Concept explainers

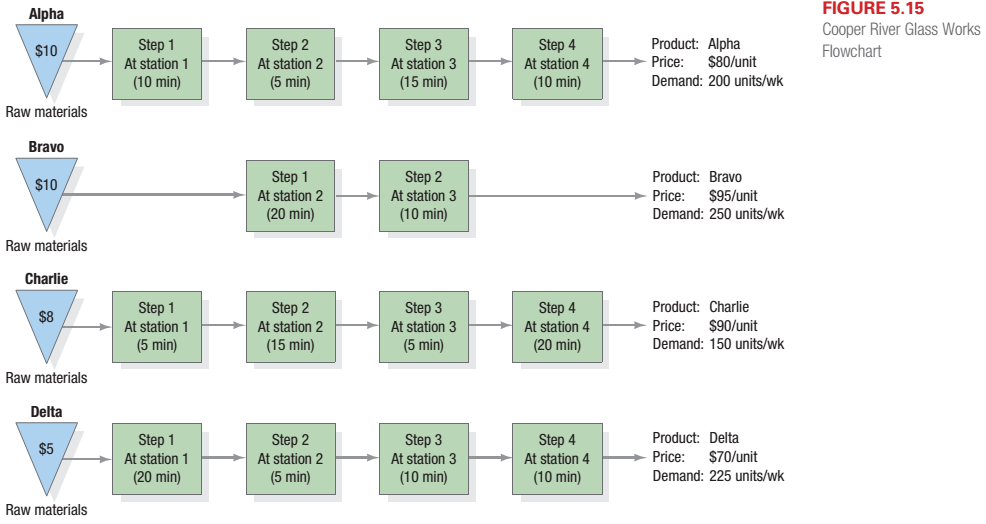

Cooper River Glass Works (RGW) produces four different models of desk lamps as shown in Figure 5.15. The operations manager knows that total monthly demand exceeds the capacity available for production. Thus, she is interested in determining the product mix which will maximize profits. Each model’s price, routing, processing times, and material cost are provided in Figure 5.15. Demand next month is estimated to be 200 units of model Alpha, 250 units of model Bravo, 150 units of model Charlie, and 225 units of model Delta. CRGW operates only one 8-hour shift per day and is

- Which station is the bottleneck?

- Using the traditional method, which bases decisions solely on a product’s contribution to profits and overhead, what is the optimal product mix and what is the overall profitability?

- Using the bottleneck-based method, what is the optimal product mix and what is the overall profitability?

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

OPERATIONS MANAGEMENT CUSTOM ACCESS

Additional Business Textbook Solutions

MARKETING:REAL PEOPLE,REAL CHOICES

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Understanding Business

Essentials of MIS (13th Edition)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Marketing: An Introduction (13th Edition)

- Excel Please. The workload of many areas of banking operations varies considerably based on time of day. A variable capacity can be achieved effectively by employing part-time personnel. Because part-timers are not entitled to all the fringe benefits, they are often more economical than full-time employees. Other considerations, however, may limit the extent to which part-time people can be hired in a given department. The problem is to find an optimal workforce schedule that would meet personnel requirements at any given time and also be economical. Some of the factors affecting personnel assignments are listed here: The bank is open from 9:00am to 7:00pm. Full-time employees work for 8 hours (1 hour for lunch included) per day. They do not necessarily have to start their shift when the bank opens. Part-time employees work for at least 4 hours per day, but less than 8 hours per day and do not get a lunch break. By corporate policy, total part-time personnel hours is limited…arrow_forwardIM.84 An outdoor equipment manufacturer sells a rugged water bottle to complement its product line. They sell this item to a variety of sporting goods stores and other retailers. The manufacturer offers quantity discounts per the following discount schedule: Option Plan Quantity Price A 1 - 2,399 $5.50 B 2,400 - 3,999 $5.20 C 4,000+ $4.50 A large big-box retailer expects to sell 9,700 units this year. This retailer estimates that it incurs an internal administrative cost of $225 each time it places an order with the manufacturer. Holding cost for the retailer is $55 per case per year. (There are 40 units or water bottles per case.) Based on this information, and not taking into account any quantity discount offers, what is the calculated EOQ (in units)? (Display your answer to the nearest whole number.) Number Based on this information, sort each quantity discount plan from left to right by dragging the MOST preferred option plan to the left, and the LEAST preferred…arrow_forwardIn less than 150 words, what is an example of what your reflection of core values means to you and your work: Commitment, Perseverance, Community, Service, Pride?arrow_forward

- Prepare a report on the following: Part 1: Discuss the role of the corporate secretary in facilitating effective governance in a limited liability company. Include the relationships with directors, shareholders, and other officers. Part 2: Compare and contrast two characteristics of different business entities (sole trader, partnership, and limited liability company). Use examples to recommend the most appropriate type of business entity for the scenario below: Scenario Background Alex, Taylor, and Jordan plan to collaborate to launch a tech startup focused on developing and selling innovative software solutions. Each individual brings unique skills and resources to the venture: Alex: A skilled software developer with technical expertise and a vision for the product. Taylor: A marketing professional with extensive connections in the technology industry, aiming to drive sales and build the brand. Jordan: An investor willing to contribute significant financial resources but…arrow_forwardProblem 1 (20 Points) Davison Electronics manufactures three LED television monitors, identified as Model A, Model B, and Model C. Davison Electronics four manufacturing plants. Each model has its lowest possible production cost when produced at Plant 1. However, Plant 1 does not have the capacity to handle the total production of all three models. As a result, at least some of the production must be routed to the other manufacturing plants. The following table shows the minimum production requirements for next month, the plant capacities in units per month, and the production cost per unit at each plant: Model Production Cost per Unit Minimum Production Requirements Plant 1 Plant 2 Plant 3 Plant 4 A $25 $28 $37 $34 48,000 B $26 $35 $36 $41 75,000 C $20 $31 $26 $23 60,000 Production Capacity 65,000 50,000 32,000 43,000 Davison’s objective is to determine the cost-minimizing production plan. Without…arrow_forwardSECTION B: TOPIC STRUCTURE CAPSTONE PROJECT TOPIC SUBMISSION TEMPLATE SECTION A: STUDENT DETAILS Student number Title (Mr/Miss/Ms/Mrs) Surname First name/s Title of research Date and year of registration Work Home Contact details Cell Region Date submitted Email 1.1 Title Insert title of the research. Choose a title that captures the essence of your proposed project. 1.2 Background to the Problem This section will be used to create the readers' interest. It can include a specific description of the topic that is to be investigated. A brief preview of the topic and the foundation of the problem should also be given. The researcher can achieve this through building up a detailed background of circumstances that lead to the problem being examined. Therefore, the background helps the reader understand the specific problem addressed by the researcher. This section should not include the background/history of the organisation. The background to the problem should not be more than ½ a page.…arrow_forward

- Does Nike Corporation's emphasis on lean operations help the Vietnamese workforce that still earns $150.00 minimum wage a month since 2014?arrow_forwardInformation Security Innovation within a Contemporary Business Environment All organisations using computers need to consider the security of information they keep. Many organisations utilise Websites for their core business functions and this results in monetary transactions being carried out on the Websites.arrow_forwardPlease help with a complete research report on the topic below: "Information Security Innovation within a Contemporary Business Environment " The format of the report should follow this below.arrow_forward

- 7. Wireless Infrastructure in the Cloud Wireless devices have changed the way organisations and their customers interact. Wireless enabled devices have driven the mindset that wireless networks must be ubiquitous, fast, and constantly available. These are demands that have traditionally put organisations and their user communities in direct conflict with their IT departments, as constructing and maintaining wireless infrastructures are typically time-consuming, complex, and costly endeavours.arrow_forwardIM.54 A growing online retailer sells thousands of items yet has has one specialty product category with just 30 items. They want to classify these thirty items according to the annual dollar volume (revenue) generated by each item. The table below lists each item number, Annual Sales (in units), and Price per unit: Item # Annual Sales Price 1 221 $25.85 2 446 $14.15 3 8,940 $168.19 4 2,965 $15.99 5 1,322 $29.37 6 2,575 $12.77 7 767 $28.43 8 5,803 $163.01 9 2,673 $20.51 10 642 $14.71 11 4,168 $54.53 12 1,881 $22.55 13 2,417 $29.63 14 5,207 $36.41 15 1,381 $20.55 16 9,635 $173.69 17 17,406 $27.07 18 1,573 $25.99 19 6,471 $64.99 20 6,047 $29.83 21 433 $20.89 22 2,279 $53.59 23 15,532 $106.91 24 1,585 $4.09 25 5,376 $65.23 26 2,965 $37.93 27 2,048 $28.51 28 1,174 $22.99 29 381 $5.57 30 2,930 $3.43 Which item in the table above has the highest annual dollar volume? In the answer field below, write the ITEM # that…arrow_forwardIM.84 An outdoor equipment manufacturer sells a rugged water bottle to complement its product line. They sell this item to a variety of sporting goods stores and other retailers. The manufacturer offers quantity discounts per the following discount schedule: Option Plan Quantity Price A 1 - 2,199 $5.00 B 2,200 - 3,699 $4.55 C 3,700+ $3.90 A large big-box retailer expects to sell 9,200 units this year. This retailer estimates that it incurs an internal administrative cost of $235 each time it places an order with the manufacturer. Holding cost for the retailer is $60 per case per year. (There are 52 units or water bottles per case.)Based on this information, and not taking into account any quantity discount offers, what is the calculated EOQ (in units)? (Display your answer to the nearest whole number.) Based on this information, sort each quantity discount plan from left to right by dragging the MOST preferred option plan to the left, and the LEAST preferred option…arrow_forward

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage LearningMarketingMarketingISBN:9780357033791Author:Pride, William MPublisher:South Western Educational Publishing

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage LearningMarketingMarketingISBN:9780357033791Author:Pride, William MPublisher:South Western Educational Publishing