To calculate: The value of

Introduction:

The future sum of money that worth today is described by the

Answer to Problem 52QP

The value of

Explanation of Solution

Given information:

The five-year

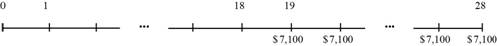

Time line of the sales:

Note: The cash flows in the given information are semiannual, so it is necessary to find the effective semiannual rate. The annual percentage rate is 8%.

Formula to calculate the monthly rate with the annual percentage rate:

Compute the monthly rate with the annual percentage rate:

Hence, the monthly rate is 0.0067

Formula to calculate the effective semiannual rate:

Compute the effective semiannual rate:

Note: To calculate the effective semiannual rate, the time period is assumed to be six months. The APR is the annual percentage rate. The monthly rate for the annual percentage rate is calculated above.

Hence, the effective semiannual rate is 0.0406 or 4.06%.

Formula to calculate the present value annuity:

Note: C denotes the annual cash flow, r denotes the rate of exchange, and t denotes the period.

Compute the present value annuity at year 9:

Note: This is the value for the first period of six months previous to the first payment, thus it is the value at the year nine. Therefore, the value at different periods asked in the question utilizes this value of nine years from now.

Hence, the present value annuity at year nine is $57,395.02

Formula to calculate the present value:

Note: r denotes the rate of discount and t denotes the number of years.

Compute the present value at year 5:

Note: The present value for the fifth year can also be calculated using the effective annual rate, the present values for the remaining years can also be calculated using the effective annual rate.

Hence, the value of annuity at 5 year is $41,721.62

Formula to calculate the effective annual rate:

Compute the effective annual rate:

Hence, the effective annual rate 0.0830 or 8.30%

Formula to calculate the present value:

Note: r denotes the rate of discount and t denotes the number of years.

Compute the present value at year 5:

Hence, the value of annuity at 5 year is $41,721.62

The value of annuity for the other years is calculated as follows:

Note: The present value at year 3 is calculated using the calculated r values

Hence, the value of year three is $35,571.70

Note: The present value at year 0 is calculated using the calculated r values

Hence, the current value is $28,003.99.

Want to see more full solutions like this?

Chapter 6 Solutions

Fundamentals of Corporate Finance

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College