Concept explainers

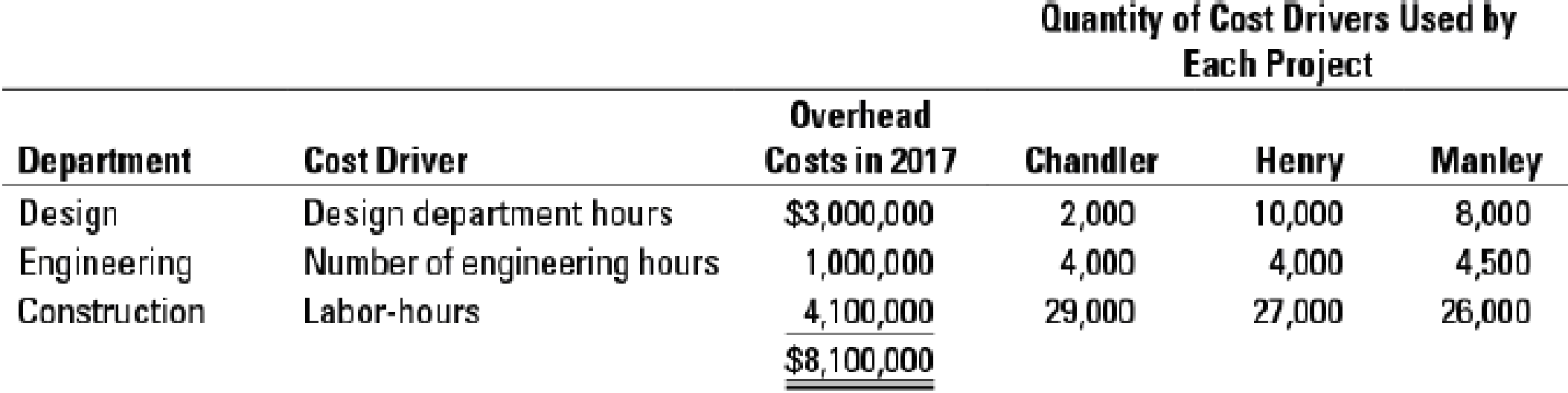

Department costing, service company. DLN is an architectural firm that designs and builds buildings. It prices each job on a cost plus 20% basis.

- 1. Compute the overhead allocated to each project in 2017 using the simple costing system that allocates overhead costs to jobs based on the number of jobs

Required

- 2. Compute the overhead allocated to each project in 2017 using department overhead cost rates.

- 3. Do you think Chandler had a valid reason for dissatisfaction with the cost and price of its building? How does the allocation based on department rates change costs for each project?

- 4. What value, if any, would DLN get by allocating costs of each department based on the activities done in that department?

Learn your wayIncludes step-by-step video

Chapter 5 Solutions

COST ACCOUNTING

Additional Business Textbook Solutions

Foundations Of Finance

Financial Accounting (12th Edition) (What's New in Accounting)

Fundamentals of Management (10th Edition)

Operations Management

Principles of Economics (MindTap Course List)

Horngren's Accounting (12th Edition)

- Financial accounting questionarrow_forwardMarilyn Terrill is the senior auditor for the audit of Uden Supply Company for the year ended December 31, 20X4. In planning the audit, Marilyn is attempting to develop expectations for planning analytical procedures based on the financial information for prior years and her knowledge of the business and the industry, including these: 1. Based on economic conditions, she believes that the increase in sales for the current year should approximate the historical trend in terms of actual dollar increases. 2. Based on her knowledge of industry trends, she believes that the gross profit percentage for 20X4 should be about 2 percent less than the percentage for 20X3. 3. Based on her knowledge of regulations, she is aware that the effective tax rate for the company for 20X4 has been reduced by 5 percent from that in 20X3. 4. Based on her knowledge of economic conditions, she is aware that the effective interest rate on the company's line of credit for 20X4 was approximately 12 percent. The…arrow_forwardAnswer this question general accountingarrow_forward

- Need correct answer general Accountingarrow_forwardAbc general accountingarrow_forwardA firm sells 2,800 units of an item each year. The carrying cost per unit is $3.26 and the fixed costs per order are $74. What is the economic order quantity? (Please round units to the nearest whole number)arrow_forward

- The lockbox systemarrow_forwardHii expert please provide correct answer general Accountingarrow_forwardRequired information [The following information applies to the questions displayed below.] Hemming Company reported the following current-year purchases and sales for its only product. Date January 1 January 10 Activities Beginning inventory Sales March 14 July 30 March 15 October 5 October 26 Purchase Sales Purchase Sales 410 units 455 units Units Acquired at Cost 255 units @ $12.20 = @ $17.20 @ $22.20 Units Sold at Retail $ 3,111 210 units @ $42.20 = 7,052 350 units @ $42.20 10,101 430 units @ $42.20 Purchase Totals 155 units 1,275 units $27.20 = 4,216 $ 24,480 990 units Ending inventory consists of 50 units from the March 14 purchase, 80 units from the July 30 purchase, and all 155 units from the October 26 purchase. Using the specific identification method, calculate the following. a) Cost of Goods Sold using Specific Identification Available for Sale Cost of Goods Sold Ending Inventory Date Activity # of units Cost Per Unit # of units sold Cost Per Unit Cost of Goods Sold Ending…arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College