Concept explainers

a)

To calculate: The annual percentage rate and the effective annual rate

Introduction:

The annual rate that is earned from the investment or charged for a borrowing is an annual percentage rate and it is also represented as APR. Thus, the APR is calculated by multiplying the rate of interest for a year with the number of months in a year. The effective annual rate is the rate of interest that is expressed as if it were compounded once in a year.

a)

Answer to Problem 77QP

The annual percentage rate is 390%, the effective annual rate is 4,197.74%

Explanation of Solution

Given information:

A check-cashing store makes a personal loan to wake-up consumers. The store offers a week loan at the rate of interest of 7.5% per week. Then, after few days, the store again makes a one-week loan at a discount interest rate of 7.5% for a week. The store also makes an add-on interest on the loan at a discount interest rate of 7.5% for a week.

Thus, if Person X borrows $100 for 4 weeks, the interest would be $33.55. As this is a discount interest rate, the net proceeding of Person X will be $66.45. Thus, Person X has to pay $100 for a month and the store also lets Person X to pay $25 in installments for a week.

Compute the annual percentage rate:

Note: The annual percentage rate is computed by multiplying the interest rate with the number of months in a year. Here, the interest is calculated per week and so the number of weeks in a year (52 weeks) is taken as the period.

Hence, the annual percentage rate is 390%

Formula to calculate the effective annual rate:

Compute the effective annual rate:

Hence, the effective annual rate is 0.41,9774 or 4,197.74%

b)

To calculate: The annual percentage rate and the effective annual rate

Introduction:

The annual rate that is earned from the investment or charged for a borrowing is an annual percentage rate and it is also represented as APR. Thus, the APR is calculated by multiplying the rate of interest for a year with the number of months in a year. The effective annual rate is the rate of interest that is expressed as if it were compounded once in a year.

b)

Answer to Problem 77QP

The annual percentage rate is 421.62%, the effective annual rate is 5,662.75%

Explanation of Solution

Given information:

A check-cashing store makes a personal loan to wake-up consumers. The store offers a week loan at the rate of interest of 7.5% per week. Then, after few days, the store again makes a one-week loan at a discount interest rate of 7.5% for a week. The store also makes an add-on interest on the loan at a discount interest rate of 7.5% for a week.

Thus, if Person X borrows $100 for 4 weeks, the interest would be $33.55. As this is a discount interest rate, the net proceeding of Person X will be $66.45. Thus, Person X has to pay $100 for a month and the store also lets Person X to pay $25 in installments for a week.

Explanation:

In the discount loan, the amount that Person X gets is reduced by the discount and Person X has to pay back the full principal value. With the discount of 7.5%, Person X receives $9.25 for each $10 as the principal value. The weekly interest rates are calculated as follows:

Note: The dollar values that are used above are not relevant. In other words, it can also be written as $0.925 and $1 or $92.5 and $100 or in any other combination that provides similar rate of interest.

Hence, the r value is 0.0811 or 8.11%

Compute the annual percentage rate:

Note: The annual percentage rate is computed by multiplying the interest rate with the number of months in a year. Here, the interest is calculated per week and so the number of weeks in a year (52 weeks) is taken as the period.

Hence, the annual percentage rate is 421.62%

Formula to calculate the effective annual rate:

Compute the effective annual rate:

Hence, the effective annual rate is 56.6275 or 5,662.75%

c)

To calculate: The annual percentage rate and the effective annual rate

Introduction:

The annual rate that is earned from the investment or charged for a borrowing is an annual percentage rate and it is also represented as APR. Thus, the APR is calculated by multiplying the rate of interest for a year with the number of months in a year. The effective annual rate is the rate of interest that is expressed as if it were compounded once in a year.

c)

Answer to Problem 77QP

The annual percentage rate is 968.19%, the effective annual rate is 717,745.21%

Explanation of Solution

Given information:

A check-cashing store makes a personal loan to wake-up consumers. The store offers a week loan at the rate of interest of 7.5% per week. Then, after few days, the store again makes a one-week loan at a discount interest rate of 7.5% for a week. The store also makes an add-on interest on the loan at a discount interest rate of 7.5% for a week.

Thus, if Person X borrows $100 for 4 weeks, the interest would be $33.55. As this is a discount interest rate, the net proceeding of Person X will be $66.45. Thus, Person X has to pay $100 for a month and the store also lets Person X to pay $25 in installments for a week.

Explanation:

In this part, the present value of an

Formula to calculate the present value annuity:

Note: C denotes the payments, r denotes the rate of exchange, and t denotes the period. Using the formulae of the present value of annuity, the interest rate is computed using the spreadsheet method.

