Concept explainers

FiberCom, Inc., a manufacturer of fiber optic communications equipment, uses a

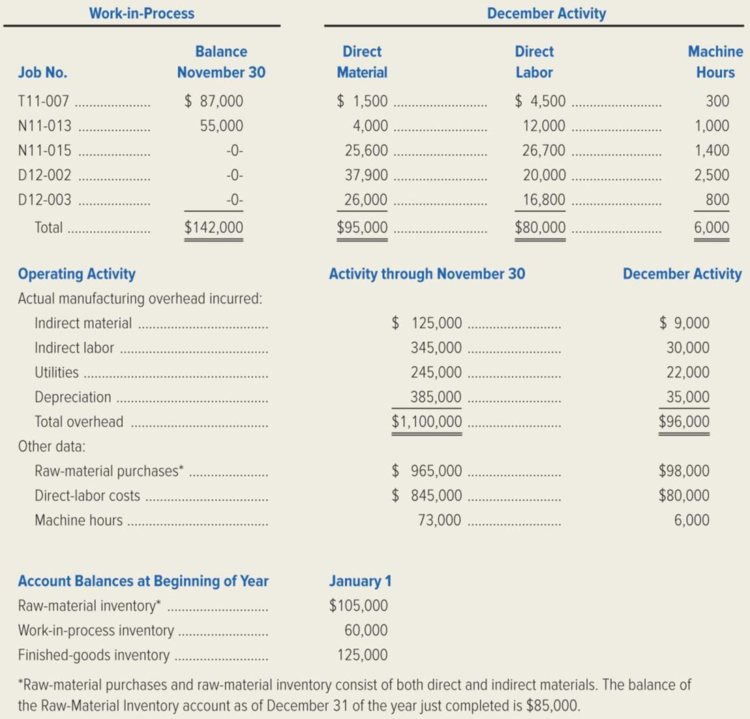

Required:

- 1. Explain why manufacturers use a predetermined overhead rate to apply manufacturing overhead to their jobs.

- 2. How much manufacturing overhead would FiberCom have applied to jobs through November 30 of the year just completed?

- 3. How much manufacturing overhead would have been applied to jobs during December of the year just completed?

- 4. Determine the amount by which manufacturing overhead is over applied or under applied as of December 31 of the year just completed.

- 5. Determine the balance in the Finished-Goods Inventory account on December 31 of the year just completed.

- 6. Prepare a Schedule of Cost of Goods Manufactured for FiberCom, Inc. for the year just completed. (Hint: In computing the cost of direct material used, remember that FiberCom includes both direct and indirect material in its Raw-Material Inventory account.)

1.

Explain the reason for using the predetermined overhead rate by the manufacturers to apply manufacturing overhead to their jobs.

Explanation of Solution

Predetermined Overhead Rate: Predetermined overhead rate is a measure used to allocate the estimated manufacturing overhead cost to the products or job orders during a particular period. This is generally evaluated at the beginning of each reporting period. The evaluation takes into account the estimated manufacturing overhead cost and the estimated allocation base that includes direct labor hours, direct labor in dollars, machine hours and direct materials.

The predetermined overhead rates are used by the manufacturers to allocate it to the production jobs the costs incurred for the production are not directly traceable to the particular job. This could result the management to have the timely and accurate job-cost information. The predetermined overhead rates are easy to apply and avoid fluctuations.

2.

Calculate the manufacturing overhead would Incorporation FC have applied to jobs through November 30 for the year just completed.

Explanation of Solution

Calculate the manufacturing overhead would Incorporation FC have applied to jobs through November 30 for the year just completed.

Thus the manufacturing overhead applied is $1,095,000.

3.

Calculate the manufacturing overhead would Incorporation FC have applied to jobs during December for the year just completed.

Explanation of Solution

Calculate the manufacturing overhead would Incorporation FC have applied to jobs during December for the year just completed.

Thus the manufacturing overhead applied is $90,000.

4.

Calculate the amount by which the manufacturing overhead is overapplied or underapplied as of December 31 for the job completed.

Explanation of Solution

Underapplied overhead:

When there is a debit balance in the manufacturing overhead account during the month end, it indicates that overheads applied to jobs are less than the actual overhead cost incurred by the business. Therefore, the debit balance in the manufacturing overhead account is referred to as underapplied overhead.

Overapplied overhead:

When there is a credit balance in the manufacturing overhead account during the month end, indicates that overheads applied to jobs is more than the actual overhead cost incurred by the business. Therefore, the credit balance in the manufacturing overhead account is referred to as over- applied overhead.

Calculate the amount by which the manufacturing overhead is overapplied or underapplied as of December 31 for the job completed.

| Particulars | Calculation | Amount ($) |

| Actual overhead | $1,196,000 | |

| Applied overhead | ($1,185,000) | |

| Underapplied overhead | $11,000 |

Table (1)

Thus, the underapplied overhead is $11,000.

5.

Calculate the balance in the finished-goods inventory account on December 31 of the year just completed.

Explanation of Solution

Calculate the balance in the finished-goods inventory account on December 31 of the year just completed.

| Particulars | Amount ($) |

| November 30 balance for Job No. N11-013 | $ 55,000 |

| December direct material | 4,000 |

| December direct labor | 12,000 |

| December overhead | 15,000 |

| Total finished-goods inventory | $ 86,000 |

Table (2)

Thus, the total finished-goods inventory is $86,000.

6.

Prepare the schedule of cost of goods manufactured for Incorporation FC for the year just completed.

Explanation of Solution

Cost of goods manufactured: Cost of goods manufactured refers to the cost incurred for a making a product, that are available for sales at the end of the accounting period.

Prepare the schedule of cost of goods manufactured for Incorporation FC for the year just completed.

| Incorporation FC | ||

| Schedule of Cost of Goods Manufactured | ||

| For the Year Ended December 31 | ||

| Particulars | Amount ($) | Amount ($) |

| Direct material: | ||

| Raw-material inventory, 1/1 | $105,000 | |

| Raw-material purchases | $1,063,000 | |

| Raw material available for use | $1,168,000 | |

| Deduct: Indirect material used | $134,000 | |

| Raw-material inventory 12/31 | $85,000 | $219,000 |

| Raw material used | $949,000 | |

| Direct labor | $925,000 | |

| Manufacturing overhead: | ||

| Indirect material | $134,000 | |

| Indirect labor | $375,000 | |

| Utilities | $267,000 | |

| Depreciation | $420,000 | |

| Total actual manufacturing overhead | $1,196,000 | |

| Less: Underapplied overhead | $11,000 | |

| Overhead applied to work in process | $1,185,000 | |

| Total manufacturing costs | $3,059,000 | |

| Add: Work-in-process inventory, 1/1 | $60,000 | |

| Subtotal | $3,119,000 | |

| Less: Work-in-process inventory, 12/31 (1) | $150,200 | |

| Cost of goods manufactured | $2,968,800 | |

Table (3)

Working note (1):

Calculate the work-in process inventory as of 12/31.

| Particulars | D12-002 | D12-003 | Total |

| Direct material | $37,900 | $26,000 | $63,900 |

| Direct labor | $20,000 | $16,800 | $36,800 |

| Applied overhead: | |||

| $37,500 | $0 | $37,500 | |

| $0 | $12,000 | $12,000 | |

| Total | $ 95,400 | $ 54,800 | $ 150,200 |

Table (4)

Want to see more full solutions like this?

Chapter 3 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Financial Accounting Questionarrow_forwardFlorida Kitchens produces high-end cooking ranges. The costs to manufacture and market the ranges at the company’s volume of 3,000 units per quarter are shown in the following table: Unit manufacturing costs Variable costs $ 1,440 Fixed overhead 720 Total unit manufacturing costs $ 2,160 Unit nonmanufacturing costs Variable 360 Fixed 840 Total unit nonmanufacturing costs 1,200 Total unit costs $ 3,360 The company has the capacity to produce 3,000 units per quarter and always operates at full capacity. The ranges sell for $4,000 per unit. Required: a. Florida Kitchens receives a proposal from an outside contractor, Burns Electric, who will manufacture 1,200 of the 3,000 ranges per quarter and ship them directly to Florida’s customers as orders are received from the sales office at Florida. Florida would provide the materials for the ranges, but Burns would assemble, box, and ship the ranges. The variable manufacturing costs would be…arrow_forwardCan you please solve this general accounting problem?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning