Concept explainers

Reynolds Printing Company specializes in wedding announcements. Reynolds uses an actual job-order costing system. An actual overhead rate is calculated at the end of each month using actual direct labor hours and overhead for the month. Once the actual cost of a job is determined, the customer is billed at actual cost plus 50%.

During April, Mrs. Lucky, a good friend of owner Jane Reynolds, ordered three sets of wedding announcements to be delivered May 10, June 10, and July 10, respectively. Reynolds scheduled production for each order on May 7, June 7, and July 7, respectively. The orders were assigned job numbers 115, 116, and 117, respectively.

Reynolds assured Mrs. Lucky that she would attend each of her daughters’ weddings. Out of sympathy and friendship, she also offered a lower price. Instead of cost plus 50%, she gave her a special price of cost plus 25%. Additionally, she agreed to wait until the final wedding to bill for the three jobs.

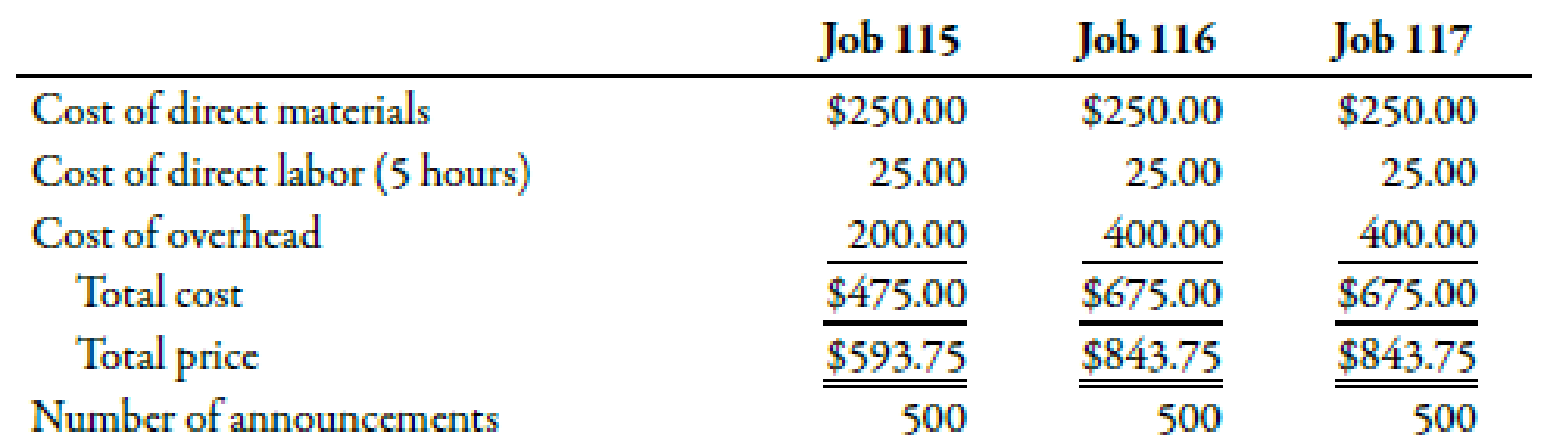

On August 15, Reynolds asked her accountant to bring her the completed job-order cost sheets for Jobs 115, 116, and 117. She also gave instructions to lower the price as had been agreed upon. The cost sheets revealed the following information:

Reynolds could not understand why the overhead costs assigned to Jobs 116 and 117 were so much higher than those for Job 115. She asked for an overhead cost summary sheet for the months of May, June, and July, which showed that actual overhead costs were $20,000 each month. She also discovered that direct labor hours worked on all jobs were 500 hours in May and 250 hours each in June and July.

Required:

- 1. How do you think Mrs. Lucky will feel when she receives the bill for the three sets of wedding announcements?

- 2. Explain how the overhead costs were assigned to each job.

- 3. Assume that Reynolds’s average activity is 500 hours per month and that the company usually experiences overhead costs of $240,000 each year. Can you recommend a better way to assign overhead

costs to jobs ? Recompute the cost of each job and its price, given your method of overhead cost assignment. Which method do you think is best? Why?

Trending nowThis is a popular solution!

Chapter 4 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- Financial Accounting Questionarrow_forwardWhat is the total net gain or loss on this transaction? Accountingarrow_forwardAccounting: [Operating leverage] Pink Corporation has sales of 1,350 units at $55 per unit. Variable expenses are 44% of the selling price. If total fixed expenses are $23,000, the degree of operating leverage is?arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College