Compute the present value annuity:

Compute the interest rate using the spreadsheet:

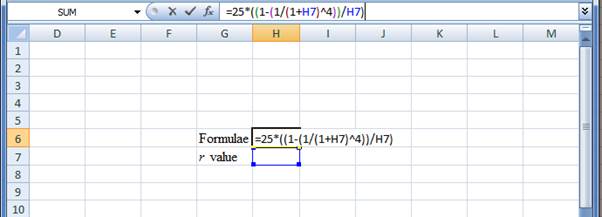

Step 1:

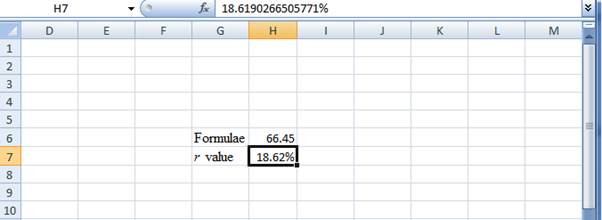

- Type the formulae of the present value annuity in H6 in the spreadsheet and consider the r value as H7

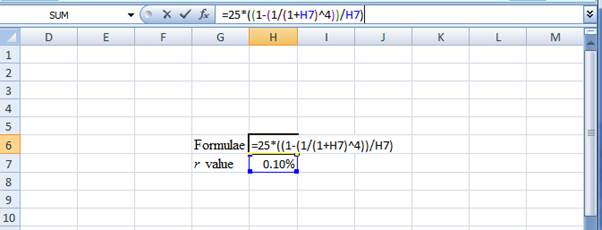

Step 2:

- Assume the r value as 0.10%

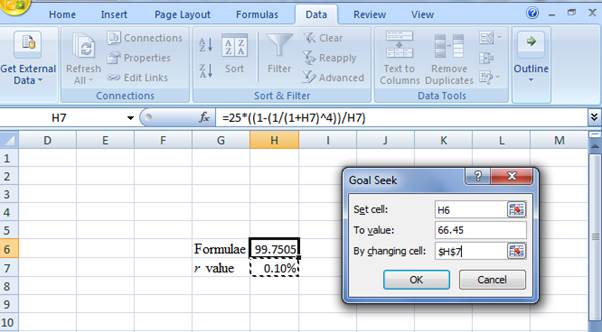

Step 3:

- In the spreadsheet, go to Data and select What-If-Analysis.

- Under What-If-Analysis, select Goal Seek

- In set cell, select H6 (the formula)

- The To value is considered as 66.45 (the value of the present value of annuity)

- The H7 cell is selected for the 'by changing cell.'

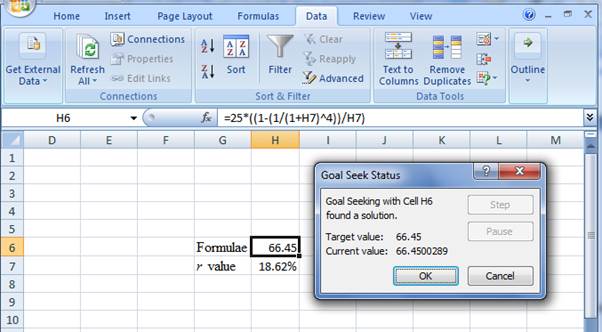

Step 4:

- Following the previous step, click OK in the Goal Seek Status. The Goal Seek Status appears with the r value

Step 5:

- The r value appears to be 18.6190266505771%

Hence, the r value is 18.62%

Compute the annual percentage rate:

Note: The annual percentage rate is computed by multiplying the interest rate with the number of periods in a year. Here, the interest is calculated per week and so the number of weeks in a year (52 weeks) is taken as the period.

Hence, the annual percentage rate is 968.19%

Formula to calculate the effective annual rate:

Compute the effective annual rate:

Hence, the effective annual rate is 7,177.4521 or 717,745.21%.

Want to see more full solutions like this?

Chapter 6 Solutions

Fundamentals of Corporate Finance

- What is the 50/30/20 budgeting rule in finance?arrow_forwardHow do student loans impact long-term financial health?arrow_forwardWith regard to foreign currency translation methods used by foreign MNCs, Multiple Choice a. foreign currency translation methods are generally only used by U.S. based MNCs since foreign firms have a built-in hedge by being foreign. b. are generally the same methods used by U.S.-based firms. c. are exactly the same methods used by U.S.-based firms since GAAP is GAAP. d. none of the options.arrow_forward

- Cray Research sold a supercomputer to the Max Planck Institute in Germany on credit and invoiced €11.60 million payable in six months. Currently, the six-month forward exchange rate is $1.18 per euro and the foreign exchange adviser for Cray Research predicts that the spot rate is likely to be $113 per euro in six months.Required: a. What is the expected gain/loss from a forward hedge?Note: A Negative value should be indicated with a minus sign. Do not round intermediate calculations. Round your final answer in whole dollars not in millions.arrow_forwardWhat is the time value of money and how is it calculated? need answer!arrow_forwardHelp me in this question! What is the time value of money and how is it calculated?arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education