Concept explainers

Calculate the missing amounts and prepare the T-accounts.

Explanation of Solution

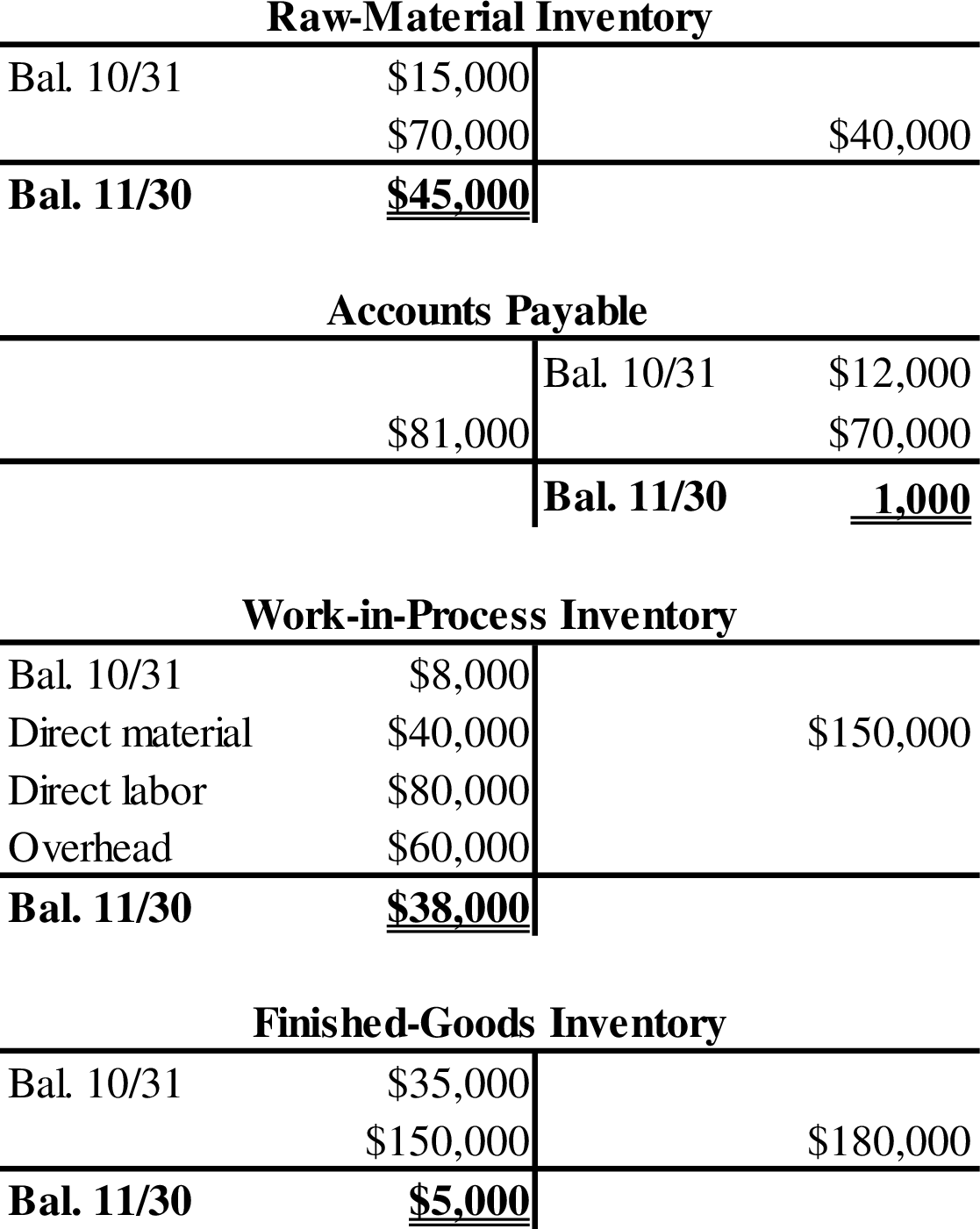

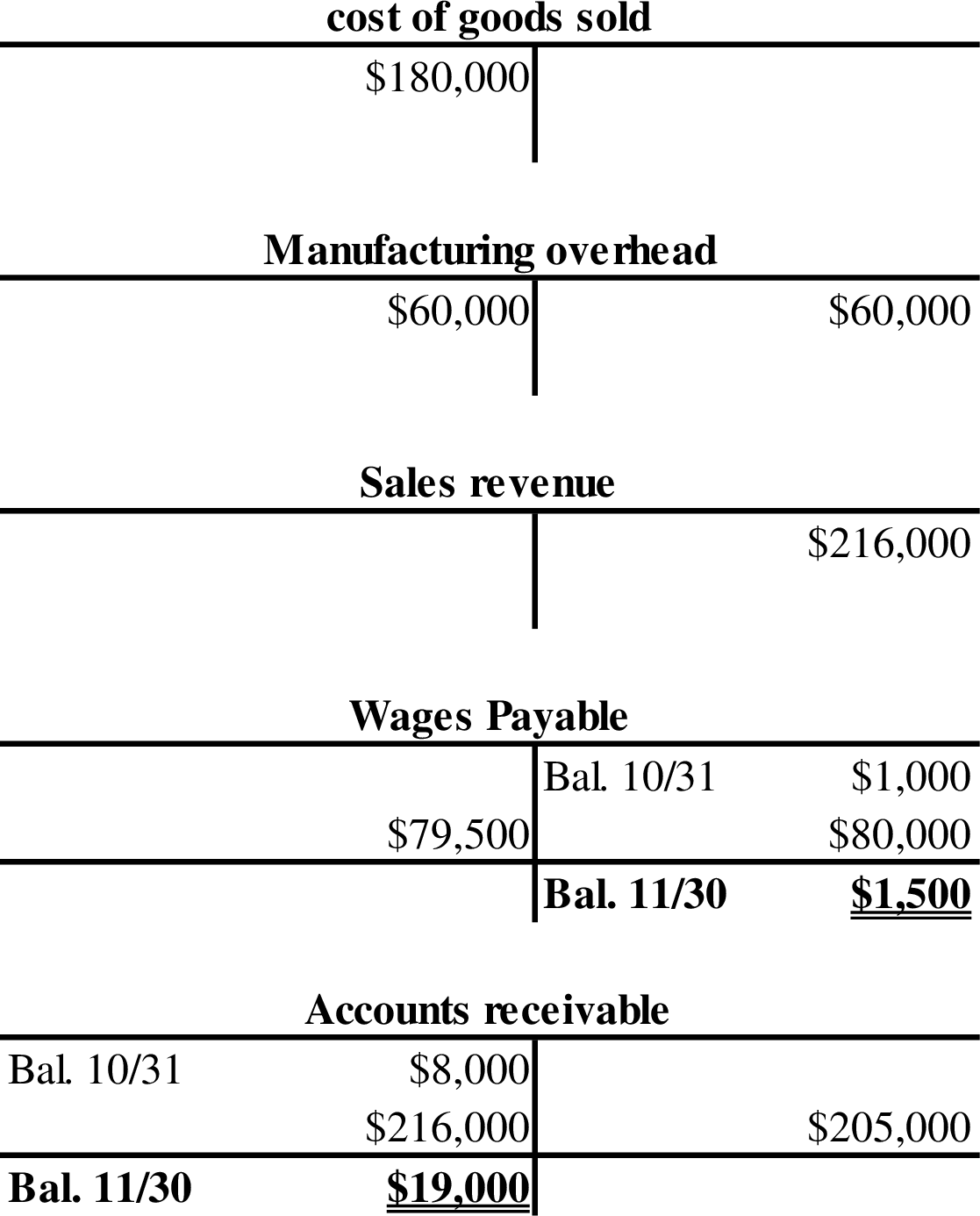

- 1. Calculate the sales revenue for November.

Thus, the sales revenue for November is $216,000.

- 2. Calculate the ending balance of accounts receivable.

Thus, the ending balance in accounts receivable is $19,000.

- 3. Calculate the cost of raw materials purchased during November.

Thus, the cost of raw materials purchased during November is $70,000.

- 4. Calculate the ending balance in the work-in-process inventory.

Step 1: Calculate the budgeted direct-labor hours.

Step 2: Calculate the predetermined overhead rate.

Step 3: Calculate the ending balance in the work-in-process inventory.

Thus, the ending balance in the work-in-process inventory is $38,000.

- 5. Calculate the amount of direct labor added to work in process during November.

Thus, the amount of direct labor added to work in process during November is $80,000.

- 6. Calculate the amount of applied overhead for November.

Step 1: Calculate the direct-labor hours.

Step 2: Calculate the amount of applied overhead for November.

Thus, the applied overhead for November is $60,000.

- 7. Calculate the cost of goods completed during November.

Thus, the cost of goods completed during November is $150,000.

- 8. Calculate the amount of raw materials used during November.

Thus, the amount of raw materials used during November is $40,000.

- 9. Calculate the amount of October 31 balance in raw-material inventory.

Thus, the amount of October 31 balances in raw-material inventory is $15,000.

- 10. Calculate the amount of overapplied or underapplied for November.

Thus, there is no underapplied or overapplied overhead for the month November.

Prepare the T-accounts.

Want to see more full solutions like this?

Chapter 3 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,