Concept explainers

(Appendix 4B) Support Department Cost Allocation

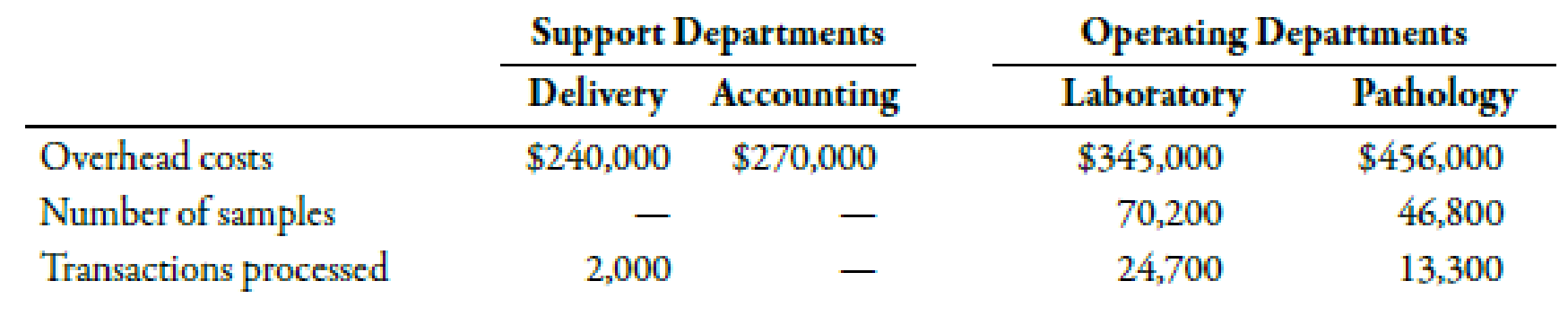

MedServices Inc. is divided into two operating departments: Laboratory and Tissue Pathology. The company allocates delivery and accounting costs to each operating department. Delivery costs include the costs of a fleet of vans and drivers that drive throughout the state each day to clinics and doctors’ offices to pick up samples and deliver them to the centrally located laboratory and tissue pathology offices. Delivery costs are allocated on the basis of number of samples. Accounting costs are allocated on the basis of the number of transactions processed. No effort is made to separate fixed and variable costs; however, only budgeted costs are allocated. Allocations for the coming year are based on the following data:

Required:

- 1. Assign the support department costs by using the direct method. (Note: Round allocation ratios to four decimal places.)

- 2. Assign the support department costs by using the sequential method, allocating accounting costs first. (Note: Round allocation ratios to four decimal places.)

1.

Calculate the assigned cost of support departments by using direct method.

Explanation of Solution

Direct Method:

Direct method implies that the unit cost must include all the factory costs. It states that the cost of support departments should not be added in the unit cost if it is not included in operating departments’ cost because they do not play any role in selling the unit or product.

Use the following formula to calculate assignment ratios on the basis of number of samples:

Laboratory department:

Substitute 70,200 for number of samples in laboratory and 117,000 for total samples in operating department in the above formula.

Therefore, the assignment ratio for laboratory department is 0.60.

Pathology department:

Substitute 46,800 for number of samples in laboratory and 117,000 for total samples in operating department in the above formula.

Therefore, the assignment ratio for pathology department is 0.40.

Use the following formula to calculate assignment ratios on the basis of transactions processed:

Laboratory department:

Substitute 24,700 for transactions processed in laboratory and 38,000 for total transactions processed in operating department in the above formula.

Therefore, the assignment ratio for laboratory department is 0.65.

Pathology department:

Substitute 13,300 for transactions processed in laboratory and 38,000 for total transactions processed in operating department in the above formula.

Therefore, the assignment ratio for pathology department is 0.35.

Assign cost of support departments to the operating departments:

| Support departments | Operating departments | |||

| Delivery($) | Accounting($) | Laboratory($) | Pathology($) | |

| Direct costs | 240,000 | 270,000 | 345,000 | 456,000 |

| Delivery1 | -240,000 | 144,000 | 96,000 | |

| Accounting1 | -270,000 | 175,500 | 94,500 | |

| Total | 0 | 0 | 664,500 | 646,500 |

Table (1)

Working Note:

1. Calculation of assigned cost of support department to operating department:

| Account Title |

Assignment ratio A |

Support department cost($) B |

Assigned cost($) |

| Delivery cost: | |||

| Laboratory | 0.6000 | 240,000 | 144,000 |

| Pathology | 0.4000 | 240,000 | 96,000 |

| Accounting: | |||

| Laboratory | 0.65 | 270,000 | 175,500 |

| Pathology | 0.35 | 270,000 | 94,500 |

Table (2)

2.

Calculate the assigned cost of support departments by using sequential method and allocate accounting costs first.

Explanation of Solution

Sequential Method:

Sequential method recognizes that there is possible interaction between the support departments. However, it does not account for such interaction in full which makes it more accurate as compared to the direct method.

Use the following formula to calculate cost assignment ratios on the basis of number of transactions processed:

Delivery:

Substitute 2,000 for transactions processed in delivery and 40,000 for total transactions processed in the above formula.

Therefore, the cost assignment ratio for delivery is 0.0500.

Laboratory department:

Substitute 24,700 for transactions processed in laboratory and 40,000 for total transactions processed in the above formula.

Therefore, the cost assignment ratio for laboratory department is 0. 6175.

Pathology department:

Substitute 13,300 for transactions processed in pathology and 40,000 for total transactions processed in the above formula.

Therefore, the cost assignment ratio for pathology department is 0.3325.

Use the following formula to calculate assignment ratios on the basis of number of samples:

Laboratory department:

Substitute 70,200 for number of samples in laboratory and 117,000 for total samples in operating department in the above formula.

Therefore, the assignment ratio for laboratory department is 0.60.

Pathology department:

Substitute 46,800 for number of samples in laboratory and 117,000 for total samples in operating department in the above formula.

Therefore, the assignment ratio for pathology department is 0.40.

Assign cost of support departments to the operating departments:

| Support departments | Operating departments | |||

| Delivery($) | Accounting($) | Laboratory($) | Pathology($) | |

| Direct costs | 240,000 | 270,000 | 345,000 | 456,000 |

| Accounting2 | 13,500 | 166,725 | 89,775 | |

| Delivery2 | -253,500 | -270,000 | 152,100 | 101,400 |

| Total | 0 | 0 | 663,825 | 647,175 |

Table (3)

Working Note:

2. Calculation of assigned cost of support department:

| Account Title |

Assignment ratio A |

Support department cost($) B |

Assigned cost($) |

| Accounting: | |||

| Delivery | 0.0500 | 270,000 | 13,500 |

| Laboratory | 0.6175 | 270,000 | 166,725 |

| Pathology | 0.3325 | 270,000 | 89,775 |

| Delivery cost: | |||

| Laboratory | 0.60 | 253,500 | 152,100 |

| Pathology | 0.40 | 253,500 | 101,400 |

Table (4)

Want to see more full solutions like this?

Chapter 4 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- Mit Distributors provided the following inventory-related data for the fiscal year: Purchases: $385,000 Purchase Returns and Allowances: $10,200 Purchase Discounts: $4,300 Freight In: $55,000 Beginning Inventory: $72,000 Ending Inventory: $95,500 What is the Cost of Goods Sold (COGS)?arrow_forwardanswer ? general accountingarrow_forwardBrightTech Corp. reported the following cost of goods sold (COGS) figures over three years: • 2023: $3,800,000 • 2022: $3,500,000 • 2021: $3,000,000 If 2021 is the base year, what is the percentage increase in COGS from 2021 to 2023?arrow_forward

- Sun Electronics operates a periodic inventory system. At the beginning of 2022, its inventory was $95,750. During the year, inventory purchases totaled $375,000, and its ending inventory was $110,500. What was the cost of goods sold (COGS) for Sun Electronics in 2022?arrow_forwardi want to this question answer of this general accountingarrow_forwardA clothing retailer provides the following financial data for the year. Determine the cost of goods sold (COGS): ⚫Total Sales: $800,000 • Purchases: $500,000 • Sales Returns: $30,000 • Purchases Returns: $40,000 • Opening Stock Value: $60,000 • Closing Stock Value: $70,000 Administrative Expenses: $250,000arrow_forward

- subject : general accounting questionarrow_forwardBrightTech Inc. had stockholders' equity of $1,200,000 at the beginning of June 2023. During the month, the company reported a net income of $300,000 and declared dividends of $175,000. What was BrightTech Inc.. s stockholders' equity at the end of June 2023?arrow_forwardQuestion 3Footfall Manufacturing Ltd. reports the following financialinformation at the end of the current year: Net Sales $100,000 Debtor's turnover ratio (based on net sales) 2 Inventory turnover ratio 1.25 fixed assets turnover ratio 0.8 Debt to assets ratio 0.6 Net profit margin 5% gross profit margin 25% return on investments 2% Use the given information to fill out the templates for incomestatement and balance sheet given below: Income Statement of Footfall Manufacturing Ltd. for the year endingDecember 31, 20XX(in $) Sales 100,000 Cost of goods sold gross profit other expenses earnings before tax tax @ 50% Earnings after tax Balance Sheet of Footfall Manufacturing Ltd. as at December 31, 20XX(in $) Liabilities Amount Assets Amount Equity Net fixed assets long term debt 50,000 Inventory short term debt debtors cash Total Totalarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning