Concept explainers

Use the following information for Brief Exercises 4-34 and 4-35:

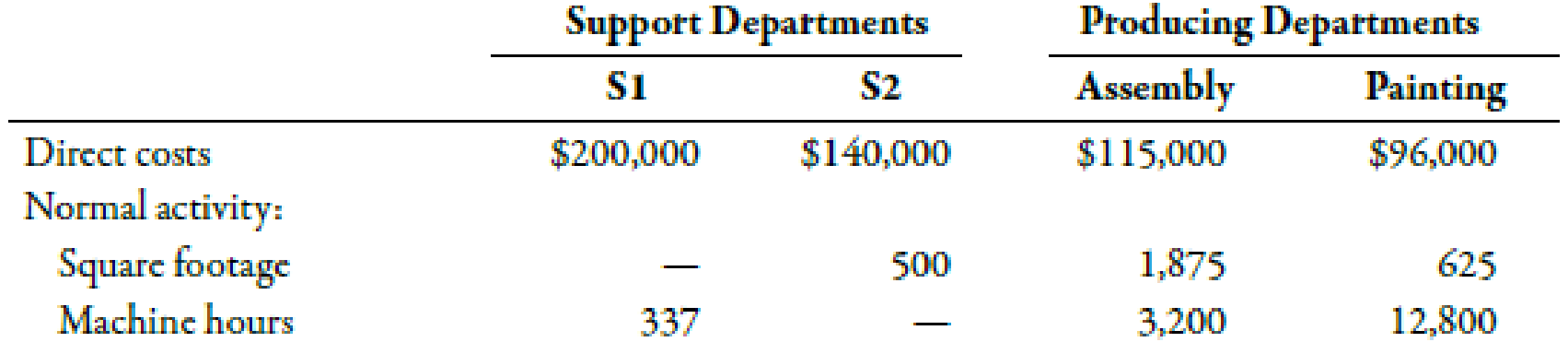

Sanjay Company manufactures a product in a factory that has two producing departments, Assembly and Painting, and two support departments, S1 and S2. The activity driver for S1 is square footage, and the activity driver for S2 is number of machine hours. The following data pertain to Sanjay:

Brief Exercises 4-35 (Appendix 4B) Sequential Method

Refer to the information for Sanjay Company on the previous page. Now assume that Sanjay uses the sequential method to allocate support department costs. S1 is allocated first, then S2.

Required:

- 1. Calculate the cost assignment ratios to be used under the sequential method for S2, Assembly, and Painting. Carry out your answers to four decimal places.

- 2. Allocate the

overhead costs to the producing departments by using the sequential method.

1.

Computecost assignment ratios for S2 under sequential method.

Explanation of Solution

Sequential Method:

Sequential method recognizes that there is possible interaction between the support departments. However, it does notaccount for such interaction in full which makes it more accurate as compared to the direct method.

Use the following formula to calculatecost assignment ratios for S1 on the basis of number of square footage:

S2:

Substitute 500 for number of square footage in S2 and 3,000 for total square footage in the above formula.

Therefore, the cost assignment ratio for S2 is 0.1667.

Assembly department:

Substitute 1,875 for number ofsquare footage in assembly and 3,000 for total square footage in the above formula.

Therefore, the cost assignment ratio for assembly department is 0.6250.

Painting department:

Substitute 625 for number ofsquare footage in assembly and 3,000 for total square footage in the above formula.

Therefore, the cost assignment ratio for painting department is 0.2083.

Use the following formula to calculate cost assignment ratios for Department S2 on the basis of number of machine hours:

Assembly department:

Substitute 3,200 for number of machine hoursofassembly and 16,000 for total machine hours of producing department in the above formula.

Therefore, the assignment ratio for assembly department is 0.20.

Painting department:

Substitute 12,800 for number of machine hours of painting and 16,000 for total machine hours of producing department in the above formula.

Therefore, the assignment ratio for painting department is 0.80.

Working Note:

1.

Calculation of total number of square footage in producing departments:

2.

Calculation of total number of machine hoursof producing departments:

2.

Allocate the support department costs to the producing departments by using the sequential method:

Explanation of Solution

Allocation:

Allocation can be defined as the process of assigning the indirect costs to the cost object with the help of a convenient and reasonable method. It is essential to allocate indirect costs to the cost objects.

| Support departments | Producing departments | |||

| Allocate | S1($) | S2($) | Assembly($) | Painting($) |

| Direct costs | 200,000 | 140,000 | 115,000 | 96,000 |

| S1 | (200,000) | 33,340 | 125,000 | 41,660 |

| S2 | (173,340) | 34,668 | 138,672 | |

| Total | 0 | 0 | 274,668 | 276,332 |

Table (1)

Working Note:

1.

Allocation of support departments cost to S2:

For S1 cost:

2.

Allocation of support departments cost to assembly department:

For S1 cost:

For S2 cost:

3.

Allocation of support departments to painting department:

For S1 cost:

For S2 cost:

Want to see more full solutions like this?

Chapter 4 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- 1. I want to know how to solve these 2 questions and what the answers are 1. Solar industries has a debt-to-equity ratio of 1.25. Its WACC is 7.8%, and its cost of debt is 4.7%. The corporate tax rate is 21%. a. What is the company’s cost of equity capital?b. What is the company’s unlevered cost of equity capital?c. What would be the cost of equity if the D/E ratio were 2? What if it were 1? 2. Therap software company is trying to determine its optimal capital structure. The company’s current capital structure consists of 35% debt and 65% common equity; however, the treasurer believes that the firm should use more debt. Currently, the company’s cost of equity capital is 9%, which is determined by CAPM. What would be Therap’s estimated cost of equity capital if they change their capital structure to 50% debt? Risk-free rate is 3%, market index returns 11%, and the Therap’s tax rate is 25%.arrow_forwardCompute the company's gross profit percentage for this financial accounting questionarrow_forwardWhat is the year 1 cash flow for this project on these financial accounting question?arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,