Concept explainers

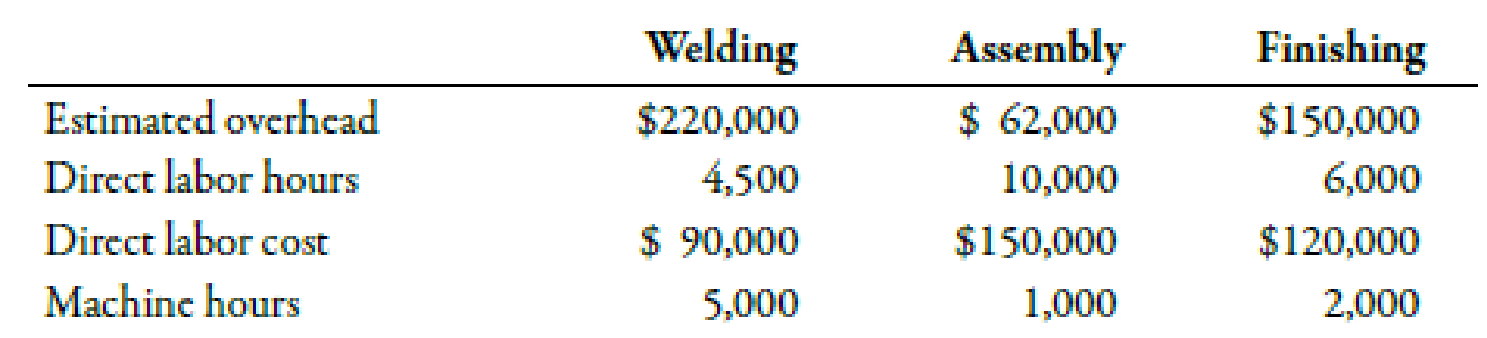

Folsom Company manufactures specialty tools to customer order. There are three producing departments. Departmental information on budgeted overhead and various activity measures for the coming year is as follows:

Currently, overhead is applied on the basis of machine hours using a plantwide rate.

However, Janine, the controller, has been wondering whether it might be worthwhile to use departmental overhead rates. She has analyzed the overhead costs and drivers for the various departments and decided that Welding and Finishing should base their overhead rates on machine hours and that Assembly should base its overhead rate on direct labor hours.

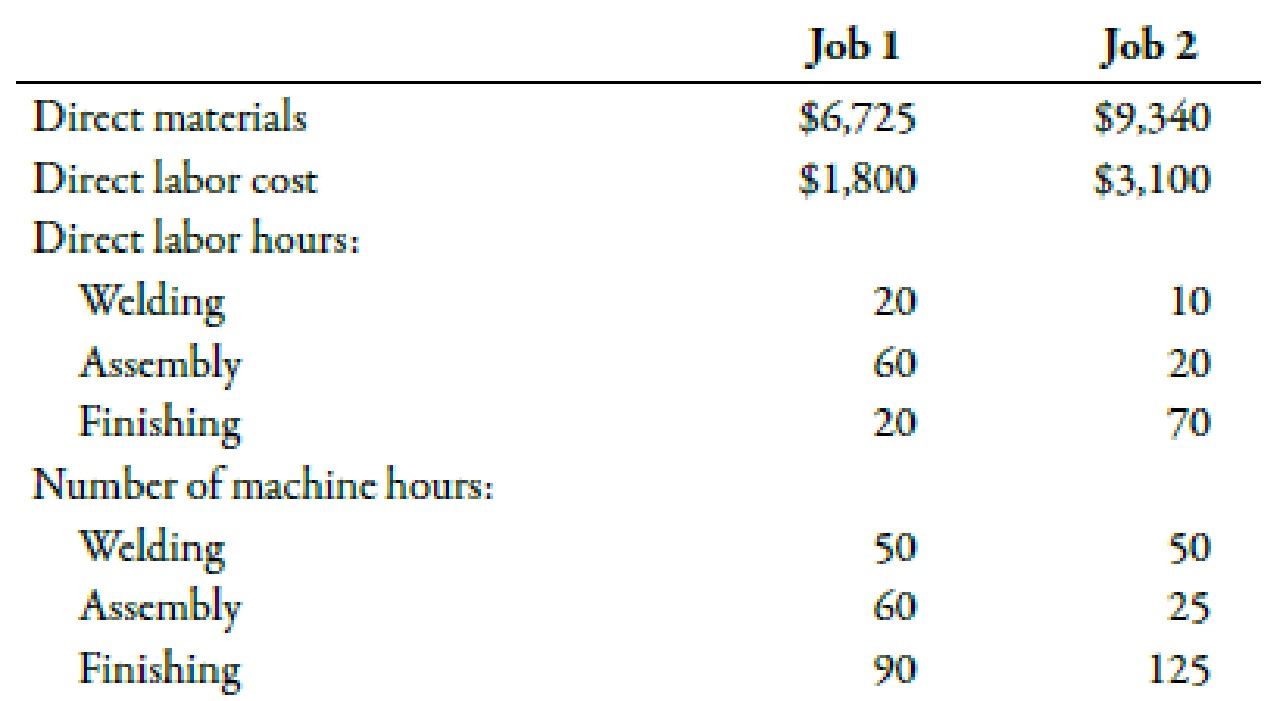

Janine has been asked to prepare bids for two jobs with the following information:

The typical bid price includes a 35% markup over full

Required:

- 1. Calculate a plantwide rate for Folsom Company based on machine hours. What is the bid price of each job using this rate?

- 2. Calculate departmental overhead rates for the producing departments. What is the bid price of each job using these rates?

1.

Compute plantwide overhead rate and the bid price of each job using this rate.

Answer to Problem 57P

The predetermined plantwide overhead rate is $54.00 per mhrs. The bid prices for Job 1 and Job 2 are $26,089 and $31,374 respectively

Explanation of Solution

Plantwide Overhead Rate

When a single rate is calculated for all the activities of the plant on the basis of total estimated cost and total estimated activity level it is known as plantwide overhead rate.

Use the following formula to calculate plantwide overhead rate:

Substitute $432,000 for estimated annual overhead and 8,000mhrs for estimated annual activity level in the above formula.

Therefore, predetermined plantwide overhead rate is $54.00 per mhrs.

Calculate bid price of each job:

| Job 1($) | |

| Direct materials | 6,725 |

| Direct labor | 1,800 |

| Overhead applied | 10,800 |

| Total manufacturing cost | 19,325 |

| Add: Markup 35% | 6,764 |

| Bid price | 26,089 |

Table (1)

Therefore, the bid prices for Job 1 and Job 2 are $26,089 and $31,374 respectively

Working Note:

1. Calculation of overhead applied:

Job 1:

Job 2:

2.

Find out the departmental overhead rates and bid price using those rates for producing departments.

Explanation of Solution

Departmental Overhead Rates:

When overhead rate is calculated for each department on the basis of their estimated cost and estimated activity level it is known as departmental overhead rate.

Use the following formula to calculate welding department overhead rate.

Substitute $220,000 for estimated annual overhead and 5,000 mhrs for estimated annual activity level in the above formula.

Therefore,welding department overhead rate is $44.00 per mhrs.

Use the following formula to calculate assembly department overhead rate.

Substitute $62,000 for estimated annual overhead and 10,000 dlhrs for estimated annual activity level in the above formula.

Therefore, assembly department overhead rate is $6.20 per dlhrs.

Use the following formula to calculate finishing department overhead rate.

Substitute $150,000 for estimated annual overhead and 2,000 mhrs for estimated annual activity level in the above formula.

Therefore, finishing department overhead rate is $75.00 per mhrs.

Calculate bid price of each job:

| Job 1($) | Job 2($) | |

| Direct materials | 6,725 | 9,340 |

| Direct labor | 1,800 | 3,100 |

| Overhead applied: | ||

| Welding | 2,200 | 2,200 |

| Assembly | 372 | 124 |

| Finishing | 6,750 | 9,375 |

| Total manufacturing cost | 17,847 | 24,139 |

| Add: Markup 35% | 6,246 | 8,449 |

| Bid price | 24,093 | 32,588 |

Table (2)

Therefore, the bid prices for Job 1 and Job 2 are $24,093 and $32,588 respectively

Working Note:

1. Calculation of overhead applied for Welding of Job 1:

Welding:

Welding of Job 2:

2. Assembly of Job 1:

Assembly of Job 2:

3 Finishing of Job 1:

Finishing of Job 2:

Want to see more full solutions like this?

Chapter 4 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning