Foundations of Financial Management

16th Edition

ISBN: 9781259277160

Author: Stanley B. Block, Geoffrey A. Hirt, Bartley Danielsen

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 20P

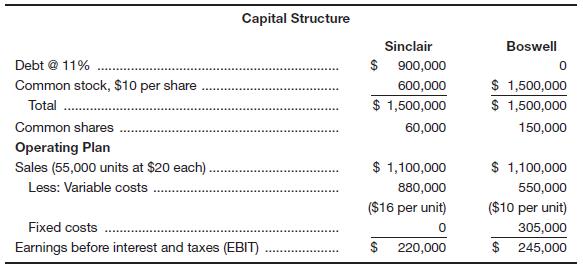

Sinclair Manufacturing and Boswell Brothers Inc. are both involved in the production of brick for the homebuilding industry. Their financial information is as follows:

a. If you combine Sinclair’s capital structure with Boswell’s operating plan, what is the degree of combined leverage? (Round to two places to the right of the decimal point.)

b. If you combine Boswell’s capital structure with Sinclair’s operating plan, what is the degree of combined leverage?

c. Explain why you got the results you did in part b.

d. In part b, if sales double, by what percentage will EPS increase?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

AGG is a US multinational that manufactures specialist high tech parts in the airline engine

industry. AGG is an established company with steady growth in turnover and dividends over the

last 10 years. The company is undertaking a projected titled Project Big as a strategic response

to the changing market scene. AGG will develop a new state of the art highly automated plant

located in Cambodia which is expected to result in cost advantages if it is implemented. The

details about the project are below

• Initital investment has been estimated at $500m

•

•

The annual pre tax savings in operating costs at current exchange rates has been

calculated at $150m for the first four years (starting in the first year)

The residual value of the project at the end of the four years is estimated to be $250m

The initial investment, net of residual value, qualifies for capital allowance and can be

claimed back on a straight line basis over the four years of the project.

Current AGG's cost of capital is…

You have just won the Strayer Lottery jackpot of $11,000,000. You will be paid in twenty-six equal annual installments beginning immediately. If you had the money now, you could invest it in an account with a quoted annual interest rate of 9% with monthly compounding of interest.

Calculate the present value of the payments you will receive. Show your calculations using formulas in your paper or provide how to do the calculations in Excel.

Explain why there is a difference between the present value of the Strayer lottery jackpot and the future value of the twenty-six annual payments based on your calculations and the information provided.

You have just won the Strayer Lottery jackpot of $11,000,000. You will be paid in twenty-six equal annual installments beginning immediately. If you had the money now, you could invest it in an account with a quoted annual interest rate of 9% with monthly compounding of interest.

Calculate the present value of the payments you will receive. Show your calculations using formulas in your paper or in an attached spreadsheet file.

Chapter 5 Solutions

Foundations of Financial Management

Ch. 5 - Discuss the various uses for break-even analysis....Ch. 5 - What factors would cause a difference in the use...Ch. 5 - Explain how the break-even point and operating...Ch. 5 - Prob. 4DQCh. 5 - What does risk taking have to do with the use of...Ch. 5 - Discuss the limitations of financial leverage....Ch. 5 - Prob. 7DQCh. 5 - Explain how combined leverage brings together...Ch. 5 - Explain why operating leverage decreases as a...Ch. 5 - Prob. 10DQ

Ch. 5 - Prob. 1PCh. 5 - Prob. 2PCh. 5 - Prob. 3PCh. 5 - Draw two break-even graphs-one for a conservative...Ch. 5 - Prob. 5PCh. 5 - Shawn Pen & Pencil Sets Inc. has fixed costs of ....Ch. 5 - Calloway Cab Company determines its break-even...Ch. 5 - Prob. 8PCh. 5 - Boise Timber Co. computes its break-even point...Ch. 5 - The Sterling Tire Company’s income statement for...Ch. 5 - Prob. 11PCh. 5 - Healthy Foods Inc. sells 50-pound bags of grapes...Ch. 5 - United Snack Company sells 50-pound bags of...Ch. 5 - Prob. 14PCh. 5 - Prob. 15PCh. 5 - Lenow’s Drug Stores and Hall’s Pharmaceuticals...Ch. 5 - The capital structure for Cain Supplies is...Ch. 5 - Sterling Optical and Royal Optical both make glass...Ch. 5 - Prob. 19PCh. 5 - Sinclair Manufacturing and Boswell Brothers Inc....Ch. 5 - DeSoto Tools Inc. is planning to expand...Ch. 5 - Prob. 23PCh. 5 - Prob. 24PCh. 5 - Prob. 25PCh. 5 - Mr. Gold is in the widget business. He currently...Ch. 5 - Delsing Canning Company is considering an...Ch. 5 - Prob. 2WECh. 5 - Prob. 3WECh. 5 - Prob. 4WECh. 5 - Prob. 5WE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The approach uses a weighted average cost of capital that is unique to a particular project while determining the appropriate discount rate.arrow_forwardAn all-equity firm faces a risk-free rate of 4%, a beta of 2, and a market risk premium of 6%. What is its cost of capital? Multiple choice question. 18% 12% 14% 16%arrow_forwardcreated or destroyed. uses the weighted average cost of capital to determine if value is beingarrow_forward

- Under the subjective approach for project evaluation, all proposed projects are placed into several Blank______ categories. Multiple choice question. risk cost revenue returnarrow_forwardUsing the WACC as the discount rate for future cash flows is appropriate only when the proposed investment is Blank______ the firm's existing activities. Multiple choice question. riskier than different from less risky than similar toarrow_forwardSuppose a project has a cost of $20 million and expected cash flows of 10 million per year for two years. If the WACC is 10%, what is the NPV of this project? Multiple choice question. $17.4 million –$2.6 million $2.6 million 0 millionarrow_forward

- Alpha Corporation consists of two divisions, X and Y. Division X is riskier than Division Y. If Alpha Corporation uses the firm's overall weighted average cost of capital to evaluate both divisions' projects, which division(s) will tend to be awarded greater funds for investment? Multiple choice question. Only division X Neither division Both divisions Only division Yarrow_forwardAlpha Corporation consists of two divisions, X and Y. Division X is riskier than Division Y. If Alpha Corporation uses the firm's overall weighted average cost of capital to evaluate both divisions' projects, which division(s) will tend to be awarded greater funds for investment? Multiple choice question. Only division X Neither division Both divisions Only division Yarrow_forwardWhich of the following is true of the dividends paid to common stockholders? Multiple choice question. All companies are legally required to pay dividends when they earn a net income. All companies are legally required to pay fixed dividends regardless of their financial performance. Dividends paid are not tax deductible. Unlike interest payments, dividends paid are tax-deductible at the corporate level and are tax-free at the personal level.arrow_forward

- If a firm issues no debt, its weighted average cost of capital will equal Blank______. Multiple choice question. its cost of debt half the sum of the cost of debt and equity its dividend yield its cost of equityarrow_forwardIf a firm issues no debt, its weighted average cost of capital will equal Blank______. Multiple choice question. its cost of debt half the sum of the cost of debt and equity its dividend yield its cost of equityarrow_forwardWhile computing the weighted average cost of capital, the is the better alternative when the market value is not readily available.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781285867977

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Working capital explained; Author: The Finance Storyteller;https://www.youtube.com/watch?v=XvHAlui-Bno;License: Standard Youtube License