problem using valid calculations.arrow_forwardCorvex Industries had sales of$620 million last year, and its production facility operated at 80% of capacity. The actual amount of fixed assets was $250 million. What total amount of fixed assets will Corvex need if it plans to increase sales by 30%?arrow_forward

- I am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardI need assistance with this financial accounting problem using appropriate calculation techniques.arrow_forwardI need help with this general accounting question using the proper accounting approach.arrow_forward

- Kepler Manufacturing has $18,000 of ending finished goods inventory as of December 31, 2023. If beginning finished goods inventory was $8,000 and the cost of goods sold (COGS) was $55,000, how much would Kepler report for cost of goods manufactured?arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Corporate Financial Accounting

Accounting

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY