Concept explainers

Activity-based costing, service company. Speediprint Corporation owns a small printing press that prints leaflets, brochures, and advertising materials Speediprint classifies its various printing jobs as standard jobs or special jobs. Speediprint’s simple

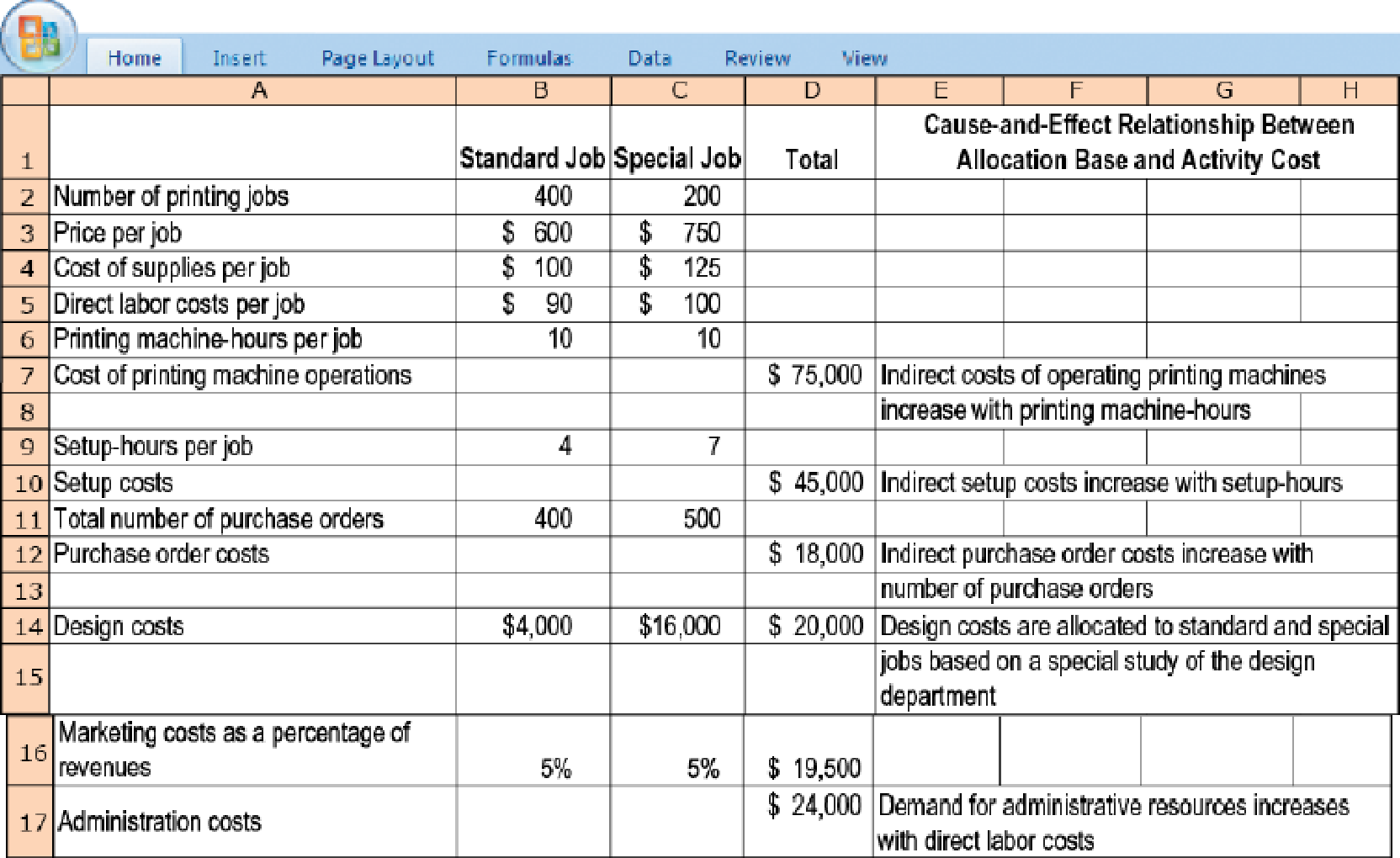

Speediprint is concerned about the accuracy of the costs assigned to standard and special jobs and therefore is planning to implement an activity-based costing system. Speediprint’s ABC system would have the same direct-cost categories as its simple costing system. However, instead of a single indirect-cost pool there would now be six categories for assigning indirect costs: design, purchasing, setup, printing machine operations, marketing, and administration. To see how activity-based costing would affect the costs of standard and special jobs. Speediprint collects the following information for the fiscal year 2017 that just ended.

- 1. Calculate the cost of a standard job and a special job under the simple costing system.

Required

- 2. Calculate the cost of a standard job and a special job under the activity-based costing system.

- 3. Compare the costs of a standard job and a special job in requirements 1 and 2. Why do the simple and activity-based costing systems differ in the cost of a standard job and a special job?

- 4. How might Speediprint use the new cost information from its activity-based costing system to better manage its business?

Trending nowThis is a popular solution!

Chapter 5 Solutions

COST ACCOUNTING

- Financial Accountingarrow_forwardMason (single) is a 50 percent shareholder in Angels Corporation (an S Corporation). Mason receives a $184,500 salary working full time for Angels Corporation. Angels Corporation reported $418,000 of taxable business income for the year. Before considering his business income allocation from Angels and the self-employment tax deduction (if any), Mason's adjusted gross income is $184,500 (all salary from Angels Corporation). Mason claims $59,000 in itemized deductions. Answer the following questions for Mason. c. b. Assuming the business income allocated to Mason is income from a specified service trade or business, except that Angels Corporation reported $168,000 of taxable business income for the year. What is Mason's deduction for qualified business income? Ignore the wage-based limitation when computing the deduction.arrow_forwardPlease give me true answer this financial accounting questionarrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning