Concept explainers

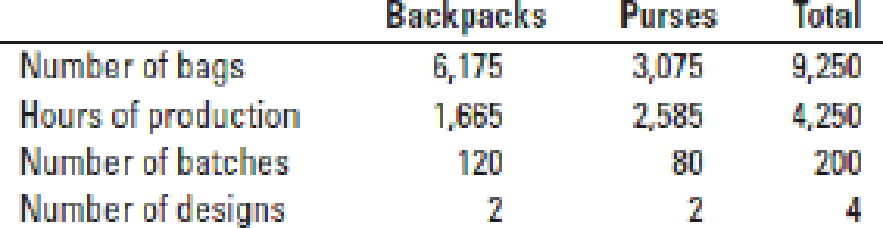

Choosing cost drivers, activity-based costing, activity-based management. Pastel Bags (PB) is a designer of high-quality backpacks and purses. Each design is made in small batches. Each spring, PB comes out with new designs for the backpack and for the purse. The company uses these designs for a year and then moves on to the next trend. The bags are all made on the same fabrication equipment that is expected to operate at capacity. The equipment must be switched over to a new design and set up to prepare for the production of each new batch of products. When completed, each batch of products is immediately shipped to a wholesaler. Shipping costs vary with the number of shipments. Budgeted information for the year is as follows:

| Pastel Bags Budget for Costs and Activities For the Year Ended February 28, 2017 | |

| Direct materials—purses | $ 319,155 |

| Direct materials—backpacks | 454,995 |

| Direct manufacturing labor—purses | 99,000 |

| Direct manufacturing labor—backpacks | 113,000 |

| Setup | 64,000 |

| Shipping | 73,000 |

| Design | 169,000 |

| Plant utilities and administration | 221,000 |

| Total | $1,513, 150 |

Other budget information follows:

Required

- 2. Identify the most appropriate cost driver for each cost category. Explain briefly your choice of cost driver.

- 3. Calculate the budgeted cost per unit of cost driver for each cost category.

- 4. Calculate the budgeted total costs and cost per unit for each product line.'

- 5. Explain how you could use the information in requirement 4 to reduce costs.

Learn your wayIncludes step-by-step video

Chapter 5 Solutions

COST ACCOUNTING

Additional Business Textbook Solutions

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Financial Accounting: Tools for Business Decision Making, 8th Edition

Foundations Of Finance

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

Business Essentials (12th Edition) (What's New in Intro to Business)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- prepare an income statement for delray manufacturing (a manufacturer)assume that its cost of goods manufactured is $1,247,000arrow_forwardOn 10/6/2024, company A sells goods to Customer C for €20,000 with an agreed credit of two months. On 31/12/2024, in the context of investigating the collectability of its receivables, the company estimates that it will only collect €10,000 from customer C and forms a provision for doubtful debts for the remaining amount. Finally, on 30/3/2025, company A receives from customer C the amount of: a. €9,000 b. €11,000. You are requested to comment on the impact of the above collection cases a. 9000 b. 11,000 on the income statement for fiscal year 2025, justifying your position.arrow_forwardNeed helparrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub