Concept explainers

Transaction Analysis

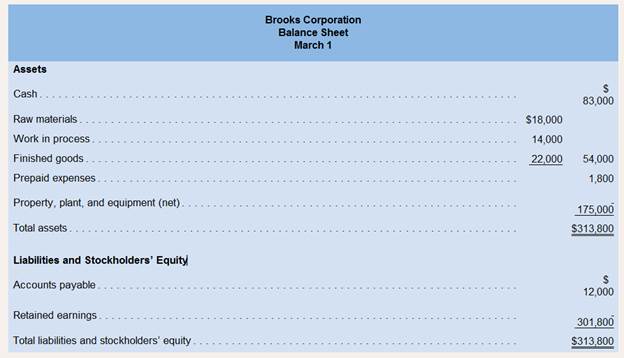

Brooks Corporation uses a

During March thecompany completed the following transactions:

a. Purchased raw materials for cash, $69,000.

b. Raw material used in production $77,000 ($67,000 was directmaterials and $10,000 was indirect materials).

c. Paid $178,000 of salaries and wages in cash ($102, 000 was direct labor, $23,000 was Indirect labor, and $53,000 was related to employees responsible for selling and administration).

d. Various manufacturing

e.

f. Various selling expenses incurred on account, $27,000.

g. Prepaid insurance expired during the month, $450 (60% related to production, and 40% related to selling and administration).

h. Manufacturing overhead applied to production, $101,000.

i. Cost of goods manufactured, $_____ ? . (Hint: The Work Process balance on March 31 is $5,000.)

j. Cash sales to customer $429,000.

k. Cost of goods sold (unadjusted), $______ ? . (Hint: The Finished Goods balance at March 31 is $6,000.)

l. Cash payments to creditors, $35,000.

m. Under applied orover applied overhead $________?.

Required:

1. Calculate the ending balances that would be reported on the company’s balance at March 31. You can derive your answers using Microsoft Excel Exhibit 3A-2 as your guide, or you can use paper, pencil, and a calculator. (Hint: Be sure to calculate the under-applied or over-applied and thenaccount for its effect on the balance sheet,)

2. Prepare Brooks Corporation’s schedule of costof goods manufactured for the month ended March 31. You can derive answers usingMicrosoft Excel and Exhibit 3A -3 as your guide, or you can use paper, pencil, and a calculator.

3. Prepare Brooks Corporation's schedule of cost of goods sold for the month ended March 31. You can derive your answers using Microsoft Excel and Exhibit 3A-4as your guide, or you can use paper, pencil, and a calculator.

4. Prepare Brooks Corporation's income statement for the month ended March 31. You can derive youranswers using Microsoft Excel and Exhibit 3A-5 as your guide, or you can usepaper, pencil, and a calculator.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Introduction To Managerial Accounting

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College