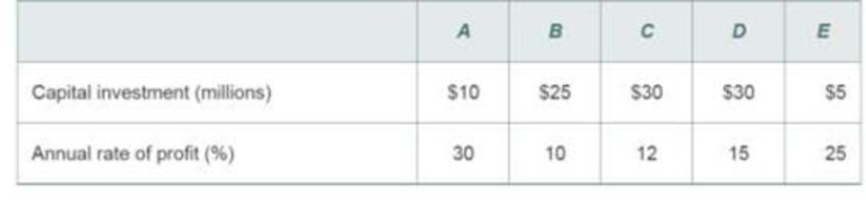

Tennessee Tool Works (TTW) is considering investment in five independent projects,

Any profitable combination of them is feasible.

TTW has$50million available to invest, and these funds are currently earning 7% interest annually from municipal bonds. If the funds available are limited to $50 million, what is TTW’s MARR that is implied by this particular situation? (5.2)

Selection of the project.

Explanation of Solution

The firm has limited investment. It can select the project that give more profit rate in order to maximize the profit. Thus, the firm can select the project A, E and D. The MARR for the firm is equal the best return of the rejected projects. Since the best return from the rejected project is 12%, the firm’s MARR is 12%.

Want to see more full solutions like this?

Chapter 5 Solutions

Engineering Economy (16th Edition) - Standalone book

Additional Business Textbook Solutions

Foundations Of Finance

Operations Management

MARKETING:REAL PEOPLE,REAL CHOICES

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Intermediate Accounting (2nd Edition)

- Use the figure below to answer the following question. Let là represent Income when healthy, let Is represent income when ill. Let E[I], represent expected income for a given probability (p) of falling ill. Utility & B естве IH S Point D represents ☑ actuarially fair & full contract actuarially fair & partial contract O actuarially unfair & full contract uninsurance incomearrow_forwardSuppose that there is a 25% chance Riju is injured and earns $180,000, and a 75% chance she stays healthy and will earn $900,000. Suppose further that her utility function is the following: U = (Income). Riju is risk. She will prefer (given the same expected income). averse; no insurance to actuarially fair and full insurance lover; actuarially fair and full insurance to no insurance averse; actuarially fair and full insurance to no insurance neutral; he will be indifferent between actuarially fair and full insurance to no insurance lover; no insurance to actuarially fair and full insurancearrow_forward19. (20 points in total) Suppose that the market demand curve is p = 80 - 8Qd, where p is the price per unit and Qd is the number of units demanded per week, and the market supply curve is p = 5+7Qs, where Q5 is the quantity supplied per week. a. b. C. d. e. Calculate the equilibrium price and quantity for a competitive market in which there is no market failure. Draw a diagram that includes the demand and supply curves, the values of the vertical- axis intercepts, and the competitive equilibrium quantity and price. Label the curves, axes and areas. Calculate both the marginal willingness to pay and the total willingness to pay for the equilibrium quantity. Calculate both the marginal cost of the equilibrium quantity and variable cost of producing the equilibrium quantity. Calculate the total surplus. How is the value of total surplus related to your calculations in parts c and d?arrow_forward

- Sam's profit is maximized when he produces shirts. When he does this, the marginal cost of the last shirt he produces is , which is than the price Sam receives for each shirt he sells. The marginal cost of producing an additional shirt (that is, one more shirt than would maximize his profit) is , which is than the price Sam receives for each shirt he sells. Therefore, Sam's profit-maximizing quantity corresponds to the intersection of the curves. Because Sam is a price taker, this last condition can also be written as .arrow_forwardWhy must total spending be equal to total income in an economy? Total income plus total spending equals total output. The value-added measurement of GDP shows this is true. Every dollar that someone spends is a dollar of income for someone else. all of the abovearrow_forwardLabor Market Data Price $5 $10 $15 $20 $25 3,000,000 6,000,000 9,000,000 12,000,000 15,000,000 Qd 15,000,000 12,000,000 9,000,000 6,000,000 3,000,000 Price $30 $25 $20 $15 $10 $5 + +- x- 3 6 Do + + F 9 12 15 Quantity (In millions) Area of a triangle = 1/2* base *height Market Efficiency & Total Surplus Worth Publishers SCENARIO: The state government is considering raising the minimum wage from $15 per hour to $20 per hour over the next 3 years. As an economic advisor to the governor, you have been asked to provide a recommendation on whether the minimum wage should be increased based on economic theory. Consider the labor market data provided. Prepare a brief report that: 1. Explains whether the labor market is currently efficient at the equilibrium wage of $15 per hour. How would you know? At equilibrium, what (dollar amount) is the Total Surplus this market provides? Show your rationale with numbers. 2. Analyzes the impact on total surplus in the market if the minimum wage is raised…arrow_forward

- Draw the IS-LM diagram at equilibrium and use it to show how one or both of the curves change based on the following exogenous changes. An increase in taxes. An increase in the money supply An increase in government purchasesarrow_forwardDon't use Ai. Answer in step by step with explanation.arrow_forwardcorospond to this message. Gross Domestic Product (GDP) represents the total value of all goods and services produced by a country. The news reporter shows excitement because rising GDP signifies positive economic performance. Consumer spending has increased while businesses expand and new job opportunities become available. If the GDP rises, your delivery business will likely handle more packages as consumer purchasing increases. The increase in business activity will lead to more opportunities for your company to generate higher profits. You may need to take action by hiring additional staff and purchasing extra delivery vehicles or finding ways to improve your operation speed and efficiency to meet increased demand.arrow_forward

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning