Engineering Economy (16th Edition) - Standalone book

16th Edition

ISBN: 9780133439274

Author: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 23P

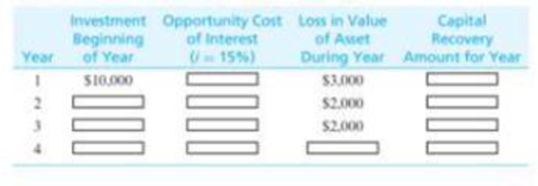

Fill in Table P5-23 below when P = $10,000, S = $2, 000 (at the end of four years), and i = 15% per year. Complete the accompanying table and show that the equivalent uniform CR amount equals $3,102.12. (5.5)

Table P5-23 Table for Problem 5-23

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Elasticity Problems

Cross Price Elasticity (Exy)

(QDX-QDo/[(QDN+QDDA)/2]

(P-POR/[(PNE+POB)/2]¯¯

11. QD of good A falls from 100 to 90 as the price of good B rose from $10 to $20.

Calculate coefficient:

(90-100) [(90+100) 21-10/95-105 - -.158

(20-10)/[(20+10)/2]

10/15

.667

Cite Elasticity: inclastic

Typs of good: complement

12. QD of good A rose from 300 to 400 as the price good K increased from $1 to $2.

Calculate coefficient

Cite Elasticity:

Ixps of reed:

13. QD for good I falls from 2000 to 1500 units as price of good Krose from $10 to $15.

Calculate coefficient:

Cite Elasticity:

Type of good:

14. QD for good X rose from 100 to 101 units as price of good Y increases from, $8 to $15.

Calculate coefficient:

Cite Elasticity:

Type of paed:

Page 124 (368)

Value of

Coefficient

Description

Positive (0)

Negative (L*0)

Type of Good(s)

Substitute

Quantity Demanded of W changes in same direction a change in price if Z

Quantity Demanded of W changes in opposite direction as change in price if Z…

Use production theory to graphically illustrate the case in which a medical innovation improves health without any change in the consumption of medical care.

According to Lee et al. (2009), the incremental cost-effectiveness ratio comparing the current dialysis treatment to the next least cost dialysis treatment is $61,294 per life year and $129,090 per QALY. Can you account for the different estimates?

Chapter 5 Solutions

Engineering Economy (16th Edition) - Standalone book

Ch. 5.A - Use the ERR method with = 8% per year to solve for...Ch. 5.A - Apply the ERR method with = 12% per year to the...Ch. 5.A - Are there multiple IRRs for the following...Ch. 5.A - Are there multiple IRRs for the following cash...Ch. 5 - Tennessee Tool Works (TTW) is considering...Ch. 5 - Prob. 2PCh. 5 - Prob. 3PCh. 5 - Prob. 4PCh. 5 - Prob. 5PCh. 5 - A large induced-draft fan is needed for an...

Ch. 5 - Prob. 7PCh. 5 - Prob. 8PCh. 5 - Prob. 9PCh. 5 - Prob. 10PCh. 5 - Prob. 11PCh. 5 - Prob. 12PCh. 5 - Prob. 13PCh. 5 - Prob. 14PCh. 5 - Prob. 15PCh. 5 - Prob. 16PCh. 5 - Prob. 17PCh. 5 - Prob. 18PCh. 5 - Prob. 19PCh. 5 - Prob. 20PCh. 5 - Determine the FW of the following engineering...Ch. 5 - Prob. 22PCh. 5 - Fill in Table P5-23 below when P = 10,000, S = 2,...Ch. 5 - Prob. 24PCh. 5 - A simple, direct space heating system is currently...Ch. 5 - Prob. 26PCh. 5 - Prob. 27PCh. 5 - Prob. 28PCh. 5 - Prob. 29PCh. 5 - Prob. 30PCh. 5 - Prob. 31PCh. 5 - Prob. 32PCh. 5 - Stan Moneymaker has been informed of a major...Ch. 5 - Prob. 34PCh. 5 - Prob. 35PCh. 5 - Prob. 36PCh. 5 - Prob. 37PCh. 5 - Prob. 38PCh. 5 - Prob. 39PCh. 5 - Prob. 40PCh. 5 - Prob. 41PCh. 5 - Prob. 42PCh. 5 - Prob. 43PCh. 5 - To purchase a used automobile, you borrow 10,000...Ch. 5 - Your boss has just presented you with the summary...Ch. 5 - Experts agree that the IRR of a college education...Ch. 5 - A company has the opportunity to take over a...Ch. 5 - The prospective exploration for oil in the outer...Ch. 5 - Prob. 49PCh. 5 - An integrated, combined cycle power plant produces...Ch. 5 - A computer call center is going to replace all of...Ch. 5 - Prob. 52PCh. 5 - Prob. 53PCh. 5 - Prob. 54PCh. 5 - Prob. 55PCh. 5 - Prob. 56PCh. 5 - Prob. 57PCh. 5 - Prob. 58PCh. 5 - Prob. 59PCh. 5 - a. Calculate the IRR for each of the three...Ch. 5 - Prob. 61PCh. 5 - Prob. 62PCh. 5 - Prob. 63PCh. 5 - Prob. 64SECh. 5 - Prob. 65SECh. 5 - Prob. 66SECh. 5 - A certain medical device will result in an...Ch. 5 - Refer to Problem 5-61. Develop a spreadsheet to...Ch. 5 - Prob. 69CSCh. 5 - Prob. 70CSCh. 5 - Suppose that the average utilization of the CVD...Ch. 5 - Prob. 72FECh. 5 - Prob. 73FECh. 5 - Prob. 74FECh. 5 - Prob. 75FECh. 5 - Prob. 76FECh. 5 - Prob. 77FECh. 5 - Prob. 78FECh. 5 - Prob. 79FECh. 5 - A new machine was bought for 9,000 with life of...Ch. 5 - Prob. 81FECh. 5 - Prob. 82FECh. 5 - Prob. 83FECh. 5 - Refer to Problem 5-2. Assuming the residual value...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Preparing Financial Statements from a Trial Balance The following accounts are taken from Equilibrium Riding, I...

Fundamentals of Financial Accounting

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

Mary Williams, owner of Williams Products, is evaluating whether to introduce a new product line. After thinkin...

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (5th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- You are employed as an economic consultant to the regional planning office of a large metropolitan area, and your task is to estimate the demand for hospital services in the area. Your estimates indicate that the own-price elasticity of demand equals 0.25, the income elasticity of demand equals 0.45, the cross-price elasticity of demand for hospital services with respect to the price of nursing home services equals 0.1, and the elasticity of travel time equals −0.37. Use this information to project the impact of the following changes on the demand for hospital services. Average travel time to the hospital diminishes by 5 percent due to overall improvements in the public transportation system. The price of nursing home care decreases by 10 percent. Average real income decreases by 10 percent. The hospital is forced to increase its price for services by 2 percent.arrow_forwardThe commissioner of health is concerned about the increasing number of reported cases of preventable childhood diseases, such as polio and rubella. It appears that a growing number of young children are not being vaccinated against childhood diseases as they should be. Two proposals to address the problem are sitting on the commissioner’s desk. The programs have equal costs, but the commissioner has funding for only one. The first proposal involves providing free vaccinations at clinics around the country. The benefits from a free vaccination program are likely to be experienced immediately in terms of a drop in the number of reported cases of illness. The second program calls for educating young married couples about the benefits of vaccination. The benefits in this instance will not be felt for some years. The commissioner wants to use cost-benefit analysis to determine which proposal should be implemented. Explain to the commissioner the critical role the discount rate plays in…arrow_forwardWhich of the following Nobel Prize Winners’ primary work in investments was consistent with market efficiency? Mark each “Yes” or “No.” You can search the internet for more information about their Nobel Prizes. Eugene Fama Harry Markowitz William Sharpe Robert Shillerarrow_forward

- not use ai pleasearrow_forwardNot use ai pleasearrow_forwardExercise 6 Imagine that you head production of a multinational food processing company. The ongoing uncer- tainty about costs means that you are unsure of the future cost of one of your inputs, x2. Your firm's production function is y = f(x1, x2) = x²x²² The output price p is 1000, x1 = 27, and wx₁ = 60. 1. Suppose the current input price is Wx2 = 50. Solve for the optimal choice of x2. 2. Now suppose that the probability the input price remains 50 is 0.65 and the probability that Wx2 60 is 0.35. Solve for the optimal choice of x2. Round down to the nearest integer. = 3. Finally, suppose the costs do actually rise, i.e., Wx2 = 60. Calculate the difference in profit from the uncertainty in (2) vs. the certainty in (1).arrow_forward

- Not use ai please letarrow_forwardQuestions from textbook: Santerre, Rexford, E., and Neun, Stephan P. Health Economics: Theories, Insights, and Industry Studies, 6th Edition, ISBN 13: 978-1-111-822729. Mason, OH: South-Western, Cengage Learning, 2013. 1. Suppose a health expenditure function is specified in the following manner: E = 500 + 0.2Y where E represents annual health care expenditures per capita and Y stands for income per capita. a. Using the slope of the health expenditure function, predict the change in per capita health care expenditures that would result from a $1,000 increase in per capita income. b. Compute the level of per capita health care spending when per capita income takes on the following dollar values: 0; 1,000; 2,000; 4,000; and 6,000. c. Using the resulting values for per capita health care spending in part B, graph the associated health care expenditure function. d. Assume that the fixed amount of health care spending decreases to $250. Graph the new and original health care functions on…arrow_forwardGraph shows the daily market price of jeans when the tax on sellers is set to zero per pair supposed the government institutes attacks of $20.30 per pair to be paid by the seller what is the quantity after taxarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning

Exploring Economics

Economics

ISBN:9781544336329

Author:Robert L. Sexton

Publisher:SAGE Publications, Inc

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...

Economics

ISBN:9781305506893

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...

Economics

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Difference between Renewable and Nonrenewable Resources; Author: MooMooMath and Science;https://www.youtube.com/watch?v=PLBK1ux5b7U;License: Standard Youtube License