Concept explainers

A Transaction Analysis L03-5

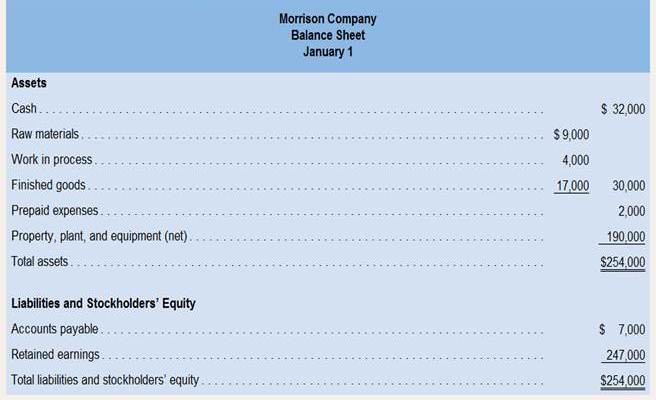

Morrison Company uses a

During January the completed the transactions:

a. Purchased raw materials on account, $74.000.

b. Raw materials used in production. $74,000 ($67,000 was direct materials and $7000 was indirect materials).

c. Paid $67,000 of salaries and wages in cash ($95,000 was direct labor, $35,000 was indirect labor, and $37,000 was related to responsible for selling and administration)

d. Various manufacturing

e.

f. Various selling expenses paid in cash, $27,000.

g. Prepaid insurance expired dating the month, $1,200 (80% related to production, and related to selling and administration) h. Manufacturing overhead applied to productive $132,000.

I. Cost of goods manufactured $288,000.

j. Cash Saks to Customers. $395,000.

k. Cost Of goods sold (unadjusted), $285,000.

l. Cash payments to $62,000.

m. under applied or over applied overhead $?

Required:

l. Calculate the ending balances that would be reported on the company’s balance sheet on January 31.You can derive your answersusing Microsoft Excel and Exhibit 3A-2 as guide, or you can use paper: pencil and a calculator (Hint: Be sure to calculate the under applied or over applied overhead and then account for its effect on the balance sheet)

2. What is Morrison Company’s net operating income for the month of January?

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Introduction To Managerial Accounting

- I am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forwardCan you help me solve this general accounting question using valid accounting techniques?arrow_forward

- I need guidance with this general accounting problem using the right accounting principles.arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardCan you explain the correct approach to solve this general accounting question?arrow_forward

- Joe and Ethan each own 50% of JH Corporation, a calendar year taxpayer. Distributions from JH are: $750,000 to Joe on April 1 and $250,000 to Ethan on May 1. JH’s current E & P is $300,000 and its accumulated E & P is $600,000. How much of the accumulated E & P is allocated to Ethan’s distribution? a. $0b. $75,000c. $150,000d. $300,000e. None of the above b or c?arrow_forwardPlease provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning