Concept explainers

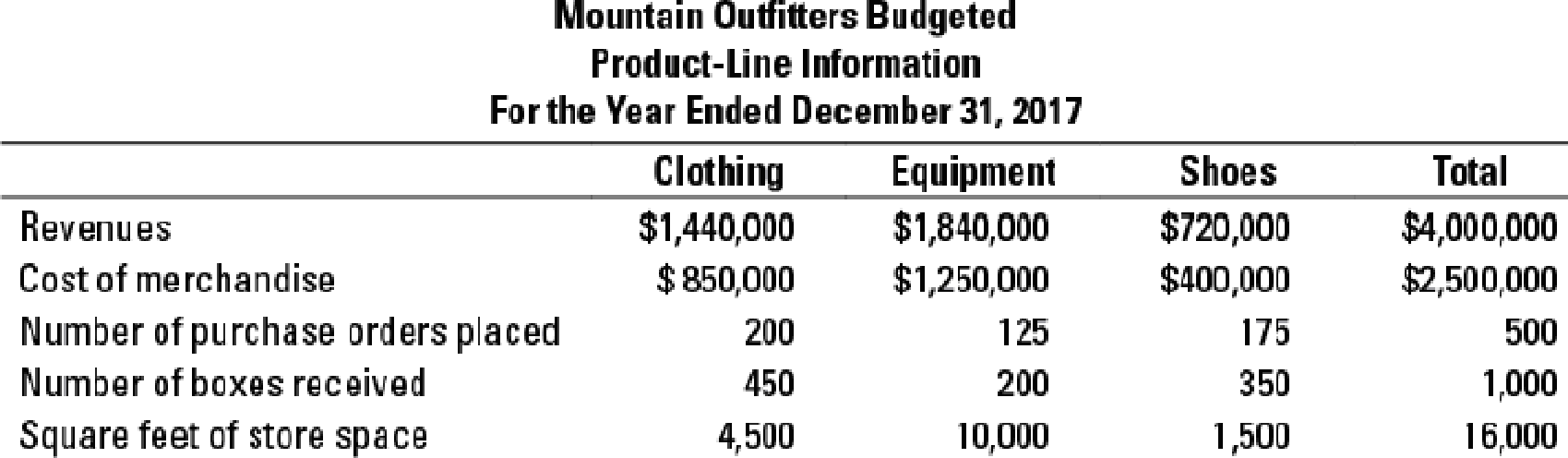

Activity-based costing, activity-based management, merchandising. Mountain Outfitters operates a large outdoor clothing and equipment store with three main product lines: clothing, equipment, and shoes. Mountain Outfitters operates at capacity and allocates selling, general, and administration (S, G & A) costs to each product line using the cost of merchandise of each product line. The company wants to optimize the pricing and cost management of each product line and is wondering if its accounting system is providing it with the best information for making such decisions. Store manager Aaron Budd gathers the following information regarding the three product lines:

For 2017, Mountain Outfitters budgets the following selling, general, and administration costs:

| Mountain Outfitters Selling, General, and Administration (S, G & A) Costs For the Year Ended December 31, 2017 | |

| Purchasing department expense | $ 320,000 |

| Receiving department expense | 210,000 |

| Customer support expense (cashiers and floor employees) | 250,000 |

| Rent | 240,000 |

| General store advertising | 100,000 |

| Store manager’s salary | 125,000 |

| $1,245,000 | |

- 1. Suppose Mountain Outfitters uses cost of merchandise to allocate all S, G & A costs. Prepare budgeted product-line and total company income statements.

Required

- 2. Identify an improved method for allocating costs to the three product lines. Explain. Use the method for allocating S, G & A costs that you propose to prepare new budgeted product-line and total company income statements. Compare your results to the results in requirement 1.

- 3. Write a memo to Mountain Outfitters management describing how the improved system might be useful for managing the store.

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

COST ACCOUNTING

- ans plzarrow_forwardWhat was the cost of goods sold of the year??arrow_forwardUnified Computing Hub (UCH) sells computers for $2,500 each and also provides a 3-year warranty, which requires the company to perform periodic services and replace defective parts. During 2023, the company sold 900 computers. Based on past experience, the company has estimated the total 3-year warranty costs per computer as $50 for parts and $90 for labor. (Assume sales all occur on December 31, 2023.) In 2024, UCH incurred actual warranty costs relative to 2023 computer sales of $15,000 for parts and $30,000 for labor. Under the expense warranty treatment (accrual method), what is the balance under current liabilities in the 2023 balance sheet? a. $126,000 b. $145,000 c. $155,000 d. $136,000arrow_forward

- Provide answerarrow_forwardWhat is the question answer? ? General Accountingarrow_forwardJohn Appraisals is appraising a commercial office building for refinancing. The company is using the expected future revenue method of determining the value of the building today. Assume the building is fully leased and expected to remain that way. Annual rental revenue is $197,000 per year. The expected life of the building is 20 years. Assuming an annual return of 20%, what is the current value of the office building?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning