CASE 5A-12 Analysis of Mixed Costs in a Pricing Decision LO5-11

Maria Chavez owns a catering company that serves food and beverages at parties and business functions. Chavez’s business is seasonal, with a heavy schedule during the summer months and holidays and a lighter schedule at other times.

One of the major events Chavez’s customers request is a cocktail party. She offers a standard cocktail party and has estimated the cost per guest as follows:

Food and beverages.................................................$15.00

Labor (0.5 hrs. @ $10.00/hr.)…………………………………………………………………………………………………5.00

Total cost per guest………………………………………………………………………………………………………………$26.99

The standard cocktail party lasts three hours and Chavez hires one worker for every six guests, so that works out to one-half hour of labor per guest. These workers are hired only as needed and are paid only for the hours they actually work.

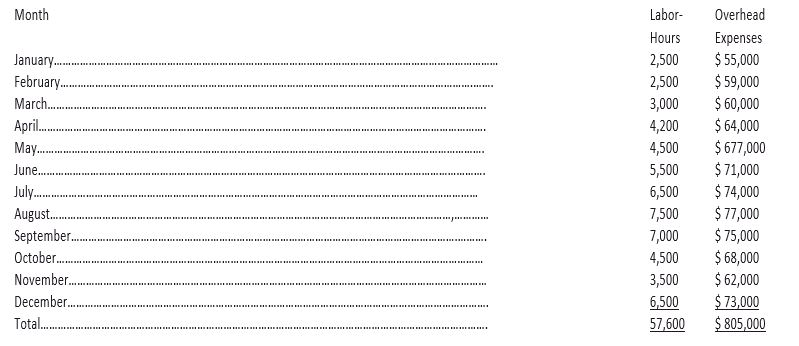

When bidding on cocktail parties. Chavez adds a 15% markup to yield a price of about $31 per guest. She is confident about her estimates of the costs of food and beverages and labor but is not as comfortable with the estimate of overhead cost. The $13.98 overhead cost per labor-hour was determined by dividing total overhead expenses for the last 12 months by total labor-hours for the same period. Monthly data concerning overhead costs and labor-hours follow:

Chavez has received a request to bid on a 180-guest fundraising cocktail party to be given next month by an important local charity. (The party would last the usual three hours.) She would like to win this contract because the guest list for this charity event includes many prominent individuals that she would like to secure as future clients. Maria is confident that these potential customers would be favorably impressed by her company’s services at the charity event.

Required:

- Prepare a scatter graph plot that puts labor-hours on the X-axis and overhead expenses on the Y-axis. What insights are revealed by your scattergraph?

- Use the least-squares regression method to estimate the fixed and variable components of overhead expenses. Express these estimates in the form Y=a+bX.

- If Chavez charges her usual price of $31 per guest for the 180-guest cocktail party, how much contribution margin will she earn by serving this event?

- How low could Chavez bid for the charity event in terms of a price per guest and still break even on the event itself?

- The individual who is organizing the charity’s fundraising event has indicated that he has already received a bid under $30 from another catering company. Do you think Chavez should bid below her normal $31 per guest price for the charity event? Why or why not?

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Managerial Accounting

- Cost Behavior Analysis in a Restaurant: High-Low Cost Estimation Assume a Papa John's restaurant has the following information available regarding costs at representative levels of monthly sales: Monthly sales in units 5,000 8,000 10,000 Cost of food sold $10,000 $16,000 $20,000 Wages and fringe benefits 4,200 4,320 4,400 Fees paid delivery help 1,100 1,760 2,200 Rent on building 1,100 1,100 1,100 Depreciation on equipment 900 900 900 Utilities 800 920 1,000 Supplies (soap, floor wax, etc.) 250 340 400 Administrative costs 1,700 1,700 1,700 Total $20,050 $27,040 $31,700 (a) Identify each cost as being variable, fixed, or mixed. Cost of food sold Wages and fringe benefits Fees paid delivery helparrow_forwardA1arrow_forwardFallow the format when doing the solution like in the picturearrow_forward

- Cost Behavior Analysis in a Restaurant: High-Low Cost Estimation Assume a Papa John's restaurant has the following information available regarding costs at representative levels of monthly sales: Cost of food sold Wages and fringe benefits Fees paid delivery help Rent on building Depreciation on equipment Utilities Supplies (soap, floor wax, etc.) Administrative costs Total Monthly sales in units 5,000 8,000 10,000 $15,000 $24,000 $30,000 4,350 4,560 4,700 1,300 2,080 2,600 1.300 1,300 1,300 400 400 400 750 840 900 150 180 200 1.500 1.500 1,500 $24.750 $34,860 $41,600 (a) Identify each cost as being variable, fixed, or mixed. Cost of food sold Wages and fringe benefits Fees paid delivery help Rent on building Depreciation on equipment Variable # Mixed ● Variable ÷ Fixed Fixedarrow_forwardacc1arrow_forwardQuestion 3 Angie March owns a catering company that stages banquets and parties for both individuals and companies. The business is seasonal, with heavy demand during the summer months and year-end holidays and light demand at other times. Angie has gathered the following cost information from the past year: Month January February March April May June July August September October November December Total ▼(a) Labor Hours Overhead Costs 3,500 2,800 3,000 4,200 4,500 5,500 6,500 7,500 7,800 4,500 Variable cost = $ x 3,100 6,500 59,400 Your answer is partially correct. Try again. Using the high-low method, compute the overhead cost per labor hour and the fixed overhead cost per month. (Round variable cost to 2 decimal places, e.g. 52.75 and all other answers to 0 decimal places, e.g. 5,275.) Fixed cost = $ $73,000 69,080 70,000 77,000 80,000 87,000 91,000 96,000 99,580 81,000 73,000 90,000 $986,660 6.1 per labor hourarrow_forward

- v.2arrow_forwardClaudia wants to perform a break-even analysis on her very busy casual-dining operation. She has obtained the following operating results from last month's income statement and POS system sales records: Guests served: Sales: Variable costs: Fixed costs: Total costs: Profit: 25,000 $210,000 $75,000 $110,000 $185,000 $25,000arrow_forwardplease help me to solve this questionarrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning