To identify: The design that will yield the highest profit.

Introduction:

Expected monetary value (EMV):

Expected monetary value (EMV) is a calculation system for expected returns for the certain decision made by a company.

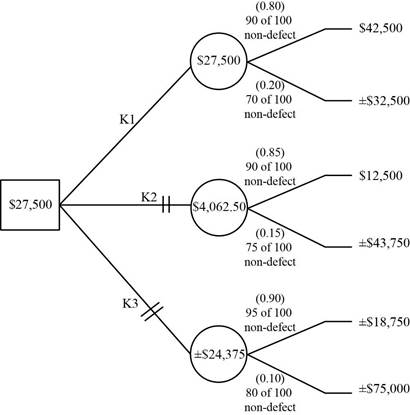

Answer to Problem 24P

The design K1 can be used because of the highest profit.

Explanation of Solution

Given information:

| Design | Cost | Probability | Number of non-defective (out of 100) |

| K1 | $100,000.00 | 0.8 | 90 |

| 0.2 | 70 | ||

| K2 | $130,000.00 | 0.85 | 90 |

| 0.15 | 75 | ||

| K3 | $180,000.00 | 0.9 | 95 |

| 0.1 | 80 |

Calculation of EMV:

Calculation of expected outcome and EMV:

Design K1:

Probability 0.80

The expected outcome is calculated by adding the cost for the design K1, $100,000 and the cost of 10 unsold sandwiches ($1.20) and subtracting the resultant with the profit of 90 sandwiches sold ($2.50-$1.20=$1.30). The expected outcome is $42,500.

Probability 0.20

The expected outcome is calculated by adding the cost for the design K1, $100,000 and cost of 30 unsold sandwiches ($1.20) and subtracting the resultant with the profit of 70 sandwiches sold ($2.50-$1.20=$1.30). The expected outcome is -$32,500.

Calculation of EMV:

EMV is calculated by multiplying the payoff with the respective probabilities.

The expected outcome for probability 0.80, $42,500 is multiplied and the expected outcome for probability 0.20, -$32,500 is multiplied and the resultant of both is added to give the EMV for design K1 is $27,500.

Design K2:

Probability 0.85

The expected outcome is calculated by adding the cost for the design K2, $130,000 and the cost of 10 unsold sandwiches ($1.20) and subtracting the resultant with the profit of 90 sandwiches sold ($2.50-$1.20=$1.30). The expected outcome is $12,500.

Probability 0.15

The expected outcome is calculated by adding the cost for the design K2, $130,000 and the cost of 25 unsold sandwiches ($1.20) and subtracting the resultant with the profit of 75 sandwiches sold ($2.50-$1.20=$1.30). The expected outcome is -$43,750.

Calculation of EMV:

EMV is calculated by multiplying the payoff with the respective probabilities.

The expected outcome for probability 0.85, $12,500 is multiplied and the expected outcome for probability 0.15, -$43,750 is multiplied and the resultant of both is added to give the EMV for design K2 is $4,062.50.

Design K3:

Probability 0.90:

The expected outcome is calculated by adding the cost for the design K3, $180,000 and the cost of 5 unsold sandwiches ($1.20) and subtracting the resultant with the profit of 95 sandwiches sold ($2.50 - $1.20=$1.30). The expected outcome is - $18,750.

Probability 0.10:

The expected outcome is calculated by adding the cost for the design K3, $180,000 and cost of 20 unsold sandwiches ($1.20) and subtracting the resultant with the profit of 80 sandwiches sold ($2.50-$1.20=$1.30). The expected outcome is - $75,000.

Calculation of EMV:

EMV is calculated by multiplying the payoff with the respective probabilities.

The probability 0.90 and its expected outcome, -$18,750 is multiplied and the expected outcome for probability 0.10, -$75,000 is multiplied and the resultant of both is added to give the EMV for design K3 is - $24.375.

From the calculated EMV of three designs K1, K2 and K3, it can be found that EMV for design K1 is higher than other two (refer equation (1),(2) and (3)). Therefore, it is recommended to use design K1.

Hence, the design K1 can be used because of the highest profit.

Want to see more full solutions like this?

Chapter 5 Solutions

Pearson eText Principles of Operations Management: Sustainability and Supply Chain Management -- Instant Access (Pearson+)

- use the screenshot to find the anwser to this If the project finishes within 27 weeks of its start, the project manager receives a $500 bonus. What is the probability of a $500 bonus? Note: Round z-value to 2 decimal places, and probability to 4 decimal places.arrow_forwardScan To Pay Log into your own Lightning UPI account of supporting app and scan QR code below to pay! ✰ BINANCEarrow_forwardTo help with preparations, a couple has devised a project network to describe the activities that must be completed by their wedding date. Start A Ꭰ F B E The following table lists the activity time estimates (in weeks) for each activity. Optimistic Most Probable Activity Pessimistic A 4 5 6 B 2.5 3 3.5 C 5 6 7 D 5 5.5 9 E 5 7 9 F 2 3 4 G 7 9 11 H 5 6 13 H Finish Based only on the critical path, what is the estimated probability that the project will be completed within the given time frame? (Round your answers to four decimal places.) (a) Within 19 weeks? (b) Within 21 weeks? (c) Within 25 weeks?arrow_forward

- You may need to use the appropriate technology to answer this question. Mueller Associates is a urban planning firm that is designing a new public park in an Omaha suburb. Coordination of the architect and subcontractors will require a major effort to meet the 46-week completion date requested by the owner. The Mueller project manager prepared the following project network. B H Start A C G Finish E Estimates of the optimistic, most probable, and pessimistic times (in weeks) for the activities are as follows. Activity Optimistic Most Probable Pessimistic A 4 12 B 6 7 8 C 6 18 D 3 5 7 E 6 9 18 F 5 8 17 G 10 15 20 H 5 13 (a) Find the critical path. (Enter your answers as a comma-separated list.) (b) What is the expected project completion time (in weeks)? weeks i (c) Based only on the critical path, what is the estimated probability the project can be completed in 46 weeks as requested by the owner? (Round your answer to four decimal places.) (d) Based only on the critical path, what is…arrow_forwardBridge City Developers is coordinating the construction of an office complex. As part of the planning process, the company generated the following activity list. Draw a project network that can be used to assist in the scheduling of the project activities. Activity Immediate Predecessor ABC E FGH ] A, B A, B D E с с F, G, H, I A E Start B D A E Start B D H H E A E Finish Start D F J Finish Start B D F Finish Finish C H I Harrow_forwardHow can mindfulness be combined with cognitive reframing to build emotional regulation and mental flexibility? What is the strategy for maintaining mental well-being to improve through deliberate practice? How to engage in practices that help regulate emotions and build resilience?arrow_forward

- • We Are HIRING Salesforce Developer (2 - 4 Years) @ Cloudodyssey It Solutions Requirement : Appropriate knowledge on Salesforce standard objects Leads, Account, Contacts, Opportunity, Products, Lead process, Sales process, is required. • Hands-on experience in Salesforce Experience Cloud, Sales Cloud and Lightning. • • Hands experience with Salesforce development, administration, system integrations, Lightning Design System, and bug fixes. Experience in configuration, integration, APIs creation, testing and deployment of Salesforce.com functionality. Eloquent verbal and written communication skills. • Familiar with Agile framework. Work Location: Bangalore SUBMIT YOUR CV hello@cloudodyssey.coarrow_forwardAgree or disagree with post On the surface, the numbers in financial statements do present a snapshot of a company's financial position and performance. However, just looking at the raw numbers often doesn't tell the whole story or reveal underlying trends and relationships that are crucial for making informed decisions. Think of it like looking at individual pieces of a puzzle. Each number is a piece, providing some information. But to see the complete picture – the company's overall financial health, its performance over time, how it compares to its peers, and its potential future – you need to assemble those pieces using different analytical tools. For example: Horizontal analysis helps us understand how specific financial statement items have changed over multiple periods. Is revenue growing? Are expenses increasing at a faster rate than sales? This reveals trends that a single year's numbers wouldn't show. Vertical analysis allows us to see the relative size of each item within…arrow_forwardWhat can you do in response to an insulting offer?arrow_forward

- Agree or disagree with post If someone hits you with an insulting offer, the first thing to do is not take it personally. It’s normal to feel a little offended, but blowing up or shutting down won’t help your case. Better move is to stay calm and treat it like a misunderstanding or just the first step in the conversation. That way, you keep things respectful but still let them know the offer doesn’t sit right with you. It also helps to back up your response with facts. Bring in things like your experience, numbers, or any specific results you delivered. That can shift the conversation away from feelings and toward the value you bring. Agree or disagree with postarrow_forwardAgree or disagree with the post When you get an insulting offer, the best thing to do is stay calm and professional. Try not to take it personally or react out of anger. Instead, ask questions to understand why the offer was so low. This helps you get a better idea of what the other person is thinking. After that, you can respond with a counteroffer that shows your value. Use simple facts like your skills, experience, and what others in your field are getting paid to back up your request. If the person still refuses to offer something fair, it’s okay to politely say no and walk away. Standing up for yourself in a respectful way shows confidence and helps others take you seriously. Agree or disagree with the postarrow_forwardRegarding perceptions that can occur when negotiating in different places and at different times, the continuation norm in e-negotiations is best described as _____. Group of answer choices A. negotiators' beliefs that negotiations are worth continuing B. the act of thinking about how things might have turned out differently C. the tendency for e-communicators to ascribe diabolical intentions to the other party D. the tendency for negotiators to behave as if they are communicating synchronously when in fact they are notarrow_forward

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage LearningMarketingMarketingISBN:9780357033791Author:Pride, William MPublisher:South Western Educational Publishing

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage LearningMarketingMarketingISBN:9780357033791Author:Pride, William MPublisher:South Western Educational Publishing Management, Loose-Leaf VersionManagementISBN:9781305969308Author:Richard L. DaftPublisher:South-Western College Pub

Management, Loose-Leaf VersionManagementISBN:9781305969308Author:Richard L. DaftPublisher:South-Western College Pub Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Contemporary MarketingMarketingISBN:9780357033777Author:Louis E. Boone, David L. KurtzPublisher:Cengage Learning

Contemporary MarketingMarketingISBN:9780357033777Author:Louis E. Boone, David L. KurtzPublisher:Cengage Learning