MyLab Operations Management with Pearson eText -- Access Card -- for Operations Management: Processes and Supply Chains

12th Edition

ISBN: 9780134742366

Author: Lee J. Krajewski, Manoj K. Malhotra, Larry P. Ritzman

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

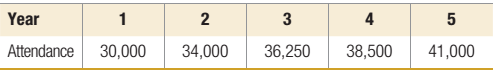

Chapter 4, Problem 12P

The Astro World amusement park has the opportunity to expand its size now (the end of year 0) by purchasing adjacent property for $250,000 and adding attractions at a cost of $550,000. This expansion is expected to increase attendance by 30 percent over projected attendance without expansion. The price of admission is $30, with a $5 increase planned for the beginning of year 3. Additional operating costs are expected to be $100,000 per year. Estimated attendance for the next five years, without expansion, is as follows:

- What are the pretax combined cash flows for years 0 through 5 that are attributable to the park’s expansion?

- Ignoring tax,

depreciation , and the Lime value of money, determine how long it will take to recover (pay back) the investment.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

provide scholarly reseach and references for the following

1. explain operational risks and examples of such risk faced by management at financial institutions

2. discuss the importance of establishing an effective risk management policy at financial institutions to manage operational risk, giving example of a risk management strategy used by financial institutions to mitigate such risk.

3. what is the rold of the core principles of effective bank supervision as it relates to operational risk, in the effective management of financial institutions.

Please show all units, work, and steps needed to solve this problem

I need answer typing clear urjent no chatgpt used pls i will give 5 Upvotes.

IM.82 A distributor of industrial equipment purchases specialized compressors for use in air conditioners. The regular price is $50, however, the manufacturer of this compressor offers quantity discounts per the following discount schedule:

Option Plan Quantity Discount

A 1 - 299 0%

B 300 - 1,199 0.50%

C 1,200+ 1.50%

The distributor pays $56 each time it places an order with the manufacturer. Holding costs are negligible (none) but they do earn 10% annual interest on all cash balances (meaning there will be a financial opportunity cost when they put cash into inventory). Annual demand is expected to be 10,750 units.

When there is no quantity discount (Option Plan A, the first row of the schedule listed above), what is the adjusted order quantity? (Display your answer to the nearest whole number.)

491

Based on your answer to the previous question, and based on the annual demand as stated above, what will be the annual ordering costs? (Display your answer to the…

Chapter 4 Solutions

MyLab Operations Management with Pearson eText -- Access Card -- for Operations Management: Processes and Supply Chains

Ch. 4 - Prob. 1DQCh. 4 - Prob. 2DQCh. 4 - The Dahlia Medical Center has 30 labor rooms, 15...Ch. 4 - A process currently services an average of 50...Ch. 4 - An airline company must plan its fleet capacity...Ch. 4 - Food Goblin Supermarkets use both cashiers and...Ch. 4 - Returning to Problem 4, under both assumption of...Ch. 4 - Purple Swift manufactures birdhouses in lots of...Ch. 4 - Macon Controls produces three different types of...Ch. 4 - Up, Up, and Away is a producer of kites and wind...

Ch. 4 - Tuff-Rider, Inc. manufactures touring bikes and...Ch. 4 - Arabelle is considering expanding the floor area...Ch. 4 - The Astro World amusement park has the opportunity...Ch. 4 - Kim Epson operates a full-service car wash, which...Ch. 4 - MKM International is seeking to purchase a new CNC...Ch. 4 - Prob. 17PCh. 4 - Prob. 18PCh. 4 - Prob. 19PCh. 4 - Dawson Electronics is a manufacturer of high-tech...Ch. 4 - A manager is trying to decide whether to buy one...Ch. 4 - Acme Steel Fabricators experienced booming...Ch. 4 - Referring to Problem 7, the operations manager at...Ch. 4 - Darren Mack owns the Gas n’ Go convenience store...Ch. 4 - Prob. 25PCh. 4 - Prob. 1VCCh. 4 - Prob. 2VCCh. 4 - How does Southwest Airlines know they are...Ch. 4 - Prob. 4VCCh. 4 - Prob. 1CCh. 4 - Prob. 2CCh. 4 - Prob. 3C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Similar questions

