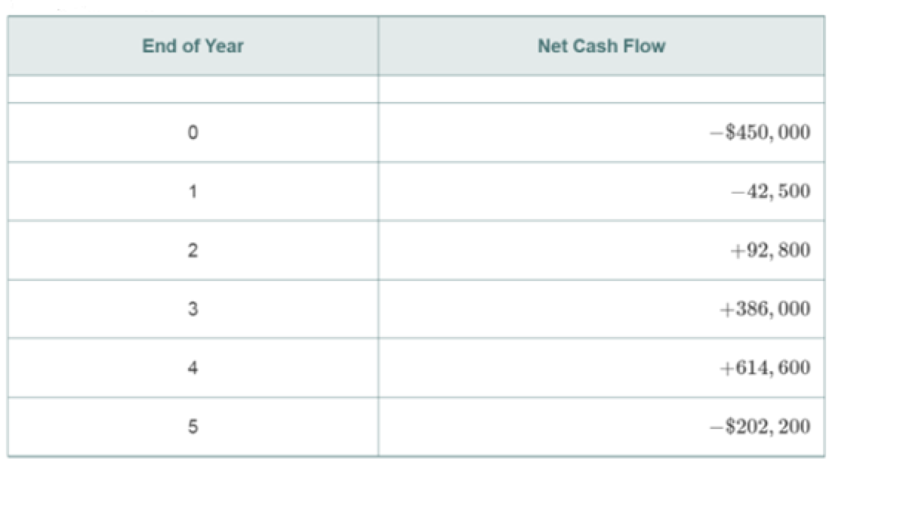

Your boss has just presented you with the summary in the accompanying table of projected costs and annual receipts for a new product line. He asks you to calculate the

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Engineering Economy (16th Edition) - Standalone book

Additional Business Textbook Solutions

Business Essentials (12th Edition) (What's New in Intro to Business)

Horngren's Accounting (12th Edition)

PRIN.OF CORPORATE FINANCE

Intermediate Accounting (2nd Edition)

Financial Accounting, Student Value Edition (5th Edition)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

- Not use ai pleasearrow_forwardnot use ai pleasearrow_forwardWhat are the key factors that influence the decline of traditional retail businesses in the digital economy? 2. How does consumer behavior impact the success or failure of legacy retail brands? 3. What role does technological innovation play in sustaining long-term competitiveness for retailers? 4. How can traditional retailers effectively adapt their business models to meet evolving market demands?arrow_forward

- Problem 1.1 Cyber security is a very costly dimension of doing business for many retailers and their customers who use credit and debit cards. A recent data breach of U.S.-based Home Depot involved some 56 million cardholders. Just to investigate and cover the immediate direct costs of this identity theft amounted to an estimated $62,000,000, of which $27,000,000 was recovered by insurance company payments. This does not include indirect costs, such as, lost future business, costs to banks, and cost to replace cards. If a cyber security vendor had proposed 8 years before the breach that a $10,000,000 investment in a malware detection system could guard the company's computer and payment systems from such a breach, would it have kept up with the rate of inflation estimated at 4% per year?arrow_forwardNot use ai pleasearrow_forwardAnalyze financial banking products from the Asset-Based Financial Products side (like credit cards, loans, mortgages, etc.). Examine aspects such as liquidity, risk, and profitability from a company and an individual point of view. Ensure that the interventions demonstrate analytical skills and clearly express the points of view regarding the topic.arrow_forward

- provide source where information was retrieved NAME OF SCHOOL: Florida Polytechnical college ADDRESS: PRIVATE OR PUBLIC: ENTRY REQUIREMENTS - GPA, SAT/ ACT SCORES: IN STATE TUITION COST: DORMITORY COST: OFF CAMPUS HOUSING OPTIONS: AVERAGE MONTHLY RENT FOR A ROOM in the area: MEAL PLAN: Do they have them? Are they mandatory for freshmen? How much $: CAMPUS SIZE: (don't put acres - is it a small, medium, or large campus?) TEACHER STUDENT RATIO/CLASS SIZE: NUMBER OF UNDERGRADUATE (freshmen, soph, junior, seniors) STUDENTS ON CAMPUS: FINANCIAL AID/SCHOLARSHIPS OPPORTUNITIES: ACCEPTANCE RATE: GRADUATION RATE: ONLINE OPTION? BUSINESS DEGREES: (list them) ACADEMIC SUPPORT - TUTORING: JOB PLACEMENT/CAREER SERVICES: what % of students get lined up with jobs right out of college with the school's help? INTERNSHIP OPPORTUNITIES: Paid? Unpaid? STUDY ABROAD PROGRAMS: Do they exist? How much $? SPORTS: Competitive - D1, D2, D3, etc? Intramural? (non-competitive sports opportunities) CLUBS: How many?…arrow_forwardExplain the following: How is 4 to 5 a 22% increase? How is 100 to 80 a 22% decrease? Not pictured: How is 100 to 90 a 11% decrease? How is 100 to 50 a 67% decrease?arrow_forwardWithout Trade Production Consumption With Trade Production Everglades Denali Shorts (Millions of Almonds Shorts Almonds pairs) (Millions of pounds) (Millions of pairs) (Millions of pounds) 12 16 5 30 12 16 5 30 64 0 0 20 Trade action Imports 13 ▼ Exports 39▾ Imports 13 ▼ Exports 39 Consumption Gains from Trade Increase in Consumptionarrow_forward

- Practice: Their labor forces are each capable of supplying four million hours per week that can be used to produce shorts, almonds, or some combination of the two. Country Shorts Almonds (Pairs per hour of labor) (Pounds per hour of labor) Everglades 4 16 Denali 5 10 Suppose that initially Denali uses 1 million hours of labor per week to produce shorts and 3 million hours per week to produce almonds, while Everglades uses 3 million hours of labor per week to produce shorts and 1 million hours per week to produce almonds. As a result, Everglades produces 12 million pairs of shorts and 16 million pounds of almonds, and Denali produces 5 million pairs of shorts and 30 million pounds of almonds. Assume there are no other countries willing to engage in trade, so, in the absence of trade between these two countries, each country consumes the amount of shorts and almonds it produces. Everglades's opportunity cost of producing 1 pair of shorts is4 pounds of…arrow_forwardQuestion #1. The Governor's budget Announcement from Decenbrer 2024. Review proposed resources for understanding the Governo's proposed FY25 Budget, provide a reflection focusing on initial thoughts and feeling on the prpposed budget for the state. Please provide APA citiatiion?arrow_forward#3. The Governor's Budget Announcement from December 2024. Review proposed resources for understanding the Governo's proposed FY25 Budget. Does the Governor's proposed budget impact the current Welfare State, Why or Why not?arrow_forward

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning