Concept explainers

Cost Flows; T-Accounts; Income Statement L03-z 103-3, LOH

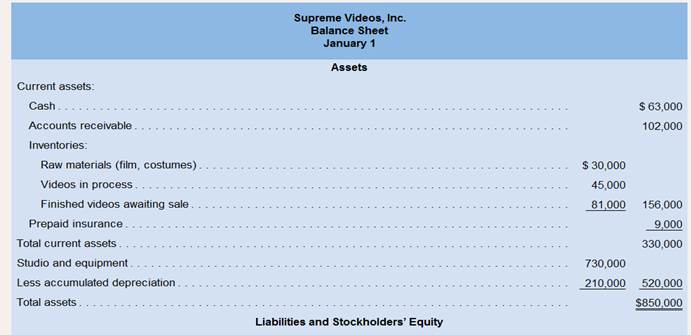

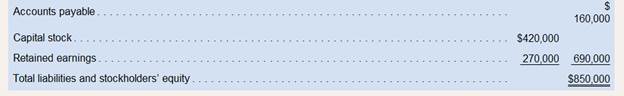

Supreme Videos: Inc., produces short musical videos for sale to retail outlets. The company's balance sheet accounts as of January 1, are given below.

Because the videos differ in length and in complexity of production, the company uses a job-order costing system to determine the cost of each video produced Studio (manufacturing)

a. Film, costumes, and similar raw materials purchased on account. $185,000.

b costumes, and other raw materials used in production, $200,000 (85% of this material was considered direct to the

Videos in production, and the other I was considered indirect).

c. Utility costs incurred in the production studio, $72, 000.

d.

e. Advertising incurred, $130,000

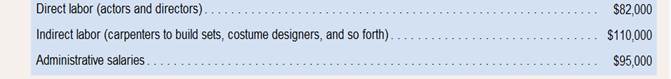

f. Costs for sallies and wages incurred as follows:

g. Prepaid insurance expired during the year, $7,000 (80% related to production of videos, and 20% related tomarketing and administrative activities).

h. Miscellaneous marketing and administrative expenses incurred. $8.600.

i. Studio (manufacturing) overhead was applied to in production. The company used 7,250 camera-hours during the year.

j. videos that cost $550,000 to produce according to their

k. Sales for the year totaled $925,000 and were all on account. The total cost to produce these videos according to their job cost sheets was $600,000.

l. Collections from customers during the year totaled $850,000.

m. Payments to suppliers on account during the year; payments to employees for salaries and wages, $285,000.

Required

1. Prepare a T-account for each account on the company's balance sheet and enter the beginning balances.

2. Record the transactions directly into the T- accounts Prepare new T -accounts as needed. Key your entries to the letters (a) through (n) above. Compute the ending balance in each account.

3. Is the Studio (manufacturing) overhead account underapplied or overapplied for the year? Make an entry in the T-accounts to close any balance in the Studio overhead account to Cost of Goods Sold

4. Prepare a schedule of cost of goods manufactured If done correctly: the cost of goods manufactured from your schedule should agree with which ofthe transactions?

5. Prepare of cost of goods sold If done correctly: the unadjusted cost of gods sold from your schedule with of the transactions?

6 .Prepareanincomestatementfortheyear.

(1) To Prepare:

T-Accounts for Opening Balances of Balance Sheet Accounts.

Introduction:

T-Accounts

- T-Accounts are a graphical representation of the postings made to the accounts during a reporting period.

- The left side records the debit entries and the right side records the credit entries of an account.

- Depending on the nature of the account i.e. Balance Sheet or Profit and Loss Account, Income or Expense account etc. the account balances are reflected.

- In case of Asset and Expenses accounts, the opening balance will be Debit Balance and in case of Liabilities and Incomes accounts, the opening balance is Credit Balance.

- They help in analysis of the transactions impacting the accounts.

Answer to Problem 17P

Solution:

| Dr. | Cash | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| Opening Balance | $ 63,000.00 | ||||

| Balance | $ 63,000.00 | ||||

| Dr. | Accounts Receivable | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| Opening Balance | $ 102,000.00 | ||||

| Balance | $ 102,000.00 | ||||

| Dr. | Raw Materials | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| Opening Balance | $ 30,000.00 | ||||

| Balance | $ 30,000.00 | ||||

| Dr. | Videos In Process | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| Opening Balance | $ 45,000.00 | ||||

| Balance | $ 45,000.00 | ||||

| Dr. | Finished Videos | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| Opening Balance | $ 81,000.00 | ||||

| Balance | $ 81,000.00 | ||||

| Dr. | Prepaid Insurance | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| Opening Balance | $ 9,000.00 | ||||

| Balance | $ 9,000.00 | ||||

| Dr. | Studio and Equipment | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| Opening Balance | $ 730,000.00 | ||||

| Balance | $ 730,000.00 | ||||

| Dr. | Accumulated Depreciation | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| Opening Balance | $ 210,000.00 | ||||

| Balance | $ 210,000.00 | ||||

| Dr. | Accounts Payable | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| Opening Balance | $ 160,000.00 | ||||

| Balance | $ 160,000.00 | ||||

| Dr. | Capital Stock | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| Opening Balance | $ 420,000.00 | ||||

| Balance | $ 420,000.00 | ||||

| Dr. | Retained Earnings | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| Opening Balance | $ 270,000.00 | ||||

| Balance | $ 270,000.00 |

Explanation of Solution

- In case of Asset and Expenses accounts, the opening balance will be Debit Balance and in case of Liabilities and Incomes accounts, the opening balance is Credit Balance.

- In order to increase balances of Asset and Expenses accounts, they are debited and in order to decrease the balances, they are credited

- In order to increase balances of Liabilities and Incomes accounts, they are credited and in order to decrease the balances, they are debited.

- Examples of Assets and Expenses −

Assets - Raw Materials, Work In process, Finished Goods, Accounts Receivable, Cash

Expenses - Manufacturing Overhead, Salary Expenses, Advertising Expenses, Rent Expenses, and Cost of Goods sold

- Examples of Liabilities and Incomes -

Liabilities − Accounts Payable, Salaries Payable

Incomes − Sales

Hence, the opening balances are recorded and T-Accounts have been prepared.

(2) To Prepare:

T-Accounts and compute closing Balances

Introduction:

T-Accounts

- T-Accounts are a graphical representation of the postings made to the accounts during a reporting period.

- The left side records the debit entries and the right side records the credit entries of an account.

- Depending on the nature of the account i.e. Balance Sheet or Profit and Loss Account, Income or Expense account etc. the account balances are reflected.

- In case of Asset and Expenses accounts, the opening balance will be Debit Balance and in case of Liabilities and Incomes accounts, the opening balance is Credit Balance.

- They help in analysis of the transactions impacting the accounts.

Explanation of Solution

| Dr. | Cash | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| Opening Balance | $ 63,000.00 | m | Accounts Payable | $ 500,000.00 | |

| l | Accounts Receivable | $ 850,000.00 | m | Salaries and Wages | $ 285,000.00 |

| Balance | $ 128,000.00 | ||||

| Dr. | Accounts Receivable | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| Opening Balance | $ 102,000.00 | l | Cash | $ 850,000.00 | |

| k | Sales | $ 925,000.00 | |||

| Balance | $ 177,000.00 | ||||

| Dr. | Raw Materials | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| Opening Balance | $ 30,000.00 | b | Videos In Progress | $ 170,000.00 | |

| a | Accounts Payable | $ 185,000.00 | b | Manufacturing Overhead | $ 30,000.00 |

| Balance | $ 15,000.00 | ||||

| Dr. | Videos In Process | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| Opening Balance | $ 45,000.00 | J | Finished Goods | $ 550,000.00 | |

| b | Raw Materials | $ 170,000.00 | |||

| d | Accumulated Depreciation | $ 63,000.00 | |||

| f | Salaries Payable | $ 82,000.00 | |||

| g | Prepaid Insurance | $ 5,600.00 | |||

| i | Manufacturing Overhead | $ 290,000.00 | |||

| Balance | $ 105,600.00 | ||||

| Dr. | Finished Videos | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| Opening Balance | $ 81,000.00 | k | Cost of Goods Sold | $ 600,000.00 | |

| j | Videos in Process | $ 550,000.00 | |||

| Balance | $ 31,000.00 | ||||

| Dr. | Prepaid Insurance | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| Opening Balance | $ 9,000.00 | g | Manufacturing Overhead | $ 1,400.00 | |

| g | Videos In Process | $ 5,600.00 | |||

| Balance | $ 2,000.00 | ||||

| Dr. | Studio and Equipment | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| Opening Balance | $ 730,000.00 | ||||

| Balance | $ 730,000.00 | ||||

| Dr. | Accumulated Depreciation | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| Opening Balance | $ 210,000.00 | ||||

| d | Videos in Process | $ 63,000.00 | |||

| Manufacturing Overhead | $ 21,000.00 | ||||

| Balance | $ 294,000.00 | ||||

| Dr. | Accounts Payable | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| m | Cash | 500000 | Opening Balance | $ 160,000.00 | |

| a | Raw Materials | $ 185,000.00 | |||

| c | Manufacturing Overhead | $ 72,000.00 | |||

| e | Advertising Expenses | $ 130,000.00 | |||

| h | Manufacturing Overhead | $ 8,600.00 | |||

| Balance | $ 55,600.00 | ||||

| Dr. | Capital Stock | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| Opening Balance | $ 420,000.00 | ||||

| Balance | $ 420,000.00 | ||||

| Dr. | Retained Earnings | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| Opening Balance | $ 270,000.00 | ||||

| Balance | $ 270,000.00 | ||||

| Dr. | Manufacturing Overhead | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| b | Raw Materials | $ 30,000.00 | i | Videos in Process | $ 290,000.00 |

| d | Accumulated Depreciation | $ 21,000.00 | |||

| f | Salaries Payable | $ 110,000.00 | |||

| c | Accounts Payable | $ 72,000.00 | |||

| g | Prepaid Insurance | $ 1,400.00 | |||

| h | Accounts Payable | $ 8,600.00 | |||

| Balance | $ 47,000.00 | ||||

| Dr. | Utility Expenses | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| c | Manufacturing Overhead | $ 72,000.00 | |||

| Balance | $ 72,000.00 | ||||

| Dr. | Advertising Expenses | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| d | Accounts Payable | $ 130,000.00 | |||

| Balance | $ 130,000.00 | ||||

| Dr. | Administrative Salaries | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| f | Salaries Payable | $ 95,000.00 | |||

| Balance | $ 95,000.00 | ||||

| Dr. | Salaries Payable | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| m | Cash | $ 285,000.00 | f | Videos in Process | $ 82,000.00 |

| f | Manufacturing Overhead | $ 110,000.00 | |||

| f | Administrative Salaries | $ 95,000.00 | |||

| Balance | $ 2,000.00 | ||||

| Dr. | Sales | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| k | Accounts Receivable | $ 925,000.00 | |||

| Balance | $ 925,000.00 | ||||

| Dr. | Cost of Goods Sold | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| k | Finished Videos | $ 600,000.00 | |||

| Balance | $ 600,000.00 | ||||

- In case of Asset and Expenses accounts, the opening balance will be Debit Balance and in case of Liabilities and Incomes accounts, the opening balance is Credit Balance.

- Examples of Assets and Expenses −

Assets - Raw Materials, Work In process, Finished Goods, Cash

Expenses - Manufacturing Overhead, Salary Expenses, Advertising Expenses, Rent Expenses, and Cost of Goods sold.

- Examples of Liabilities and Incomes -

Liabilities − Salaries Payable

Incomes - Sales

- In order to increase balances of Asset and Expenses accounts, they are debited and in order to decrease the balances, they are credited

- In order to increase balances of Liability and Income accounts, they are credited and in order to decrease the balances, they are debited.

Hence, the transactions have been posted to T-Accounts.

(3) To Compute:

Close balance of Manufacturing Overhead by passing suitable journal entries.

Introduction:

Application of Overhead

- Overhead refers to the various types of costs associated with the costs of production.

- These can include direct over heads such as factory rent, factory electricity expenses etc or indirect overheads such as depreciation, insurance expenses etc.

- The application of overhead means allocation of costs of production that are attributable to the goods manufactured in a fixed proportion or method of allocation.

- The difference between the actual manufacturing overhead and the applied manufacturing overhead is the under application or over application of overhead.

Journal Entries

- Journal entries are the first step in recording financial transactions and preparation of financial statements.

- These represent the impact of the financial transaction and demonstrate the effect on the accounts impacted in the form of debits and credits.

- Assets and expenses have debit balances and Liabilities and Incomes have credit balances

T-Accounts

- T-Accounts are a graphical representation of the postings made to the accounts during a reporting period.

- The left side records the debit entries and the right side records the credit entries of an account.

- Depending on the nature of the account i.e. Balance Sheet or Profit and Loss Account, Income or Expense account etc. the account balances are reflected.

Explanation of Solution

| Date | Particulars | Debit ($) | Credit ($) |

| 12.31.18 | Manufacturing Overhead | 47,000 | |

| Cost of Goods Sold | 47,000 | ||

| (Being Over applied overhead closed to Cost of Goods Sold) |

- The application of overhead to work in progress in a pre-determined rate often results in under or over absorption of the overhead.

- The difference between the applied overhead and the actual overhead is the under or over application of the overhead.

- When the actual overhead is greater than the applied overhead, it results in under application of the manufacturing overhead.

- When the actual overhead is less than the applied overhead, it results in over application of the manufacturing overhead.

- Over applied overhead is a favorable variance since it results in a lower than expected cost of goods sold.

- The overhead is applied at a pre-determined rate of $4 ($280,000 / 7000 * 7250 hours) per direct labor hour for 7,250 Labor Hours, resulting in over application of overhead since the actual manufacturing overhead is only $243,000 whereas the applied overhead is $290,000.

- The over applied Manufacturing Overhead is transferred to the cost of goods sold and it is calculated accordingly.

- The T- Account is presented herewith for understanding

| Dr. | Manufacturing Overhead | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| b | Raw Materials | $ 30,000.00 | i | Videos in Process | $ 290,000.00 |

| d | Accumulated Depreciation | $ 21,000.00 | |||

| f | Salaries Payable | $ 110,000.00 | |||

| c | Accounts Payable | $ 72,000.00 | |||

| g | Prepaid Insurance | $ 1,400.00 | |||

| h | Accounts Payable | $ 8,600.00 | |||

| Cost of Goods Sold | $ 47,000.00 | ||||

Hence, the transaction of transferring the manufacturing overhead balance to cost of goods sold is journalized.

(4) To Prepare:

Schedule of Cost of Goods Manufactured.

Introduction:

Schedule of Cost of Goods Manufactured:

- The Schedule of Cost of Goods Manufactured is used to compute the cost of producing goods for a particular period.

- It comprises of Cost of Materials, Labor and Overhead attributable to goods manufactured.

- Cost of goods manufactured is the total cost of producing goods that are later sold to realize revenues. It includes direct and indirect materials, labor and overhead.

Explanation of Solution

| Direct Materials Used: | ||

| Beginning Materials Inventory | 30,000 | |

| Add: Cost of Raw Materials Purchased | 185,000 | |

| Total Raw Materials Available | 215,000 | |

| Less: Closing Materials Inventory | (15,000) | |

| Total Raw Materials Used | 200,000 | |

| Direct Labor | 82,000 | |

| Manufacturing Overhead | ||

| Material | 30,000 | |

| Depreciation | 21,000 | |

| Prepaid Insurance | 1,400 | |

| Salaries | 110,000 | |

| Maintainance Expenses | 8,600 | |

| Utilities | 72,000 | |

| Total Manufacturing Overhead | 243,000 | |

| Total Manufacturing Costs | 525,000 | |

| Add: Beginning Work In Progress Inventory | 45,000 | |

| Less: Closing Work In Progress Inventory | 105,600 | |

| Cost Of Goods Manufactured | 464,400 |

- The cost of goods manufactured is a sum of the direct material, labor and manufacturing overhead attributable to the product.

- The direct material is calculated by adding the beginning raw materials inventory to the cost of raw materials purchased and reducing the balance of ending raw materials inventory.

- The opening and closing balances of Raw materials along with the cost of purchases are given. These are used to calculate the cost of material consumed.

- Direct labor and Manufacturing Overhead are also calculated. These along with cost of materials help in ascertaining the total manufacturing costs.

- Manufacturing overhead is considered at actuals and not at the rate of application of overhead.

- The opening and closing balance of Work in progress are given.

- The cost of manufacturing goods is calculated by adding the beginning Work in progress inventory to the cost of material, labor and overhead and reducing the balance of ending Work in progress inventory.

Hence, the cost of goods manufactured is $464,400.

(5) To Compute:

Cost of Goods Sold.

Introduction:

Cost of Goods Sold

- The Schedule of Cost of Goods sold is used to compute the cost of goods sold in a particular period.

- Cost of goods sold comprises of the cost of

- Goods manufactured along with the effect of the change in inventory of the finished goods.

- The cost of goods manufactured is a sum of the direct material, labor and manufacturing overhead attributable to the product.

Explanation of Solution

| Schedule of Cost Of Goods Sold | |

| Beginning Finished Goods Inventory | 81,000 |

| Cost of Goods Manufactured | 464,400 |

| Total Goods Available for Sale | 545,400 |

| Ending Finished Goods Inventory | 31,000 |

| Overapplied Overhead | 47,000 |

| Cost of Goods Sold | 561,400 |

- The application of overhead to work in progress in a pre-determined rate often results in under or over absorption of the overhead.

- The difference between the applied overhead and the actual overhead is the under or over application of the overhead.

- When the actual overhead is greater than the applied overhead, it results in under application of the manufacturing overhead.

- When the actual overhead is less than the applied overhead, it results in over application of the manufacturing overhead.

- Over applied overhead is a favorable variance since it results in a lower than expected cost of goods sold.

- The cost of Goods sold is calculated by adding the beginning finished goods inventory to the cost of goods manufactured and reducing the balance of ending finished goods inventory.

- The cost of goods manufactured is a sum of the direct material, labor and manufacturing overhead attributable to the product.

- The opening and closing balances of finished goods inventory are given in the question. These are used to ascertain the actual cost of goods sold.

- The over applied Manufacturing Overhead is transferred to the cost of goods sold and it is calculated accordingly

Hence, the transaction of transferring the manufacturing overhead balance to cost of goods sold is journalized and the cost of goods sold is $ 561,400.

(6) To Prepare:

Income Statement for the year

Introduction:

Income Statement:

- Income Statement is a record of the revenues goods sold, expenses of direct and indirect nature, and the change in inventory.

- The difference between the revenues and expenses is the profit or loss for the reporting period.

- The profit or loss for the period is transferred to the Balance Sheet.

Explanation of Solution

Solution:

| Income Statement | ||

| Sales | 925,000 | |

| Cost of Goods Sold | ||

| Beginning Finished Goods Inventory | 81,000 | |

| Cost of Goods Manufactured | 464,400 | |

| Total Goods Available for Sale | 545,400 | |

| Ending Finished Goods Inventory | 31,000 | |

| Over applied Overhead | 47,000 | |

| Cost of Goods Sold | 561,400 | |

| Gross Profit | 363,600 | |

| Operating Expenses | ||

| Selling and Administrative Expenses | ||

| Material | 30,000 | |

| Depreciation | 21,000 | |

| Salaries | 110,000 | |

| Utilities | 72,000 | |

| Prepaid Insurance | 1,400 | |

| Misc Expenses | 8,600 | |

| Total Operating Expenses | 243,000 | |

| Income From Operations | 120,600 |

- The Income statement is a record of the various expenses such as cost of goods manufactured, and revenues such as sales revenue.

- Income from operations is calculated as $120,600. This is the difference between the Gross Profit and the Operating Expenses.

- Selling and Administrative Expenses of $ 243,000 are calculated based on the various transactions occurring during the reporting period. These constitute the Total Operating Expenses.

- The difference of Net Income from Sales and Total Cost of Goods Sold is the Gross Profit.

- The ending finished goods inventory is calculated as a difference of the Cost of Goods sold and the Cost of Goods available for Sale.

- The cost of Goods sold is calculated by adding the beginning finished goods inventory.

Hence, Income Statement has been prepared and the net income from operations is $120,600.

Want to see more full solutions like this?

Chapter 3 Solutions

Introduction To Managerial Accounting

- I need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forwardCan you solve this financial accounting problem using appropriate financial principles?arrow_forward

- Please explain the solution to this financial accounting problem with accurate principles.arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forwardCould you help me solve this financial accounting question using appropriate calculation techniques?arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning  Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning