Concept explainers

Comprehensive problem L03-1, L03-2, L03-4

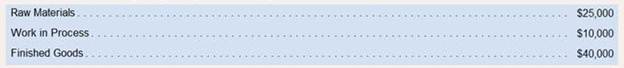

Gold Nest Company of Guangdong: China, is a family-owned enterprise that makes birdcages for the South China market. The company sells its birdcages through an extensive network of street vendors who receive commissions on their sales.

The company uses a job-order costing system in which

a. During the year, the following transactions were completed:

Raw materials purchased for cash. $275,000.

Raw materials used in production, $280,000 (materials costing $20,000 were charged directly to jobs. the remaining materials were indirect).

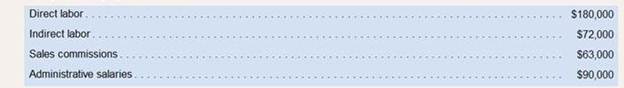

c. Cash paid to employees as follows:

d. Cash paid for rent the year was $18,000 ($13,000 of bills amount rented to factory operations, and the remainderrelated to selling and administrative activities).

e. Cash paid for utility costs in the factory, $57,000.

f. Cash paid for a advertising, $14,000.

g.

h. Manufacturing overhead cost was applied to jobs $?

i. Goods that had cost $675,000 to manufacture according to their

J The total

Required:

1. Prepare

2. Prepare T-accounts for each inventory account, Manufacturing overhead, and Cost of Goods Sold Post related data from vu journal entries to these T-accounts (don’t forget to enter the beginning balances in you inventory accounts). Compute an ending balance in each account.

3 Is manufacturing overhead under applied or over applied for the year? Prepare a journal theManufacturing overhead account to Cost of Goods Sold.

4 Prepare income come statement for the year. (Donotprepareascheduleofcostofgoods manufactured, all of the informationneededfor the income statement is available in the journal entries and T you have prepared).

1)

Concept Introduction:

Fixed and Variable Costs in Manufacturing:

- Variable costs refer to the costs of manufacture that have a direct co-relation with the volume of the goods manufactured, i.e. the costs increase with an increase in the goods produced.

- Examples are costs of direct material and direct labor.

- Fixed costs refer to the costs of manufacture that have an inverse co-relation with the volume of the goods manufactured, i.e. the costs decrease with an increase in the goods produced.

- Examples are costs of factory rent, depreciation on plant and equipment

- Manufacturing costs are costs that are directly incurred in connection with manufacture of goods.

- Examples are Direct materials and Manufacturing Overhead

Journal Entries

- Journal entries are the first step in recording financial transactions and preparation of financial statements.

- These represent the impact of the financial transaction and demonstrate the effect on the accounts impacted in the form of debits and credits.

- Assets and expenses have debit balances and Liabilities and Incomes have credit balances

To Prepare:

Journal Entries to record transactions.

Explanation of Solution

| Transaction | Particulars | Debit ($) | Credit ($) |

| a | Raw Materials | $ 275,000 | |

| Cash | $ 275,000 | ||

| (Being raw materials purchased incurred) | |||

| b | Work in Process | $ 220,000 | |

| Manufacturing Overhead | $ 60,000 | ||

| Raw Materials | $ 280,000 | ||

| (Being raw materials used in production) | |||

| c | Work in Process | $ 180,000 | |

| Manufacturing Overhead | $ 72,000 | ||

| Sales Commissions | $ 63,000 | ||

| Administrative Salaries | $ 90,000 | ||

| Cash | $ 405,000 | ||

| (Being accrued Salaries and wages paid) | |||

| d | Manufacturing Overhead | $ 13,000 | |

| Rent Expense | $ 5,000 | ||

| Cash | $ 18,000 | ||

| (Being Rent expenses relating to factory facilities and selling and administrative facilities , distributed 85% to Factory facilities and rest to selling and administrative faciltities) | |||

| e | Manufacturing Overhead | $ 57,000 | |

| Cash | $ 57,000 | ||

| (Being Utility expenses incurred incurred) | |||

| f | Advertising Expenses | $ 140,000 | |

| Cash | $ 140,000 | ||

| (Being Advertising expenses incurred incurred) | |||

| g | Manufacturing Overhead | $ 88,000 | |

| Depreciation Expense | $ 12,000 | ||

| Accumulated Depreciation | $ 100,000 | ||

| (Being depreciation relating to factory equipment and selling and administrative equipment, distributed 80% to Factory equipment and rest to selling and administrative equipment) | |||

| h | Work in Process | $ 297,000 | |

| Manufacturing Overhead | $ 297,000 | ||

| (Being overhead applied at a pre-determined rate of $1.65 per direct labor hour for $180,000 Labor Hours, resulting in over application of overhead) | |||

| i | Finished Goods Inventory | $ 675,000 | |

| Work in Process | $ 675,000 | ||

| (Being Cost of goods manufactured calculated by transferring the Balance of Direct material, Overhead [Through Work in Process] and Direct Labor) | |||

| j | Cash | $ 1,250,000 | |

| Sales | $ 1,250,000 | ||

| (Being Sales recorded) | |||

| Cost of Goods Sold | $ 700,000 | ||

| Finished Goods | $ 700,000 | ||

| (Being Cost of Goods sold recorded) |

- In case of Asset and Expenses accounts, the opening balance will be Debit Balance and in case of Liabilities and Incomes accounts, the opening balance is Credit Balance.

- Examples of Assets and Expenses − Assets - Raw Materials, Work In process, Finished Goods, Cash

Expenses - Manufacturing Overhead, Salary Expenses, Advertising Expenses, Rent Expenses, and Cost of Goods sold

- Examples of Liabilities and Incomes - Liabilities − Salaries Payable

Incomes - Sales

- In order to increase balances of Asset and Expenses accounts, they are debited and in order to decrease the balances, they are credited

- In order to increase balances of Liability and Income accounts, they are credited and in order to decrease the balances, they are debited.

Explanations for the journal entries are as follows:

- Raw Materials

will be debited by $ 275,000 and Cash will be credited since raw materials purchased for cash.

- Work in Process will be debited by $ 220,000, Manufacturing Overhead will be debited by $60,000 to record indirect material used, and Raw Materials will be credited by $280,000 since raw materials used in production

- Work In Process will be debited by $ 180,000, Manufacturing Overhead will be debited by $ 72,000, Sales Commissions will be debited by $63,000, Administrative Salaries will be debited by $ 90,000 and Cash will be credited by $405,000 since accrued Salaries and wages are paid

- Manufacturing Overhead will be debited by $ 13,000, Rent Expense will be debited by $5,00 and Cash will be credited by $18,000 since rent expenses are incurred.

- Manufacturing Overhead will be debited by $ 57,000 and Cash will be credited since Utility expenses relating to factory incurred.

- Advertising Expenses will be debited by $ 140,000 and Cash will be credited since Advertising expenses incurred

- Manufacturing Overhead will be debited by $ 88,000, Depreciation Expense will be debited by $ 12,000 and Accumulated Depreciation will be credited by $100,000 since depreciation relating to factory equipment and selling and administrative equipment is distributed to Factory equipment and rest to depreciation expense

- Work in Process will be debited by $ 297,000 and Manufacturing Overhead will be credited since overhead applied at a pre-determined rate of $1.65 ($330,000 / $200,000 hours) per direct labor hour for $180,000 Labor Hours, resulting in over application of overhead

- Finished Goods Inventory will be debited by $ 675,000, Work in Process will be credited by since Cost of goods manufactured calculated by transferring Work in Process.

- Cash will be debited by $ 1,250,000 and Sales will be credited since Sales incurred are recorded.

- Cost of Goods Sold will be debited by $ 700,000 and Finished Goods will be credited since Cost of Goods sold are recorded

Hence, the transactions are journalized and entries are recorded.

2)

Concept Introduction:

T-Accounts

- T-Accounts are a graphical representation of the postings made to the accounts during a reporting period.

- The left side records the debit entries and the right side records the credit entries of an account.

- Depending on the nature of the account i.e. Balance Sheet or Profit and Loss Account, Income or Expense account etc. the account balances are reflected.

- In case of Asset and Expenses accounts, the opening balance will be Debit Balance and in case of Liabilities and Incomes accounts, the opening balance is Credit Balance.

- They help in analysis of the transactions impacting the accounts.

To Prepare:

T-Accounts for Inventory and Manufacturing Overhead and compute closing Balances

Explanation of Solution

| Dr. | Raw Materials | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| Opening Balance | $ 25,000.00 | b | Work in Process | $ 220,000.00 | |

| A | Cash | $ 275,000.00 | Manufacturing Overhead | $ 60,000.00 | |

| Balance | $ 20,000.00 | ||||

| Dr. | Work In Process | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| Opening Balance | $ 10,000.00 | i | Finished Goods | $ 675,000.00 | |

| H | Manufacturing Overhead | $ 297,000.00 | |||

| B | Raw Materials | $ 220,000.00 | |||

| C | Salaries and Wages Payable | $ 180,000.00 | |||

| Balance | $ 32,000.00 | ||||

| Dr. | Finished Goods | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| Opening Balance | $ 40,000.00 | j | Cost of Goods Sold | $ 700,000.00 | |

| I | Work in Process | $ 675,000.00 | |||

| Balance | $ 15,000.00 | ||||

| Dr. | Manufacturing Overhead | Cr. | |||

| Transaction | Particulars | Amount ($) | Transaction | Particulars | Amount ($) |

| C | Raw Materials | $ 60,000.00 | i | Work in process | $ 297,000.00 |

| D | Salaries and Wages Payable | $ 72,000.00 | |||

| G | Accumulated Depreciation | $ 88,000.00 | |||

| H | Cash | $ 13,000.00 | |||

| E | Cash | $ 57,000.00 | |||

| Balance | $ 7,000.00 | ||||

- Raw Materials

will be debited by $ 275,000 and Cash will be credited since raw materials purchased for cash.

- Work in Process will be debited by $ 220,000, Manufacturing Overhead will be debited by $60,000 to record indirect material used, and Raw Materials will be credited by $280,000 since raw materials used in production

- Work In Process will be debited by $ 180,000, Manufacturing Overhead will be debited by $ 72,000, Sales Commissions will be debited by $63,000, Administrative Salaries will be debited by $ 90,000 and Cash will be credited by $405,000 since accrued Salaries and wages are paid

- Manufacturing Overhead will be debited by $ 13,000, Rent Expense will be debited by $5,00 and Cash will be credited by $18,000 since rent expenses are incurred.

- Manufacturing Overhead will be debited by $ 57,000 and Cash will be credited since Utility expenses relating to factory incurred.

- Advertising Expenses will be debited by $ 140,000 and Cash will be credited since Advertising expenses incurred

- Manufacturing Overhead will be debited by $ 88,000, Depreciation Expense will be debited by $ 12,000 and Accumulated Depreciation will be credited by $100,000 since depreciation relating to factory equipment and selling and administrative equipment is distributed to Factory equipment and rest to depreciation expense

- Work in Process will be debited by $ 297,000 and Manufacturing Overhead will be credited since overhead applied at a pre-determined rate of $1.65 ($330,000 / $200,000 hours) per direct labor hour for $180,000 Labor Hours, resulting in over application of overhead

- Finished Goods Inventory will be debited by $ 675,000, Work in Process will be credited by since Cost of goods manufactured calculated by transferring Work in Process.

- Cash will be debited by $ 1,250,000 and Sales will be credited since Sales incurred are recorded.

- Cost of Goods Sold will be debited by $ 700,000 and Finished Goods will be credited since Cost of Goods sold are recorded

Hence,the closing balances are computed and T-Accounts have been prepared.

3)

Concept Introduction:

Application of Overhead

- Overhead refers to the various types of costs associated with the costs of production.

- These can include direct over heads such as factory rent, factory electricity expenses etc or indirect overheads such as depreciation, insurance expenses etc.

- The application of overhead means allocation of costs of production that are attributable to the goods manufactured in a fixed proportion or method of allocation.

- The difference between the actual manufacturing overhead and the applied manufacturing overhead is the under application or over application of overhead.

Journal Entries

- Journal entries are the first step in recording financial transactions and preparation of financial statements.

- These represent the impact of the financial transaction and demonstrate the effect on the accounts impacted in the form of debits and credits.

- Assets and expenses have debit balances and Liabilities and Incomes have credit balances

Cost of Goods Sold

- The Schedule of Cost of Goods sold is used to compute the cost of goods sold in a particular period.

- Cost of goods sold comprises of the cost of

Goods manufactured along with the effect of the change in inventory of the finished goods.

- The cost of goods manufactured is a sum of the direct material, labor and manufacturing overhead attributable to the product.

To Compute:

Cost of Goods Sold and close balance of Manufacturing Overhead by passing suitable journal entries

Explanation of Solution

| Date | Particulars | Debit ($) | Credit ($) |

| 12.31.18 | Manufacturing Overhead | 7,000 | |

| Cost of Goods Sold | 7,000 | ||

| (Being Over applied overhead closed to Cost of Goods Sold) |

- The application of overhead to work in progress in a pre-determined rate often results in under or over absorption of the overhead.

- The difference between the applied overhead and the actual overhead is the under or over application of the overhead.

- When the actual overhead is greater than the applied overhead, it results in under application of the manufacturing overhead.

- When the actual overhead is less than the applied overhead, it results in over application of the manufacturing overhead.

- Over applied overhead is a favorable variance since it results in a lower than expected cost of goods sold.

- The overhead is applied at a pre-determined rate of $1.65 ($330,000 / $200,000 hours) per direct labor hour for $180,000 Labor Hours, resulting in over application of overhead since the actual manufacturing overhead is only $290,000 whereas the applied overhead is $297,000.

- The over applied Manufacturing Overhead is transferred to the cost of goods sold and it is calculated accordingly

Hence, the transaction of transferring the manufacturing overhead balance to cost of goods sold is journalized.

4)

Concept Introduction:

Income Statement:

- Income Statement is a record of the revenues goods sold, expenses of direct and indirect nature, and the change in inventory.

- The difference between the revenues and expenses is the profit or loss for the reporting period.

- The profit or loss for the period is transferred to the Balance Sheet.

To Prepare:

Income Statement for the year

Explanation of Solution

| Income Statement | ||

| Sales | 1,250,000 | |

| Cost of Goods Sold | ||

| Beginning Finished Goods Inventory | 40,000 | |

| Cost of Goods Manufactured | 675,000 | |

| Total Goods Available for Sale | 715,000 | |

| Ending Finished Goods Inventory | 15,000 | |

| Cost of Goods Sold | 700,000 | |

| Gross Profit | 550,000 | |

| Operating Expenses | ||

| Selling and Administrative Expenses | ||

| Sales Commissions | 63,000 | |

| Administrative Salaries | 90,000 | |

| Depreciation | 12,000 | |

| Rental Cost | 5,000 | |

| Advertising Expenses | 140,000 | |

| Total Operating Expenses | 310,000 | |

| Income From Operations | 240,000 |

- The Income statement is a record of the various expenses such as cost of goods manufactured, and revenues such as sales revenue.

- Income from operations is calculated as $240,000. This is the difference between the Gross Profit and the Operating Expenses.

- Selling and Administrative Expenses of $ 310,000 are calculated based on the various transactions occurring during the reporting period. These constitute the Total Operating Expenses.

- The difference of Net Income from Sales and Total Cost of Goods Sold is the Gross Profit.

- The Cost of Goods Sold is given as $700,000.

- The ending finished goods inventory is calculated as a difference of the Cost of Goods sold and the Cost of Goods available for Sale.

- The beginning finished goods inventory is given as $40,000. Sales of $ 1,250,000 are given.

- The cost of Goods sold is calculated by adding the beginning finished goods inventory

Hence, Income Statement has been prepared and the net income from operations is $240,000.

Want to see more full solutions like this?

Chapter 3 Solutions

Introduction To Managerial Accounting

- During its first year, Yutsang Enterprises showed a $22 per-unit profit under absorption costing but would have reported a total profit of $20,000 less under variable costing. Suppose production exceeded sales by 600 units and an average contribution margin of 58% was maintained. a. What is the fixed cost per unit? b. What is the sales price per unit? c. What is the variable cost per unit? d. What is the unit sales volume if total profit under absorption costing was $240,000?arrow_forwardIf you give me correct answer this financial accounting question I will give you helpful ratearrow_forwardhelp this answer with accountingarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning