Engineering Economy (16th Edition) - Standalone book

16th Edition

ISBN: 9780133439274

Author: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 21P

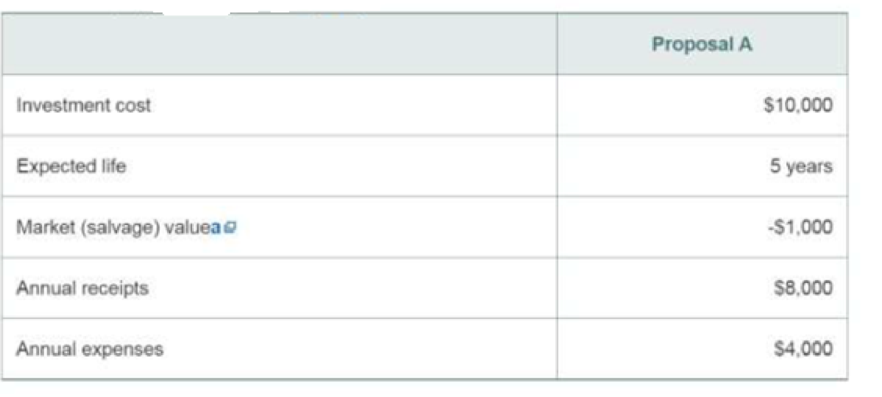

Determine the FW of the following engineering project when the MARR is 15% per year. Is the project acceptable? (5.4)

a A negative market value means that there is a net cost to dispose of an asset.

Expert Solution & Answer

Learn your wayIncludes step-by-step video

schedule05:35

Students have asked these similar questions

A monopolist had the following fixed costs and marginal revenue and costs for each unit of production:

0 units where fixed costs are 10

1 unit where MR = 60 & MC = 20 & FC = 10

2 units where MR = 50 & MC = 30 & FC = 10

3 units where MR = 45 & MC = 38 & FC = 10

4 units where MR = 40 & MC = 40 & FC = 10

How many units should the firm produce and why?

Respond to this post.

Hello Professor,

A rise in consumption in the economy would cause an increase in aggregate demand. Therefore, when consumers spend money on everyday goods and services, it not only helps to stimulate economic growth, but it could also present potential issues like unsustainable debt levels or inflation. I believe that it would be beneficial to consider such factors and adopt a purchasing strategy to help navigate the challenges posed by inflation or unsustainable debt levels.

First, do you think our business will be affected because inflation is rising? How?

Yes, I do believe that the business will be affected because of inflationary pressures. Inflation rising will affect the cost of goods, services, and labor, which could lead to higher operating expenses. The potential reduction of profit margin because of inflation could lead to a smaller percentage of revenue being retained as profit. Therefore, inflation rising will force us to raise prices for…

Not use ai please

Chapter 5 Solutions

Engineering Economy (16th Edition) - Standalone book

Ch. 5.A - Use the ERR method with = 8% per year to solve for...Ch. 5.A - Apply the ERR method with = 12% per year to the...Ch. 5.A - Are there multiple IRRs for the following...Ch. 5.A - Are there multiple IRRs for the following cash...Ch. 5 - Tennessee Tool Works (TTW) is considering...Ch. 5 - Prob. 2PCh. 5 - Prob. 3PCh. 5 - Prob. 4PCh. 5 - Prob. 5PCh. 5 - A large induced-draft fan is needed for an...

Ch. 5 - Prob. 7PCh. 5 - Prob. 8PCh. 5 - Prob. 9PCh. 5 - Prob. 10PCh. 5 - Prob. 11PCh. 5 - Prob. 12PCh. 5 - Prob. 13PCh. 5 - Prob. 14PCh. 5 - Prob. 15PCh. 5 - Prob. 16PCh. 5 - Prob. 17PCh. 5 - Prob. 18PCh. 5 - Prob. 19PCh. 5 - Prob. 20PCh. 5 - Determine the FW of the following engineering...Ch. 5 - Prob. 22PCh. 5 - Fill in Table P5-23 below when P = 10,000, S = 2,...Ch. 5 - Prob. 24PCh. 5 - A simple, direct space heating system is currently...Ch. 5 - Prob. 26PCh. 5 - Prob. 27PCh. 5 - Prob. 28PCh. 5 - Prob. 29PCh. 5 - Prob. 30PCh. 5 - Prob. 31PCh. 5 - Prob. 32PCh. 5 - Stan Moneymaker has been informed of a major...Ch. 5 - Prob. 34PCh. 5 - Prob. 35PCh. 5 - Prob. 36PCh. 5 - Prob. 37PCh. 5 - Prob. 38PCh. 5 - Prob. 39PCh. 5 - Prob. 40PCh. 5 - Prob. 41PCh. 5 - Prob. 42PCh. 5 - Prob. 43PCh. 5 - To purchase a used automobile, you borrow 10,000...Ch. 5 - Your boss has just presented you with the summary...Ch. 5 - Experts agree that the IRR of a college education...Ch. 5 - A company has the opportunity to take over a...Ch. 5 - The prospective exploration for oil in the outer...Ch. 5 - Prob. 49PCh. 5 - An integrated, combined cycle power plant produces...Ch. 5 - A computer call center is going to replace all of...Ch. 5 - Prob. 52PCh. 5 - Prob. 53PCh. 5 - Prob. 54PCh. 5 - Prob. 55PCh. 5 - Prob. 56PCh. 5 - Prob. 57PCh. 5 - Prob. 58PCh. 5 - Prob. 59PCh. 5 - a. Calculate the IRR for each of the three...Ch. 5 - Prob. 61PCh. 5 - Prob. 62PCh. 5 - Prob. 63PCh. 5 - Prob. 64SECh. 5 - Prob. 65SECh. 5 - Prob. 66SECh. 5 - A certain medical device will result in an...Ch. 5 - Refer to Problem 5-61. Develop a spreadsheet to...Ch. 5 - Prob. 69CSCh. 5 - Prob. 70CSCh. 5 - Suppose that the average utilization of the CVD...Ch. 5 - Prob. 72FECh. 5 - Prob. 73FECh. 5 - Prob. 74FECh. 5 - Prob. 75FECh. 5 - Prob. 76FECh. 5 - Prob. 77FECh. 5 - Prob. 78FECh. 5 - Prob. 79FECh. 5 - A new machine was bought for 9,000 with life of...Ch. 5 - Prob. 81FECh. 5 - Prob. 82FECh. 5 - Prob. 83FECh. 5 - Refer to Problem 5-2. Assuming the residual value...

Additional Business Textbook Solutions

Find more solutions based on key concepts

(Record inventory transactions in the periodic system) Wexton Technologies began the year with inventory of 560...

Financial Accounting (12th Edition) (What's New in Accounting)

Graphically portray the Keynesian transmission mechanism under the following conditions: a. A decrease in the m...

Macroeconomics

How would the decision to dispose of a segment of operations using a split-off rather than a spin-off impact th...

Advanced Financial Accounting

Determining Acquisition Cost. Haply, Inc. incurred the following expenditures when acquiring a new assembly mac...

Intermediate Accounting (2nd Edition)

Communication Activity 9-1

In 150 words or fewer, explain the different methods that can be used to calculate d...

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

•• B.4. Consider the following linear programming problem:

Operations Management

Knowledge Booster

Similar questions

- Bzbsbsbdbdbdbdarrow_forwardRecent research indicates potential health benefits associated with coffee consumption, including a potential reduction in the incidence of liver disease. Simultaneously, new technology is being applied to coffee bean harvesting, leading to cost reductions in coffee production. How will these developmentsaffect the demand and supply of coffee? How will the equilibrium price and quantity of coffee change? Use both words and graphs to explain.arrow_forwardRecent research indicates potential health benefits associated with coffee consumption, including a potential reduction in the incidence of liver disease. Simultaneously, new technology is being applied to coffee bean harvesting, leading to cost reductions in coffee production. How will these developmentsaffect the demand and supply of coffee? How will the equilibrium price and quantity of coffee change? Use both words and graphs to explain.arrow_forward

- ► What are the 95% confidence intervals for the intercept and slope in this regression of college grade point average (GPA) on high school GPA? colGPA = 1.39 + .412 hsGPA (.33) (.094)arrow_forwardG Interpret the following estimated regression equations: wagehr = 0.5+ 2.5exper, where wagehr is the wage, measured in £/hour and exper is years of experience, colGPA = 1.39.412 hsGPA where colGPA is grade point average for a college student, and hsGPA is the grade point average they achieved in high school, cons 124.84 +0.853 inc where cons and inc are annual household consumption and income, both measured in dollars What is (i) the predicted hourly wage for someone with five years of experience? (ii) the predicted grade point average in college for a student whose grade point average in high school was 4.0, (iii) the predicted consumption when household income is $30000? =arrow_forward1. Solving the system of inequalities: I≥3 x+y1 2. Graph y=-2(x+2)(x-3) 3. Please graph the following quadratic inequalities Solve y≤ -1²+2+3arrow_forward

- Not use ai pleasearrow_forwardnot use ai pleasearrow_forwardWhat are the key factors that influence the decline of traditional retail businesses in the digital economy? 2. How does consumer behavior impact the success or failure of legacy retail brands? 3. What role does technological innovation play in sustaining long-term competitiveness for retailers? 4. How can traditional retailers effectively adapt their business models to meet evolving market demands?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Exploring Economics

Economics

ISBN:9781544336329

Author:Robert L. Sexton

Publisher:SAGE Publications, Inc

Essentials of Economics (MindTap Course List)

Economics

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...

Economics

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:Cengage Learning