- Excel Please. The workload of many areas of banking operations varies considerably based on time of day. A variable capacity can be achieved effectively by employing part-time personnel. Because part-timers are not entitled to all the fringe benefits, they are often more economical than full-time employees. Other considerations, however, may limit the extent to which part-time people can be hired in a given department. The problem is to find an optimal workforce schedule that would meet personnel requirements at any given time and also be economical. Some of the factors affecting personnel assignments are listed here: The bank is open from 9:00am to 7:00pm. Full-time employees work for 8 hours (1 hour for lunch included) per day. They do not necessarily have to start their shift when the bank opens. Part-time employees work for at least 4 hours per day, but less than 8 hours per day and do not get a lunch break. By corporate policy, total part-time personnel hours is limited…arrow_forwardIM.84 An outdoor equipment manufacturer sells a rugged water bottle to complement its product line. They sell this item to a variety of sporting goods stores and other retailers. The manufacturer offers quantity discounts per the following discount schedule: Option Plan Quantity Price A 1 - 2,399 $5.50 B 2,400 - 3,999 $5.20 C 4,000+ $4.50 A large big-box retailer expects to sell 9,700 units this year. This retailer estimates that it incurs an internal administrative cost of $225 each time it places an order with the manufacturer. Holding cost for the retailer is $55 per case per year. (There are 40 units or water bottles per case.) Based on this information, and not taking into account any quantity discount offers, what is the calculated EOQ (in units)? (Display your answer to the nearest whole number.) Number Based on this information, sort each quantity discount plan from left to right by dragging the MOST preferred option plan to the left, and the LEAST preferred…arrow_forwardIn less than 150 words, what is an example of what your reflection of core values means to you and your work: Commitment, Perseverance, Community, Service, Pride?arrow_forward

- Prepare a report on the following: Part 1: Discuss the role of the corporate secretary in facilitating effective governance in a limited liability company. Include the relationships with directors, shareholders, and other officers. Part 2: Compare and contrast two characteristics of different business entities (sole trader, partnership, and limited liability company). Use examples to recommend the most appropriate type of business entity for the scenario below: Scenario Background Alex, Taylor, and Jordan plan to collaborate to launch a tech startup focused on developing and selling innovative software solutions. Each individual brings unique skills and resources to the venture: Alex: A skilled software developer with technical expertise and a vision for the product. Taylor: A marketing professional with extensive connections in the technology industry, aiming to drive sales and build the brand. Jordan: An investor willing to contribute significant financial resources but…arrow_forwardProblem 1 (20 Points) Davison Electronics manufactures three LED television monitors, identified as Model A, Model B, and Model C. Davison Electronics four manufacturing plants. Each model has its lowest possible production cost when produced at Plant 1. However, Plant 1 does not have the capacity to handle the total production of all three models. As a result, at least some of the production must be routed to the other manufacturing plants. The following table shows the minimum production requirements for next month, the plant capacities in units per month, and the production cost per unit at each plant: Model Production Cost per Unit Minimum Production Requirements Plant 1 Plant 2 Plant 3 Plant 4 A $25 $28 $37 $34 48,000 B $26 $35 $36 $41 75,000 C $20 $31 $26 $23 60,000 Production Capacity 65,000 50,000 32,000 43,000 Davison’s objective is to determine the cost-minimizing production plan. Without…arrow_forwardSECTION B: TOPIC STRUCTURE CAPSTONE PROJECT TOPIC SUBMISSION TEMPLATE SECTION A: STUDENT DETAILS Student number Title (Mr/Miss/Ms/Mrs) Surname First name/s Title of research Date and year of registration Work Home Contact details Cell Region Date submitted Email 1.1 Title Insert title of the research. Choose a title that captures the essence of your proposed project. 1.2 Background to the Problem This section will be used to create the readers' interest. It can include a specific description of the topic that is to be investigated. A brief preview of the topic and the foundation of the problem should also be given. The researcher can achieve this through building up a detailed background of circumstances that lead to the problem being examined. Therefore, the background helps the reader understand the specific problem addressed by the researcher. This section should not include the background/history of the organisation. The background to the problem should not be more than ½ a page.…arrow_forward

- Does Nike Corporation's emphasis on lean operations help the Vietnamese workforce that still earns $150.00 minimum wage a month since 2014?arrow_forwardInformation Security Innovation within a Contemporary Business Environment All organisations using computers need to consider the security of information they keep. Many organisations utilise Websites for their core business functions and this results in monetary transactions being carried out on the Websites.arrow_forwardPlease help with a complete research report on the topic below: "Information Security Innovation within a Contemporary Business Environment " The format of the report should follow this below.arrow_forward

- 7. Wireless Infrastructure in the Cloud Wireless devices have changed the way organisations and their customers interact. Wireless enabled devices have driven the mindset that wireless networks must be ubiquitous, fast, and constantly available. These are demands that have traditionally put organisations and their user communities in direct conflict with their IT departments, as constructing and maintaining wireless infrastructures are typically time-consuming, complex, and costly endeavours.arrow_forwardIM.54 A growing online retailer sells thousands of items yet has has one specialty product category with just 30 items. They want to classify these thirty items according to the annual dollar volume (revenue) generated by each item. The table below lists each item number, Annual Sales (in units), and Price per unit: Item # Annual Sales Price 1 221 $25.85 2 446 $14.15 3 8,940 $168.19 4 2,965 $15.99 5 1,322 $29.37 6 2,575 $12.77 7 767 $28.43 8 5,803 $163.01 9 2,673 $20.51 10 642 $14.71 11 4,168 $54.53 12 1,881 $22.55 13 2,417 $29.63 14 5,207 $36.41 15 1,381 $20.55 16 9,635 $173.69 17 17,406 $27.07 18 1,573 $25.99 19 6,471 $64.99 20 6,047 $29.83 21 433 $20.89 22 2,279 $53.59 23 15,532 $106.91 24 1,585 $4.09 25 5,376 $65.23 26 2,965 $37.93 27 2,048 $28.51 28 1,174 $22.99 29 381 $5.57 30 2,930 $3.43 Which item in the table above has the highest annual dollar volume? In the answer field below, write the ITEM # that…arrow_forwardIM.84 An outdoor equipment manufacturer sells a rugged water bottle to complement its product line. They sell this item to a variety of sporting goods stores and other retailers. The manufacturer offers quantity discounts per the following discount schedule: Option Plan Quantity Price A 1 - 2,199 $5.00 B 2,200 - 3,699 $4.55 C 3,700+ $3.90 A large big-box retailer expects to sell 9,200 units this year. This retailer estimates that it incurs an internal administrative cost of $235 each time it places an order with the manufacturer. Holding cost for the retailer is $60 per case per year. (There are 52 units or water bottles per case.)Based on this information, and not taking into account any quantity discount offers, what is the calculated EOQ (in units)? (Display your answer to the nearest whole number.) Based on this information, sort each quantity discount plan from left to right by dragging the MOST preferred option plan to the left, and the LEAST preferred option…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning- MarketingMarketingISBN:9780357033791Author:Pride, William MPublisher:South Western Educational Publishing

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Marketing

Marketing

ISBN:9780357033791

Author:Pride, William M

Publisher:South Western Educational Publishing

Inventory Management | Concepts, Examples and Solved Problems; Author: Dr. Bharatendra Rai;https://www.youtube.com/watch?v=2n9NLZTIlz8;License: Standard YouTube License, CC-BY