Concept explainers

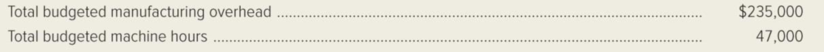

Midnight Sun Apparel Company uses normal costing, and manufacturing

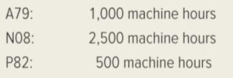

During January, the firm began the following production jobs:

During January, job numbers A79 and N08 were completed, and job number A79 was sold. The actual manufacturing overhead incurred during January was $26,000.

Required:

- 1. Compute the company’s predetermined overhead rate for the current year.

- 2. How much manufacturing overhead was applied to production during January?

- 3. Calculate the over applied or under applied overhead for January.

- 4. Prepare a

journal entry to close the balance calculated in requirement (3) into Cost of Goods Sold. - 5. Prepare a journal entry to prorate the balance calculated in requirement (3) among the Work-in-Process Inventory, Finished-Goods Inventory, and Cost of Goods Sold accounts.

1.

Calculate the predetermined overhead rate for Company MSA for the current year.

Explanation of Solution

Predetermined Overhead Rate: Predetermined overhead rate is a measure used to allocate the estimated manufacturing overhead cost to the products or job orders during a particular period. This is generally evaluated at the beginning of each reporting period. The evaluation takes into account the estimated manufacturing overhead cost and the estimated allocation base that includes direct labor hours, direct labor in dollars, machine hours and direct materials.

Calculate the predetermined overhead rate for Company MSA for the current year.

Thus, the predetermined overhead rate for Company MSA for the current year is $5 per machine hour.

2.

Calculate the amount of manufacturing overhead was applied to production for the month January.

Explanation of Solution

Manufacturing overheads:

Manufacturing overheads refers to the indirect factory- related cost that has occurred while manufacturing a product. Some of the examples of manufacturing overheads are indirect labor, indirect materials, factory building and indirect factory supplies.

Calculate the amount of manufacturing overhead was applied to production for the month January.

Thus, the amount of manufacturing overhead was applied to production for the month January is $20,000.

3.

Compute the overapplied or underapplied overhead for January.

Explanation of Solution

Underapplied overhead:

When there is a debit balance in the manufacturing overhead account during the month end, it indicates that overheads applied to jobs are less than the actual overhead cost incurred by the business. Therefore, the debit balance in the manufacturing overhead account is referred to as underapplied overhead.

Overapplied overhead:

When there is a credit balance in the manufacturing overhead account during the month end, indicates that overheads applied to jobs is more than the actual overhead cost incurred by the business. Therefore, the credit balance in the manufacturing overhead account is referred to as over- applied overhead.

Compute the overapplied or underapplied overhead for January.

During the month January, the overhead is underapplied by $6,000.

4.

Record the journal entry to close the underapplied overhead to cost of goods sold.

Explanation of Solution

Record the journal entry to close the underapplied overhead to cost of goods sold.

| Date | Account title and explanation | Debit ($) | Credit ($) |

| Cost of goods sold | 6,000 | ||

| Manufacturing overhead | 6,000 | ||

| (To close the underapplied overhead to cost of goods sold) |

Table (1)

- Cost of goods sold is an expense account and it decreases the value of stockholders’ equity. Thus, debit cost of goods sold with $6,000.

- Manufacturing overhead is credited as the overhead is underapplied. Thus, credit manufacturing overhead with $6,000.

5.

Record the journal entry to prorate the balance among the work-in-process inventory, finished goods inventory, and cost of goods sold account.

Explanation of Solution

- a. Calculate the proration amounts.

| Account | Amount | Percentage (2) | |

| Work in Process | Job P82 only | $ 2,500 | (1) 12.5% |

| Finished Goods | Job N08 only | 12,500 | (2) 2.5% |

| Cost of Goods sold | Job A79 only | 5,000 | (3) 25.00% |

| Total | $ 20,000 | 100.00% |

Table (2)

Note: The amount is calculated by using the following formula.

Working note (1):

Calculate the amount of percentage for work-in-process.

Working note (2):

Calculate the amount of percentage for finished goods.

Working note (3):

Calculate the amount of percentage for cost of goods sold.

| Account | Underapplied overhead | Percentage | Amount added to Account | |

| Work in Process | $ 6,000 | 12.50% | $ 750 | |

| Finished Goods | $6,000 | 62.50% | $3,750 | |

| Cost of Goods Sold | $6,000 | 25.00% | $1,500 | |

| Total | $ 6,000 |

Table (3)

b) Journal entry.

| Date | Account title and explanation | Debit ($) | Credit ($) |

| Work-in-process inventory | 750 | ||

| Finished-goods inventory | 3,750 | ||

| Cost of goods sold | 1,500 | ||

| Manufacturing overhead | 6,000 | ||

| (To close the underapplied overhead to cost of goods sold) |

Table (4)

- Work-in-process inventory is an asset account and it is increased. Thus, it is debited.

- Finished-goods inventory is an asset account and it is increased. Thus, it is debited.

- Cost of goods sold is an expense account and it decreases the stockholders’ equity. Thus it is debited.

- Manufacturing overhead is credited with 6,000.

Want to see more full solutions like this?

Chapter 3 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Poonam's material quantity variance is favorable or unfavorablearrow_forward??arrow_forwardPoonam has a standard of 1.5 pounds of materials per unit, at S6 per pound. In producing 2,000 units, Poonam used 3,100 pounds of materials at a total cost of $18,135. Poonam's material quantity variance is favorable or unfavorable?arrow_forward

- General Accountingarrow_forwardSubject: General Accountingarrow_forwardThe following information describes a company's usage of direct labor in a recent period: Actual direct labor hours used 32,500 Actual rate per hour $18.00 Standard rate per hour $16.50 Standard hours for units produced 32,000 How much is the direct labor efficiency variance? Answer: $8,250 unfavorablearrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College