a.

To calculate: The EPS of Lopez-Portillo Company before the expansion, if EBIT is 9% on total assets.

Introduction:

Earning per share (EPS):

It is the profit per outstanding share of a public company. A higher EPS indicates higher value of the company because investors are ready to pay higher price for one share of the company.

a.

Answer to Problem 25P

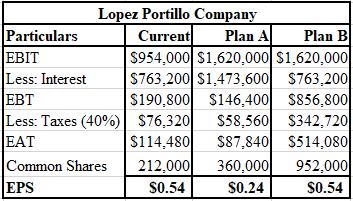

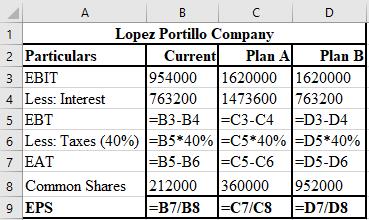

The calculation of EPS of current plan, plan D, and plan E of Lopez-Portillo Company is shown below.

Explanation of Solution

The formulae used for the computation of EPS of current plan, plan D, and plan E are shown below.

Working notes:

Calculation of interest on current plan:

Calculation of common shares of current plan:

Calculation of interest of plan A:

Calculation of common shares of plan A:

Calculation of common shares of plan B:

Note : The interest of plan B is unchanged.

b.

To calculate: The DFL of Lopez-Portillo company of each plan.

Introduction:

Degree of Financial Leverage (DFL):

It refers to the leverage ratio that evaluates the company’s EPS to the variations in its operating income. This ratio indicates that higher DFL leads to the higher earnings of the firm.

b.

Answer to Problem 25P

The DFL of current plan is 5 times , plan A is 11.07 times, and plan B is 1.89 times.

Explanation of Solution

Computation of DFL of current plan:

Computation of DFL of plan A:

Computation of DFL of plan B:

c.

To calculate: The EPS of each Plan and also determine the impact of each plan of Lopez-Portillo company.

Introduction:

Earning per share(EPS):

It is the profit per outstanding share of a public company. A higher EPS indicates higher value of the company because investors are ready to pay higher price for one share of the company.

c.

Answer to Problem 25P

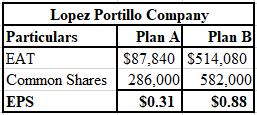

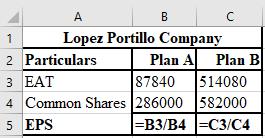

The calculation of EPS of plan A and plan B of Lopez-Portillo Company is shown below.

Explanation of Solution

The formula used for the computation of EPS of Plan A and Plan B are shown below.

Plan B will provide a higher EPS on a constant basis.

Working notes:

Calculation of common shares of plan A:

Calculation of common shares of plan B:

d.

To explain: The reason behind the concern of CFO about the stock values of Lopez-Portillo Company.

Introduction:

Share price:

The highest price of one share of a company that an investor is willing to pay is termed as the share’s price. It is the current price used for the trading of such shares.

d.

Answer to Problem 25P

The CFO of the company is concerned about the value of the stock because it impacts capital budgeting decisions and it also influences the ability to finance projects.

Explanation of Solution

The reason behind CFO’s concern about the common stock values are as follows:

(a) Common stock creates shareholder’s wealth.

(b) It impacts the capital budgeting decisions.

(c) It also influences the potential of financing any undertaken projects either at a high or low cost of capital.

Want to see more full solutions like this?

Chapter 5 Solutions

Foundations of Financial Management

- Don't use ai. if image is blurr or data is not showing properly then dont answer i will sure deslike. please comment i will write values.arrow_forwardno ai Please don't answer i posted blurred image mistakely. please comment below i will write values. if you answer with incorrect values i will give unhelpful confirm.arrow_forwardFinance SubjPlease don't answer i posted blurred image mistakely. please comment below i will write values. if you answer with incorrect values i will give unhelpful confirm.arrow_forward

- calculate ratios for the financial statment given and show all working manually: 1. Total Assets Turnover 2. Inventory Turnover 3. Inventory Periodarrow_forwardcalculate ratios for the financial statment given and show all working manually: 1. Debt Ratios 2. Debt to Equityarrow_forwardcalculate the following ratios for the statements and show all working: 1. Current Ratios 2. Quick Ratio 3. Cash Ratioarrow_forward

- Dont solve this question with incorrect values. i will give unhelpful . do not solvearrow_forwardJeff Krause purchased 1,000 shares of a speculative stock in January for $1.89 per share. Six months later, he sold them for $9.95 per share. He uses an online broker that charges him $10.00 per trade. What was Jeff's annualized HPR on this investment? Jeff's annualized HPR on this investment is %. (Round to the nearest whole percent.)arrow_forwardno ai do not answer this question if data is not clear or image is blurr. but do not amswer with unclear values. i will give unhelpful.arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT