Concept explainers

Applying

L03-4

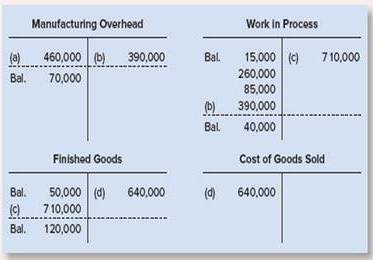

The following information is from the accounts of Latta Company. The entries in the T-accounts are summaries of the transactions that affected those accounts during the year.

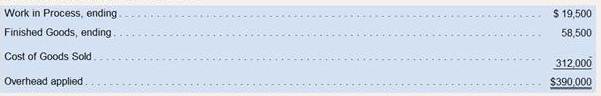

The Overhead that had been applied to production during the year is distributed among work in Process, Finishing Goods and the cost of Goods Sold as of the end of the year follows:

1. Identify reasons for entries (a) through (d).

2. Assume that the under applied or over appliedoverhead is closed to Cost of Goals Sold Prepare the necessary

3. Assume that the under applied or over appliedoverhead is closed proportionally to work in process. Finishing goods, and cost of goods soldPrepare the necessary journal entry. Provide supporting computation.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Introduction To Managerial Accounting

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,